Assurance in relationships reflects a partner's confidence and commitment, while a guarantee suggests an absolute promise of specific outcomes. Explore the key differences between assurance and guarantee to strengthen your partnership in this article.

Table of Comparison

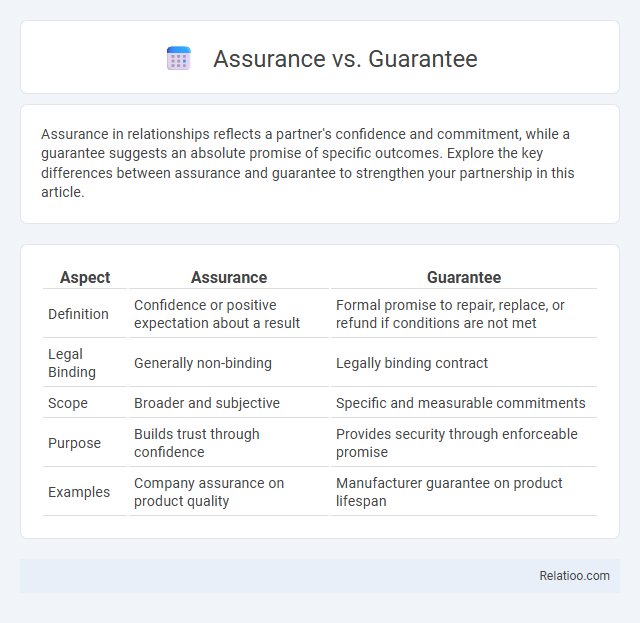

| Aspect | Assurance | Guarantee |

|---|---|---|

| Definition | Confidence or positive expectation about a result | Formal promise to repair, replace, or refund if conditions are not met |

| Legal Binding | Generally non-binding | Legally binding contract |

| Scope | Broader and subjective | Specific and measurable commitments |

| Purpose | Builds trust through confidence | Provides security through enforceable promise |

| Examples | Company assurance on product quality | Manufacturer guarantee on product lifespan |

Understanding the Concepts: Assurance vs Guarantee

Assurance involves a confident declaration or promise regarding the quality or outcome of a product or service, emphasizing trust and reliability without a legally binding commitment. Guarantee refers to a formal, often written, pledge that explicitly obligates the provider to repair, replace, or refund if the product or service fails to meet specified standards within a certain period. Understanding the distinction highlights that assurance builds consumer confidence with subjective commitment, while guarantee provides a quantifiable legal safeguard ensuring accountability.

Definitions: What is Assurance?

Assurance refers to a firm commitment or confidence given to someone that a particular event or condition will definitely occur or a promise will be fulfilled. It involves a psychological state of certainty, often supported by evidence or expert judgment, offering reassurance in situations with some degree of uncertainty. Your understanding of assurance helps distinguish it from guarantees, which are formal promises backed by legally binding contracts, and warranties, which specifically cover repair or replacement in case of product failure.

Definitions: What is Guarantee?

A guarantee is a formal promise or warranty, often legally binding, that ensures a product or service will meet specified quality and performance standards, offering compensation or repair if it fails to do so. Unlike assurance, which is a general expression of confidence, a guarantee provides concrete, enforceable protection for your purchase. Understanding the guarantee terms helps you secure your rights and remedies in case the product or service does not fulfill its promised features.

Core Differences Between Assurance and Guarantee

Assurance involves a commitment based on confidence that an event will occur, typically linked to long-term ongoing activities like life insurance, whereas a guarantee is a promise to compensate if a particular event or product fails, often related to short-term contracts such as product warranties. The core difference lies in assurance covering uncertain future events through continuous payment and risk pooling, while a guarantee provides a security promise irrespective of ongoing premiums. Understanding these distinctions helps you select the right financial protection tailored to your needs.

Legal Implications and Binding Nature

Assurance in legal terms refers to a promise or confidence given without strict legal enforceability, often seen in statements or conduct implying intent but lacking formal obligation. Guarantee constitutes a legally binding commitment, usually documented in a contract, ensuring that specific conditions will be met or a product/service will perform as stated, with clear remedies available upon breach. Warranty falls between these concepts as a contractual assurance guaranteeing certain standards or repairs within a defined period, providing enforceable rights while typically covering defects or non-conformity.

Common Use Cases: When to Use Assurance

Assurance is commonly used in professional services and quality management to provide confidence that specific standards or conditions will be met, such as in financial audits or product reliability assessments. Guarantee is typically applied in consumer products or services, offering a formal promise to repair, replace, or refund if the agreed-upon outcomes or performance levels are not achieved. While warranty often refers to a written promise related to the condition and durability of goods, assurance focuses more on ongoing confidence and risk reduction in processes or transactions.

Common Use Cases: When to Use Guarantee

Guarantees are commonly used in product sales and service contracts to provide a formal promise that the product or service will meet specified standards or be repaired or replaced if it fails. Assurance generally refers to a less formal, trust-based commitment often used in customer service or business agreements to instill confidence without legal obligation. Use a guarantee when legally binding protection of consumer rights is needed, such as warranties on electronics, appliances, or performance contracts.

Industry Examples: Assurance vs Guarantee in Practice

Assurance in industries like manufacturing ensures product quality through rigorous testing, while a guarantee often promises repair or replacement if standards aren't met, exemplified by electronics companies offering warranties. Financial firms provide assurance through audits confirming accurate statements, whereas a guarantee might back loans with third-party commitments. Your understanding of assurance versus guarantee influences decision-making processes, emphasizing risk management versus customer confidence.

Choosing the Right Approach: Factors to Consider

Choosing the right approach between assurance, guarantee, and warranty depends on the level of risk, legal obligations, and customer expectations involved. Assurance typically offers a promise of quality without legal enforcement, while a guarantee provides a legally binding commitment with possible remedies. Your decision should factor in product complexity, industry standards, and the importance of building consumer trust to ensure optimal protection and satisfaction.

Summary Table: Assurance vs Guarantee Comparison

Assurance provides a promise based on confidence or certainty, typically involving personal or professional integrity, while a guarantee is a formal, often written, commitment ensuring product or service performance or compensation if terms are unmet. In your comparison table, assurance relates to confidence in outcomes without legal obligation, whereas a guarantee legally binds the provider to fulfill specific conditions. Understanding these distinctions helps you make informed decisions about contractual and non-contractual commitments.

Infographic: Assurance vs Guarantee

relatioo.com

relatioo.com