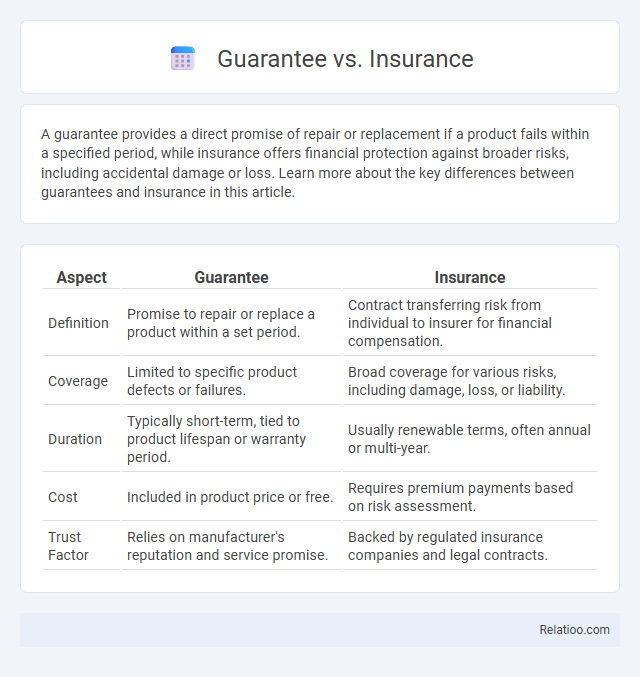

A guarantee provides a direct promise of repair or replacement if a product fails within a specified period, while insurance offers financial protection against broader risks, including accidental damage or loss. Learn more about the key differences between guarantees and insurance in this article.

Table of Comparison

| Aspect | Guarantee | Insurance |

|---|---|---|

| Definition | Promise to repair or replace a product within a set period. | Contract transferring risk from individual to insurer for financial compensation. |

| Coverage | Limited to specific product defects or failures. | Broad coverage for various risks, including damage, loss, or liability. |

| Duration | Typically short-term, tied to product lifespan or warranty period. | Usually renewable terms, often annual or multi-year. |

| Cost | Included in product price or free. | Requires premium payments based on risk assessment. |

| Trust Factor | Relies on manufacturer's reputation and service promise. | Backed by regulated insurance companies and legal contracts. |

Understanding Guarantee and Insurance: Key Differences

Guarantee and insurance both provide financial protection but serve distinct purposes: a guarantee ensures the fulfillment of a commitment or product quality, while insurance compensates for specific losses or damages. Your understanding of guarantees centers on a promise made by a party to uphold certain conditions, whereas insurance involves risk transfer to an insurer in exchange for premiums. Recognizing these differences helps you choose the right form of security based on your needs for assurance versus risk management.

Definition of Guarantee: What Does It Mean?

A guarantee is a formal promise assuring that a product or service will meet specified standards or conditions, and if it fails to do so, the guarantor commits to repair, replace, or refund. Unlike insurance, which compensates for financial loss from uncertain events, a guarantee directly covers the quality or performance of goods and services. This legally binding assurance enhances consumer confidence by protecting against defects or non-compliance within a defined period.

Exploring Insurance: Core Concepts Explained

Insurance provides financial protection by transferring risk from you to an insurer in exchange for premiums, covering unexpected losses like accidents or damages. Unlike a guarantee, which promises product performance or repairs within a certain period, insurance involves a contract that compensates for specified risks. Understanding core insurance concepts such as policy coverage, deductibles, and claim processes helps you make informed decisions about managing potential financial burdens.

Types of Guarantees and Their Uses

Types of guarantees include performance guarantees, payment guarantees, and warranty guarantees, each serving distinct purposes in contractual agreements to ensure obligations are met or compensation is provided. Performance guarantees assure the completion of a project or contract, payment guarantees secure financial transactions, and warranty guarantees protect against defects or failures within a specified period. Understanding these guarantees helps you select the right type to mitigate risks effectively in business dealings.

Various Forms of Insurance Policies

Various forms of insurance policies offer financial protection against specific risks, such as health, auto, home, and life insurance, each designed to cover different aspects of potential loss. Unlike guarantees that promise compensation for product defects or service failures, insurance policies typically require premiums and provide coverage based on the terms agreed upon in the contract. Understanding your insurance options helps you manage risk effectively and ensures your assets and well-being are safeguarded against unforeseen events.

Legal Framework: Guarantee vs Insurance

In the legal framework, guarantees involve a secondary obligation where the guarantor promises to fulfill the primary debtor's duty if they default, typically governed by contract law principles. Insurance contracts create a primary obligation where the insurer directly indemnifies the insured against specified risks under regulatory insurance laws. Unlike insurance, guarantees do not cover losses from risk events but ensure performance or payment, highlighting distinct liability scopes and enforcement mechanisms.

Risk Coverage: Comparing Guarantees and Insurance

Guarantees provide a contractual promise ensuring product performance or service quality, offering direct risk coverage to the buyer if terms are unmet, while insurance transfers financial risk to the insurer against potential losses or damages beyond product faults. Guarantees typically cover specific risks limited to the product or service condition, whereas insurance encompasses broader risk protection including liability, property, and casualty. Understanding the distinct scopes of guarantees versus insurance is crucial for optimal risk management in consumer and business transactions.

Claims Process: Guarantee Versus Insurance Claims

The claims process for guarantees typically involves direct engagement with the guarantor, often requiring proof of contract non-performance and documentation confirming the failure to meet obligations, leading to faster resolution. Insurance claims necessitate filing detailed claims forms, providing evidence of loss or damage, and undergoing an insurer's assessment, which can extend the payout timeline due to risk evaluation procedures. Unlike insurance, where risk transfer and premium payments apply, guarantees act as a promise to fulfill contractual terms, focusing claims on breach verification rather than loss valuation.

Cost Implications: Guarantee versus Insurance Premiums

Guarantees typically involve a one-time cost or a fee tied to the product or service, while insurance premiums require ongoing payments that can fluctuate based on risk factors and coverage limits. Your decision between a guarantee and insurance should consider these cost implications, as guarantees often cover specific failures or defects, whereas insurance offers broader protection against diverse risks. Understanding the financial commitment and coverage scope helps optimize your investment and risk management strategy.

Choosing Between Guarantee and Insurance: Factors to Consider

Choosing between guarantee and insurance involves evaluating risk coverage, cost, and duration; guarantees provide a direct promise of performance or quality often linked to product lifespan, whereas insurance transfers financial risk to an insurer for potential losses. Key factors include the specific liability scope, claim procedures, and regulatory terms unique to guarantees and insurance policies. Understanding whether the protection sought is for product defects, contractual obligations, or unforeseen events guides the decision toward the appropriate mechanism.

Infographic: Guarantee vs Insurance

relatioo.com

relatioo.com