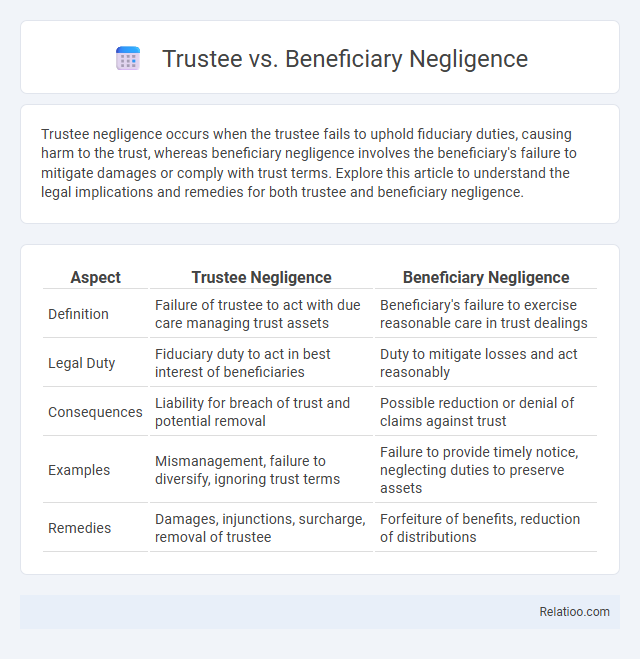

Trustee negligence occurs when the trustee fails to uphold fiduciary duties, causing harm to the trust, whereas beneficiary negligence involves the beneficiary's failure to mitigate damages or comply with trust terms. Explore this article to understand the legal implications and remedies for both trustee and beneficiary negligence.

Table of Comparison

| Aspect | Trustee Negligence | Beneficiary Negligence |

|---|---|---|

| Definition | Failure of trustee to act with due care managing trust assets | Beneficiary's failure to exercise reasonable care in trust dealings |

| Legal Duty | Fiduciary duty to act in best interest of beneficiaries | Duty to mitigate losses and act reasonably |

| Consequences | Liability for breach of trust and potential removal | Possible reduction or denial of claims against trust |

| Examples | Mismanagement, failure to diversify, ignoring trust terms | Failure to provide timely notice, neglecting duties to preserve assets |

| Remedies | Damages, injunctions, surcharge, removal of trustee | Forfeiture of benefits, reduction of distributions |

Understanding Trustee and Beneficiary Roles

Trustee negligence occurs when a trustee fails to fulfill fiduciary duties, such as mismanaging trust assets or breaching the trust agreement, leading to potential harm to the trust or its beneficiaries. Beneficiary negligence involves a beneficiary's failure to act reasonably in protecting their interests, which may complicate claims against trustees but does not excuse trustee misconduct. Understanding the distinct roles clarifies that trustees hold a duty of care and loyalty to administer the trust properly, while beneficiaries have rights to enforce the trust terms and ensure trustees' accountability.

Legal Responsibilities of Trustees

Trustees hold a fiduciary duty to manage trust assets prudently and act in beneficiaries' best interests, making them legally responsible for negligence that causes harm to the trust. Negligence by a trustee involves failing to exercise reasonable care or skill, leading to potential financial loss, whereas beneficiary negligence generally does not relieve the trustee from their duties unless it directly impacts the management of the trust. Legal accountability of trustees in negligence cases emphasizes the protection of beneficiary rights and the enforcement of trust terms under trust law.

Duties Owed by Beneficiaries

Beneficiaries owe a duty to act in good faith and avoid negligence that could harm the trust's interests or other beneficiaries' rights. Your responsibilities include monitoring the trustee's management and promptly addressing any breaches to protect the trust's assets. Failure to fulfill these duties may result in shared liability alongside trustee negligence.

Defining Trustee Negligence

Trustee negligence occurs when a trustee fails to fulfill their fiduciary duties, including managing trust assets with reasonable care, skill, and prudence, resulting in harm to the trust or its beneficiaries. This form of negligence differs from beneficiary negligence, where the beneficiary fails to act with reasonable care in their own actions related to the trust. Understanding trustee negligence is crucial in trust law, as it determines liability for losses caused by breaches of duty versus ordinary negligence claims.

Examples of Beneficiary Negligence

Beneficiary negligence occurs when a trust beneficiary fails to act with reasonable care, such as neglecting to notify the trustee of changes that affect the trust or mismanaging trust distributions received. Examples include a beneficiary not reporting income derived from trust assets, resulting in tax complications, or wasting distributed funds contrary to the trust's purpose. Differentiated from trustee negligence--which involves breach of fiduciary duties like mismanagement or failure to invest prudently--beneficiary negligence impacts trust administration primarily through lack of cooperation or disregard of responsibilities.

Consequences of Trustee Negligence

Trustee negligence occurs when a trustee fails to fulfill their fiduciary duties, leading to potential financial losses or legal liabilities for the trust. Beneficiary negligence, on the other hand, generally involves a beneficiary's failure to act prudently, but it does not absolve the trustee from their obligations. Your primary concern with trustee negligence should be the severe consequences, including breach of trust claims, removal of the trustee, and damages owed to the beneficiaries.

Consequences of Beneficiary Negligence

Beneficiary negligence occurs when your failure to act with reasonable care jeopardizes the trust's assets or interests, potentially leading to diminished trust value or legal disputes. Unlike trustee negligence, which involves a breach of fiduciary duty by the trustee, beneficiary negligence can result in personal liability if their actions contribute to loss or harm. Courts may reduce or deny distributions to a negligent beneficiary to protect the trust's integrity and other beneficiaries' rights.

Legal Remedies for Negligence in Trusts

Legal remedies for negligence in trusts hinge on the distinction between trustee and beneficiary roles. Trustees are legally obligated to act with reasonable care, skill, and diligence, failing which they may face claims for breach of trust and be required to compensate for losses. Beneficiaries suffering from trustee negligence can seek remedies such as damages, injunctions, or removal of the trustee to protect trust assets and enforce fiduciary duties.

Preventing Negligence: Best Practices

Preventing negligence in trustee versus beneficiary disputes requires clear documentation of fiduciary duties and consistent communication between parties to uphold trust obligations effectively. You should implement rigorous oversight mechanisms, such as regular audits and compliance checks, to minimize errors and breaches of duty. Emphasizing education on legal responsibilities and conflict resolution strategies further strengthens protection against negligence claims.

Trustee vs Beneficiary Negligence: Key Differences

Trustee negligence occurs when a trustee fails to fulfill fiduciary duties, such as mismanaging trust assets or breaching trust terms, leading to financial harm to the trust. Beneficiary negligence, though less common as a legal concept, typically involves a beneficiary failing to meet obligations or causing losses, but does not usually impose fiduciary duties or liability similar to trustees. The key difference centers on fiduciary responsibility: trustees have a legal duty to act prudently and in the beneficiaries' best interests, while beneficiaries generally do not owe such duties to the trust or other parties.

Infographic: Trustee vs Beneficiary Negligence

relatioo.com

relatioo.com