A Financial Manager oversees overall financial planning and analysis to optimize company performance, while a Treasurer specifically manages liquidity, risk, and investment strategies. Discover detailed distinctions and key responsibilities between Financial Managers and Treasurers in this article.

Table of Comparison

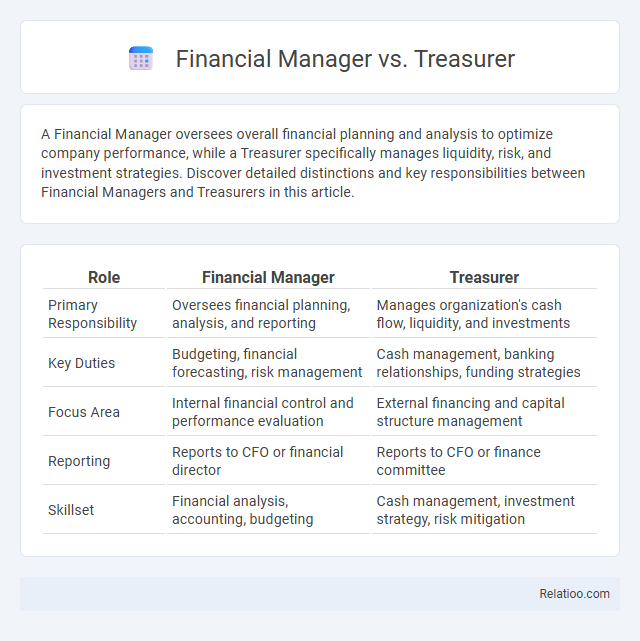

| Role | Financial Manager | Treasurer |

|---|---|---|

| Primary Responsibility | Oversees financial planning, analysis, and reporting | Manages organization's cash flow, liquidity, and investments |

| Key Duties | Budgeting, financial forecasting, risk management | Cash management, banking relationships, funding strategies |

| Focus Area | Internal financial control and performance evaluation | External financing and capital structure management |

| Reporting | Reports to CFO or financial director | Reports to CFO or finance committee |

| Skillset | Financial analysis, accounting, budgeting | Cash management, investment strategy, risk mitigation |

Introduction to Financial Manager and Treasurer Roles

Financial managers oversee an organization's financial health by developing strategies for budgeting, forecasting, and risk management, ensuring long-term profitability and compliance. Treasurers focus specifically on liquidity management, cash flow optimization, and investment activities to maintain adequate funding and minimize financial risks. Both roles require strong analytical skills but differ in scope, with financial managers handling broader financial planning and treasurers concentrating on cash and asset management.

Key Responsibilities of a Financial Manager

A Financial Manager oversees an organization's financial health by developing strategies for budgeting, forecasting, and financial reporting to ensure efficient capital management and compliance. Key responsibilities include analyzing market trends, preparing financial statements, managing investment portfolios, and coordinating with other departments to optimize financial performance. Unlike Treasurers who primarily focus on cash management and short-term financing, Financial Managers have a broader role in strategic planning and financial analysis.

Main Duties of a Treasurer

The Treasurer primarily manages an organization's cash flow, oversees banking relationships, and ensures sufficient liquidity for operational needs. You are responsible for risk management related to investments, debt issuance, and compliance with financial regulations. Unlike a Financial Manager who concentrates on budgeting and financial analysis, the Treasurer focuses on optimizing capital structure and safeguarding company assets.

Financial Manager vs Treasurer: Core Differences

Financial Managers oversee overall financial health by planning, analyzing, and directing investment activities, budgeting, and risk management to ensure organizational growth and profitability. Treasurers specifically manage liquidity, cash flow, and financing strategies, focusing on securing funds and optimizing capital structure to maintain operational solvency. The core difference lies in scope: Financial Managers handle broad financial strategy and reporting, while Treasurers concentrate on cash management, funding, and banking relationships.

Required Skills and Qualifications

Financial Managers typically require strong expertise in financial analysis, budgeting, and regulatory compliance, along with a bachelor's degree in finance, accounting, or business administration and often an MBA or relevant certification like CFA or CPA. Treasurers prioritize skills in cash management, risk assessment, investment strategies, and liquidity planning, frequently needing extensive experience in corporate finance and certifications such as CTP (Certified Treasury Professional). While both roles demand proficiency in financial software and strategic decision-making, Financial Managers focus more on overall organizational financial health, whereas Treasurers specialize in managing the company's capital and financial assets.

Organizational Structure and Hierarchy

The Financial Manager oversees a company's budgeting, financial planning, and reporting, typically reporting to the Chief Financial Officer (CFO) within the organizational hierarchy. The Treasurer focuses specifically on managing the company's liquidity, investments, and capital structure, often positioned under the CFO but sometimes directly linked to the Finance Manager depending on the size of the organization. Your understanding of these roles clarifies the distinct responsibilities and hierarchical placement that optimize financial operations in an organization.

Decision-Making and Strategic Influence

Financial managers primarily focus on analyzing financial data to guide budgeting and investment decisions, impacting your company's short-term financial health. Treasurers handle cash flow management, risk assessment, and capital structure, playing a critical role in strategic financial planning and liquidity optimization. Both positions contribute to decision-making, but financial managers emphasize operational efficiency while treasurers drive long-term strategic financial influence.

Career Paths and Advancement Opportunities

Financial Manager roles focus on strategic financial planning and analysis, often leading to senior executive positions like CFO, while Treasurers specialize in cash management, investments, and liquidity, advancing toward chief treasury officer or similar niche leadership roles. Your career path as a Financial Manager tends to be broader, encompassing budgeting, risk management, and financial reporting, providing diverse advancement opportunities across various industries. Treasurers typically build deep expertise in corporate finance and capital structure, positioning themselves for specialized high-level roles in risk mitigation and corporate funding strategies.

Challenges Faced by Financial Managers and Treasurers

Financial managers and treasurers face unique challenges that require distinct skill sets; financial managers must oversee budgeting, forecasting, and financial reporting while ensuring compliance with regulatory standards. Treasurers focus on cash flow management, risk mitigation, and investment strategies to maintain liquidity and optimize capital structure. Your ability to balance these responsibilities impacts overall financial stability and strategic growth within an organization.

Choosing Between a Financial Manager and a Treasurer

Choosing between a financial manager and a treasurer depends on the organization's specific needs: a financial manager focuses on budgeting, forecasting, and financial analysis to guide strategic decisions, while a treasurer handles cash management, investment strategies, and risk mitigation. Companies seeking to improve internal financial planning and performance monitoring benefit from financial managers, whereas those prioritizing liquidity management, fundraising, and banking relationships require experienced treasurers. Understanding these distinct roles ensures optimal allocation of financial responsibilities aligned with the company's objectives and growth stage.

Infographic: Financial Manager vs Treasurer

relatioo.com

relatioo.com