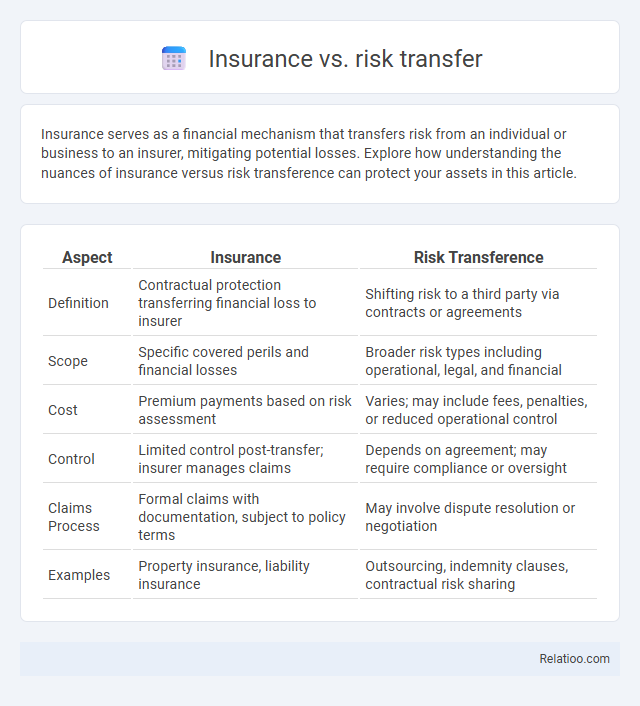

Insurance serves as a financial mechanism that transfers risk from an individual or business to an insurer, mitigating potential losses. Explore how understanding the nuances of insurance versus risk transference can protect your assets in this article.

Table of Comparison

| Aspect | Insurance | Risk Transference |

|---|---|---|

| Definition | Contractual protection transferring financial loss to insurer | Shifting risk to a third party via contracts or agreements |

| Scope | Specific covered perils and financial losses | Broader risk types including operational, legal, and financial |

| Cost | Premium payments based on risk assessment | Varies; may include fees, penalties, or reduced operational control |

| Control | Limited control post-transfer; insurer manages claims | Depends on agreement; may require compliance or oversight |

| Claims Process | Formal claims with documentation, subject to policy terms | May involve dispute resolution or negotiation |

| Examples | Property insurance, liability insurance | Outsourcing, indemnity clauses, contractual risk sharing |

Understanding Insurance: Definition and Purpose

Insurance is a financial product designed to manage risk by providing compensation in case of specified losses, effectively transferring the potential financial burden from You to the insurer. Risk transference involves shifting the responsibility of loss or damage to another party, often through contracts or insurance policies, minimizing Your direct exposure. Understanding the core purpose of insurance helps clarify how transferring risk protects Your assets and ensures financial stability during unforeseen events.

What is Risk Transference?

Risk transference involves shifting the potential financial consequences of a loss from one party to another, typically through contractual agreements or insurance policies. Unlike general insurance, which provides protection against various risks under a policy, risk transference specifically designates responsibility for a particular risk to a third party, such as contractors or service providers. Effective risk transference mitigates potential liabilities and enhances an organization's risk management strategy by clearly defining accountability.

Key Differences Between Insurance and Risk Transference

Insurance provides financial protection by transferring specific risks to an insurance company through a policy, while risk transference involves shifting risk exposure to a third party via contracts or agreements, which may not necessarily include insurance coverage. The key difference lies in insurance's formalized mechanism with regulated indemnity and premium payments, whereas risk transference can include contractual methods like indemnity clauses, hold harmless agreements, or outsourcing certain activities. Understanding these distinctions helps you optimize your risk management strategy by selecting appropriate methods that align with your business objectives and risk tolerance.

Types of Risk Transference Mechanisms

Types of risk transference mechanisms include insurance, contractual agreements, and hedging strategies, each designed to shift financial exposure from one party to another. Insurance involves transferring risk to an insurer who assumes the financial burden in exchange for premiums, providing protection against specified losses. Contractual risk transference, such as indemnity clauses, allocates responsibility between parties, while hedging uses financial instruments like derivatives to mitigate potential losses from market fluctuations.

Pros and Cons of Insurance

Insurance provides financial protection by transferring risk to an insurer, offering peace of mind and coverage for unexpected losses, but it often involves premiums, deductibles, and coverage limits that may not address all risks. Risk transference can include contracts or outsourcing to shift liability, potentially reducing direct losses but sometimes leading to complex negotiations and partial protection. Transference broadly reallocates risk but lacks the comprehensive financial guarantee insurance provides, making insurance more reliable yet sometimes costly and inflexible.

Advantages and Limitations of Risk Transference

Risk transference shifts potential financial loss from you to another party, usually through contracts or insurance policies, reducing your exposure to specific liabilities. Advantages include predictable financial outcomes and enhanced risk management by leveraging third-party resources to absorb impacts of unforeseen events. Limitations involve dependence on the solvency and reliability of the transferee and possible incomplete coverage, leaving residual risks that you must still manage.

When to Choose Insurance Over Risk Transference

You should choose insurance over risk transference when you need comprehensive financial protection against potential losses that could impact your assets or business operations. Insurance provides a formal contract where the insurer assumes the risk in exchange for premiums, offering predictable coverage and claim processes. Risk transference, such as contractual agreements, is better suited for shifting specific liabilities but may not cover unforeseen or broader risks.

Cost Implications: Insurance vs Risk Transference

Insurance involves paying premiums to transfer financial risk to an insurer, often resulting in predictable and manageable costs for your business. Risk transference, such as contractual agreements, may reduce immediate financial exposure but can introduce variable expenses and potential liabilities if the other party fails to fulfill obligations. Evaluating cost implications requires analyzing premium stability against the uncertainty and enforcement costs inherent in non-insurance transference methods.

Real-World Examples: Practical Applications

Insurance serves as a structured risk transference tool where businesses transfer potential financial losses to insurers, exemplified by manufacturing firms securing liability coverage against product defects. Risk transference extends beyond insurance to contractual agreements, such as construction companies including indemnity clauses to shift liability to subcontractors. Real-world applications highlight how technology companies mitigate data breach risks through cyber insurance while employing service-level agreements to transfer operational risks to cloud providers.

Choosing the Right Strategy for Your Risk Management Needs

Choosing the right strategy for your risk management needs involves understanding the distinctions between insurance, risk transference, and transference. Insurance provides a contractual financial safeguard against specific risks, while risk transference encompasses broader methods, including outsourcing or contractual agreements, to shift risk. You must evaluate your organization's risk exposure, financial capacity, and operational goals to determine the most effective approach for minimizing potential losses.

Infographic: Insurance vs risk transference

relatioo.com

relatioo.com