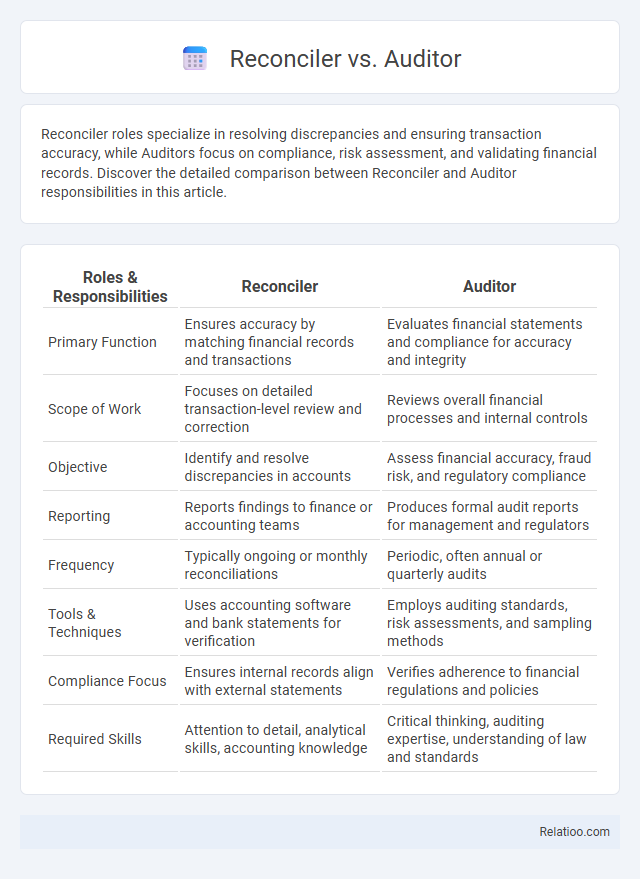

Reconciler roles specialize in resolving discrepancies and ensuring transaction accuracy, while Auditors focus on compliance, risk assessment, and validating financial records. Discover the detailed comparison between Reconciler and Auditor responsibilities in this article.

Table of Comparison

| Roles & Responsibilities | Reconciler | Auditor |

|---|---|---|

| Primary Function | Ensures accuracy by matching financial records and transactions | Evaluates financial statements and compliance for accuracy and integrity |

| Scope of Work | Focuses on detailed transaction-level review and correction | Reviews overall financial processes and internal controls |

| Objective | Identify and resolve discrepancies in accounts | Assess financial accuracy, fraud risk, and regulatory compliance |

| Reporting | Reports findings to finance or accounting teams | Produces formal audit reports for management and regulators |

| Frequency | Typically ongoing or monthly reconciliations | Periodic, often annual or quarterly audits |

| Tools & Techniques | Uses accounting software and bank statements for verification | Employs auditing standards, risk assessments, and sampling methods |

| Compliance Focus | Ensures internal records align with external statements | Verifies adherence to financial regulations and policies |

| Required Skills | Attention to detail, analytical skills, accounting knowledge | Critical thinking, auditing expertise, understanding of law and standards |

Introduction to Reconciler and Auditor Roles

Reconciler roles primarily involve verifying and matching financial records to ensure accuracy and consistency across accounts, playing a critical role in maintaining organizational financial health. Auditor roles focus on independently examining financial statements and internal controls to assess compliance, accuracy, and detect potential fraud or misstatements. Both positions are essential in financial management but differ in their scope, with Reconciler duties centered on daily transaction matching and Auditors handling broader compliance and risk evaluation.

Defining Key Responsibilities

A Reconciler primarily ensures the accuracy of financial records by comparing and matching transactions across accounts to identify discrepancies. An Auditor examines financial statements and processes to verify compliance with regulatory standards and internal controls, often providing objective assessments through systematic reviews. While both focus on financial accuracy, the Reconciler handles day-to-day transaction validation, whereas the Auditor performs comprehensive evaluations to ensure overall financial integrity.

Core Differences Between Reconciler and Auditor

A reconciler primarily focuses on verifying and matching financial records to ensure accuracy and consistency in transactions, while an auditor examines the overall financial statements and internal controls for compliance and fraud detection. Your choice between a reconciler and an auditor depends on whether you need routine transaction verification or a comprehensive evaluation of financial integrity. Reconciler tasks tend to be transactional and frequent, whereas auditor responsibilities are broader and often periodic.

Skills Required for Each Position

Reconciler roles demand strong attention to detail, proficiency in accounting software, and expertise in transaction verification to ensure accurate financial records. Auditors require analytical thinking, risk assessment capabilities, and deep knowledge of compliance standards and regulatory frameworks to evaluate financial statements and internal controls. Reconciliation specialists must excel in data management, problem-solving, and communication skills to resolve discrepancies and maintain consistency across accounting systems.

Workflow and Daily Tasks Comparison

Reconciler roles primarily involve verifying financial records by matching transactions and resolving discrepancies to ensure data accuracy, focusing on detailed transaction-level review within accounting systems. Auditors assess overall financial statements and internal controls through systematic examination and testing, aiming to identify compliance issues, errors, or fraud, often working with broader datasets and audit plans. While Reconcilers execute routine, transactional workflows daily, Auditors engage in periodic, comprehensive evaluations requiring strategic analysis and reporting of findings.

Importance in Financial Integrity

Reconciler, Auditor, and Controller each play crucial roles in maintaining financial integrity by ensuring accuracy, accountability, and compliance in financial processes. Reconcilers focus on verifying and matching transactions to correct discrepancies, Auditors conduct independent evaluations to detect errors or fraud, and Controllers oversee overall financial reporting and internal controls. Together, their collaboration significantly reduces financial risks and enhances trust in financial statements.

Tools and Software Used

Reconciler tools like BlackLine and ReconArt automate transaction matching and discrepancy detection to streamline financial close processes. Auditor software such as ACL Analytics and IDEA emphasizes risk assessment, compliance checks, and sample testing to enhance audit accuracy and efficiency. Both rely on data integration platforms like SAP and Oracle ERP systems to ensure seamless access to financial records and real-time reporting.

Challenges Faced by Reconcilers and Auditors

Reconcilers face challenges such as managing large volumes of transactional data, identifying discrepancies promptly, and maintaining accuracy under tight deadlines. Auditors encounter difficulties in verifying compliance with complex regulatory standards, ensuring data integrity across multiple systems, and detecting potential fraud or errors. Both roles require meticulous attention to detail and robust internal controls to mitigate financial risks and ensure reliable financial reporting.

Career Pathways and Advancement

Career pathways for Reconciler, Auditor, and Accountant roles differ significantly in scope and advancement opportunities. Reconciler positions typically serve as entry-level roles focused on ensuring financial accuracy through transaction matching, offering advancement into senior accounting or finance specialist roles. Auditors have a more specialized career trajectory involving financial analysis, risk assessment, and compliance, often progressing to senior auditor, audit manager, or internal control roles, while Accountants can diversify into management accounting, financial analysis, or chief financial officer (CFO) tracks with experience and certifications like CPA or CMA.

Choosing the Right Role: Reconciler vs Auditor

Choosing the right role between reconciler and auditor depends on your goal: a reconciler focuses on verifying and matching financial records to ensure accuracy in transactions, while an auditor investigates broader financial statements, compliance, and internal controls to identify risks and discrepancies. Your choice should align with whether you prefer a detail-oriented role handling day-to-day data consistency or a strategic position assessing overall financial integrity and regulatory adherence. Understanding these distinctions helps optimize your career path in finance and accounting.

Infographic: Reconciler vs Auditor

relatioo.com

relatioo.com