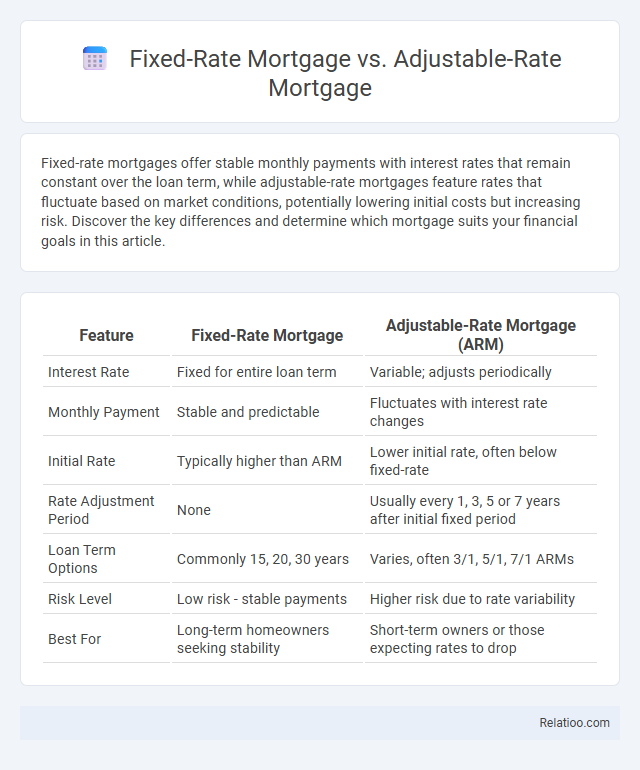

Fixed-rate mortgages offer stable monthly payments with interest rates that remain constant over the loan term, while adjustable-rate mortgages feature rates that fluctuate based on market conditions, potentially lowering initial costs but increasing risk. Discover the key differences and determine which mortgage suits your financial goals in this article.

Table of Comparison

| Feature | Fixed-Rate Mortgage | Adjustable-Rate Mortgage (ARM) |

|---|---|---|

| Interest Rate | Fixed for entire loan term | Variable; adjusts periodically |

| Monthly Payment | Stable and predictable | Fluctuates with interest rate changes |

| Initial Rate | Typically higher than ARM | Lower initial rate, often below fixed-rate |

| Rate Adjustment Period | None | Usually every 1, 3, 5 or 7 years after initial fixed period |

| Loan Term Options | Commonly 15, 20, 30 years | Varies, often 3/1, 5/1, 7/1 ARMs |

| Risk Level | Low risk - stable payments | Higher risk due to rate variability |

| Best For | Long-term homeowners seeking stability | Short-term owners or those expecting rates to drop |

Introduction to Fixed-Rate and Adjustable-Rate Mortgages

Fixed-rate mortgages offer a consistent interest rate and monthly payments throughout the loan's term, providing stability and predictability for your budget. Adjustable-rate mortgages (ARMs) start with a lower initial interest rate that adjusts periodically based on market conditions, potentially leading to fluctuating monthly payments. Understanding the differences between these loan types helps you choose the best mortgage for your home's financing needs and long-term financial plans.

How Fixed-Rate Mortgages Work

Fixed-rate mortgages maintain a constant interest rate throughout the loan term, providing predictable monthly payments and long-term stability for homeowners. Unlike adjustable-rate mortgages, which fluctuate based on market indices, fixed-rate mortgages shield borrowers from rising interest rates. This stability makes fixed-rate mortgages ideal for buyers planning to stay in their homes for an extended period, ensuring budget consistency and financial planning ease.

How Adjustable-Rate Mortgages Work

Adjustable-rate mortgages (ARMs) feature an interest rate that changes periodically based on a specific benchmark or index, such as the LIBOR or the U.S. Treasury rate, plus a fixed margin. Initial interest rates on ARMs are usually lower than fixed-rate mortgages, offering borrowers lower initial monthly payments, but rates adjust after an initial fixed period, impacting future repayment amounts. Homebuyers should carefully evaluate the adjustment frequency, caps on rate changes, and their financial stability when considering an ARM to balance potential savings against the risk of rising payments.

Key Differences Between Fixed and Adjustable Rates

Fixed-rate mortgages offer a consistent interest rate and monthly payment throughout the loan term, providing predictability and stability for homeowners. Adjustable-rate mortgages (ARMs) feature interest rates that fluctuate periodically based on market indexes, potentially starting with lower initial rates but carrying the risk of increased payments over time. Understanding the key differences in payment consistency, interest rate changes, and risk tolerance is essential when choosing between fixed-rate and adjustable-rate home loans.

Pros and Cons of Fixed-Rate Mortgages

Fixed-rate mortgages offer predictable monthly payments and protection against interest rate fluctuations, making them ideal for long-term homeowners seeking financial stability. However, their initial interest rates are generally higher than adjustable-rate mortgages, potentially leading to higher overall costs if market rates decline. Homebuyers preferring stability may favor fixed-rate options, but those anticipating short-term ownership or increasing income might consider adjustable rates to benefit from lower starting payments.

Pros and Cons of Adjustable-Rate Mortgages

Adjustable-Rate Mortgages (ARMs) offer lower initial interest rates compared to Fixed-Rate Mortgages, making them attractive for homebuyers planning to sell or refinance within a few years. You benefit from potentially lower monthly payments early on, but face the risk of rising rates and increased payments after the initial fixed period ends. ARMs provide flexibility and cost savings initially, but unpredictable interest fluctuations can lead to budgeting challenges over the life of your home loan.

Best Situations for Choosing a Fixed-Rate Mortgage

A fixed-rate mortgage is ideal for homeowners seeking stability in monthly payments and long-term budgeting certainty, especially when interest rates are low or expected to rise. You benefit most from this type of loan if you plan to stay in your home for many years and want consistent financial planning without the risk of payment fluctuations. Choosing a fixed-rate mortgage ensures predictable expenses, making it the best option for those who prioritize financial security and long-term cost control.

Best Situations for Choosing an Adjustable-Rate Mortgage

An adjustable-rate mortgage (ARM) is best suited for homebuyers planning to sell or refinance within a short to medium timeframe, typically 5 to 7 years, due to its lower initial interest rates compared to fixed-rate mortgages. Homeowners expecting an increase in income or anticipating interest rates to remain stable or decline can benefit from the flexibility and potential savings an ARM offers. This mortgage type is also advantageous in a low-interest-rate environment where initial rates are significantly below fixed rates, maximizing cost efficiency during the initial period.

Factors to Consider When Choosing a Mortgage Type

When choosing a mortgage type, consider your financial stability, risk tolerance, and future plans, as fixed-rate mortgages offer predictable monthly payments ideal for long-term budgeting, while adjustable-rate mortgages typically start lower but can fluctuate based on market conditions. Evaluate your expected time in the home and potential interest rate trends to decide if initial savings outweigh the uncertainty of rate adjustments. Your decision should balance monthly affordability with long-term financial goals to ensure the mortgage aligns with your unique homeownership needs.

Final Thoughts: Which Mortgage is Right for You?

Choosing between a fixed-rate mortgage and an adjustable-rate mortgage depends on your financial stability, risk tolerance, and how long you plan to stay in the home. Fixed-rate mortgages offer predictable monthly payments and protection against interest rate fluctuations, ideal for long-term homeowners seeking stability. Adjustable-rate mortgages typically start with lower rates, benefiting those who plan to sell or refinance within a few years, but they carry the risk of increased payments if interest rates rise.

Infographic: Fixed-Rate Mortgage vs Adjustable-Rate Mortgage

relatioo.com

relatioo.com