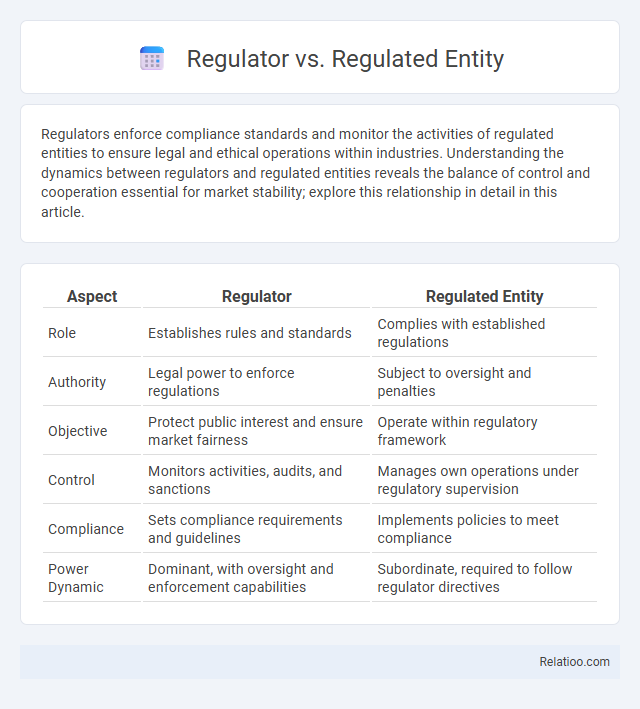

Regulators enforce compliance standards and monitor the activities of regulated entities to ensure legal and ethical operations within industries. Understanding the dynamics between regulators and regulated entities reveals the balance of control and cooperation essential for market stability; explore this relationship in detail in this article.

Table of Comparison

| Aspect | Regulator | Regulated Entity |

|---|---|---|

| Role | Establishes rules and standards | Complies with established regulations |

| Authority | Legal power to enforce regulations | Subject to oversight and penalties |

| Objective | Protect public interest and ensure market fairness | Operate within regulatory framework |

| Control | Monitors activities, audits, and sanctions | Manages own operations under regulatory supervision |

| Compliance | Sets compliance requirements and guidelines | Implements policies to meet compliance |

| Power Dynamic | Dominant, with oversight and enforcement capabilities | Subordinate, required to follow regulator directives |

Understanding Regulators and Regulated Entities

Regulators are government agencies or authorities responsible for enforcing laws and rules to ensure compliance within specific industries, while regulated entities are organizations or individuals subject to these regulations. Understanding the relationship between regulators and regulated entities is critical for maintaining accountability and transparency, as it defines the scope and limits of authority and compliance requirements. Oversight mechanisms involve continuous monitoring, audits, and enforcement actions to uphold regulatory standards and protect public interests.

Key Differences Between Regulators and Regulated Entities

Regulators are authoritative bodies responsible for creating, enforcing, and monitoring compliance with laws and standards within specific industries, while regulated entities are companies or organizations subject to these rules. Key differences include the regulator's role in oversight, policy making, and sanctions authority compared to the regulated entity's obligation to adhere to regulations and implement compliance measures. Oversight involves continuous evaluation and enforcement to ensure regulated entities maintain legal and ethical standards.

Roles and Responsibilities of Regulators

Regulators establish and enforce rules to ensure that regulated entities comply with legal and ethical standards, protecting public interest and maintaining market integrity. They monitor activities, conduct audits, and impose penalties to mitigate risks and prevent misconduct. Your compliance depends on understanding regulators' authority and their proactive role in overseeing industry practices.

Obligations of Regulated Entities

Regulated entities have specific obligations to comply with legal and regulatory requirements established by regulators, including reporting, transparency, risk management, and adherence to operational standards. These obligations ensure that regulated entities maintain financial stability, protect consumer interests, and mitigate systemic risks within the regulated industry. Oversight mechanisms enforce these obligations through monitoring, audits, and sanctions to guarantee accountability and compliance.

Legal Framework Governing Regulatory Relationships

The legal framework governing regulatory relationships defines the roles and responsibilities of regulators, regulated entities, and oversight bodies to ensure compliance and accountability within specific industries. Regulators enforce laws and regulations established by legislation, while regulated entities operate under these rules, adhering to compliance standards to mitigate risks. Oversight mechanisms, often embedded within the legal framework, provide monitoring, enforcement, and dispute resolution functions to maintain transparency and protect public interests.

Regulatory Compliance Requirements

Regulatory compliance requirements mandate that regulated entities adhere to specific laws and standards set by regulators to ensure lawful and ethical operations. Regulators establish these rules and conduct oversight to monitor compliance, enforce penalties, and promote transparency within industries. Effective regulatory oversight involves continuous risk assessments and audits to guarantee that regulated entities maintain proper controls and report accurate information.

Enforcement Actions and Penalties

Regulators impose enforcement actions and penalties on regulated entities to ensure compliance with legal standards and maintain market integrity. Regulated entities must adhere to regulations to avoid sanctions such as fines, license revocations, or operational restrictions. Oversight mechanisms involve continuous monitoring and audits to detect violations and initiate corrective measures promptly.

Challenges in Regulator-Regulated Entity Dynamics

Challenges in regulator-regulated entity dynamics often stem from information asymmetry, where regulated entities possess more detailed operational knowledge than regulators, complicating effective oversight. Conflicting objectives between regulators, focused on public interest and compliance, and entities aiming for profitability can create friction and enforcement difficulties. Maintaining transparent communication and adaptive regulatory frameworks is essential to mitigate these tensions and ensure balanced governance.

Best Practices for Effective Collaboration

Effective collaboration between regulators, regulated entities, and oversight bodies hinges on transparent communication and clearly defined roles that foster mutual understanding and trust. Implementing standardized reporting protocols and regular dialogue sessions enables timely issue resolution and proactive compliance management, enhancing regulatory outcomes. Your organization should prioritize shared goals and continuous feedback loops to ensure adaptive strategies that respond swiftly to evolving regulatory landscapes.

Future Trends in Regulation and Compliance

Future trends in regulation and compliance emphasize increased collaboration between regulators, regulated entities, and oversight bodies through advanced technologies like AI and blockchain to enhance transparency and efficiency. Your organization must adapt to dynamic regulatory frameworks that prioritize real-time data sharing, predictive analytics, and automated compliance monitoring to mitigate risks proactively. Embracing these innovations will drive more agile governance models, ensuring stronger accountability and improved regulatory outcomes.

Infographic: Regulator vs Regulated Entity

relatioo.com

relatioo.com