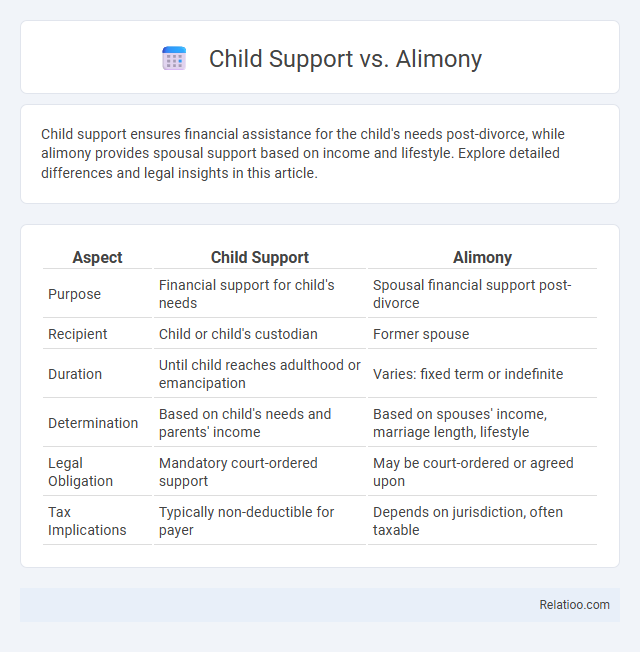

Child support ensures financial assistance for the child's needs post-divorce, while alimony provides spousal support based on income and lifestyle. Explore detailed differences and legal insights in this article.

Table of Comparison

| Aspect | Child Support | Alimony |

|---|---|---|

| Purpose | Financial support for child's needs | Spousal financial support post-divorce |

| Recipient | Child or child's custodian | Former spouse |

| Duration | Until child reaches adulthood or emancipation | Varies: fixed term or indefinite |

| Determination | Based on child's needs and parents' income | Based on spouses' income, marriage length, lifestyle |

| Legal Obligation | Mandatory court-ordered support | May be court-ordered or agreed upon |

| Tax Implications | Typically non-deductible for payer | Depends on jurisdiction, often taxable |

Understanding Child Support and Alimony

Child support is financial payment from a non-custodial parent to support the child's living expenses, education, healthcare, and general welfare, governed by state guidelines to ensure the child's best interests. Alimony, also known as spousal support, is a court-ordered financial support paid by one ex-spouse to the other to help maintain their standard of living post-divorce, based on factors like marriage duration, income disparity, and the recipient's needs. Understanding the legal distinctions between child support and alimony is crucial for ensuring proper financial arrangements tailored to the responsibilities associated with child care versus spousal maintenance.

Key Differences Between Child Support and Alimony

Child support is a legal obligation for the non-custodial parent to provide financial assistance specifically for the child's living expenses, education, and healthcare, whereas alimony is a spousal support payment intended to help the lower-earning spouse maintain a similar standard of living post-divorce. Child support amounts are typically determined based on state guidelines and the needs of the child, while alimony payments depend on factors such as the duration of the marriage, income disparity, and the recipient's ability to become self-sufficient. The enforcement and duration of child support usually continue until the child reaches adulthood, whereas alimony can be temporary, rehabilitative, or permanent depending on the court's decision and specific circumstances.

Legal Definitions: Child Support vs. Alimony

Child support is a legal obligation requiring a non-custodial parent to provide financial assistance for the child's living expenses, education, and healthcare. Alimony, also known as spousal support, is a court-ordered payment from one spouse to another following separation or divorce to help maintain the recipient's standard of living. Unlike child support, alimony is based on the financial needs and earning capacities of the spouses rather than the child's welfare.

Eligibility Criteria for Child Support and Alimony

Child support eligibility is determined by the legal obligation of the non-custodial parent to contribute to a child's financial needs, generally based on income, custody arrangements, and state-specific guidelines. Alimony eligibility depends on factors such as the length of the marriage, the financial disparity between spouses, and the recipient's ability to become self-sufficient. You must understand that child support prioritizes the child's welfare, while alimony addresses spousal financial support after separation.

Calculation Methods for Payments

Child support calculations are based on state guidelines considering factors like parental income, custody time, and child needs to ensure fair financial support. Alimony payments depend on the duration of marriage, income disparity, and each party's standard of living, with formulas varying widely by jurisdiction. Your non-custodial support obligations are specifically derived from these calculations to maintain financial responsibility for your children while reflecting your financial capacity.

Duration of Child Support and Alimony

Child support typically lasts until the child reaches adulthood or graduates from college, varying by state laws, while alimony duration depends on factors like marriage length and income disparity, often set for a fixed term or indefinitely in some cases. Non-custodial parents are usually responsible for paying child support but may also be obligated to contribute to alimony depending on the divorce agreement. Understanding how long these payments last is crucial for managing Your financial obligations and planning for future stability.

Tax Implications: Child Support vs. Alimony

Child support payments are not tax-deductible for the payer and are not considered taxable income for the recipient, ensuring that Your child's financial needs are prioritized without impacting your tax burden. Alimony, under laws applicable to divorces finalized before 2019, is deductible for the payer and taxable income for the recipient, affecting their respective tax returns. Non-custodial parents must understand these differences to manage financial responsibilities and tax liabilities effectively.

Modification and Enforcement of Payments

Child support, alimony, and non-custodial payments each have distinct modification processes and enforcement mechanisms governed by family law statutes. Modification of child support typically requires a significant change in circumstances, such as income alteration or custody shifts, and enforcement can include wage garnishment or contempt orders. Alimony modifications depend on changes in spouses' financial status or cohabitation, while non-custodial payment enforcement often involves legal penalties or income withholding to ensure your obligations are met consistently.

Factors Affecting Court Decisions

Courts consider factors such as the income and earning capacity of both parents when determining child support, ensuring the child's financial needs are met. Alimony decisions depend on the length of the marriage, the standard of living during the marriage, and each spouse's ability to become self-supporting. The status of the non-custodial parent, including their compliance with visitation rights and payment history, also impacts court rulings on support obligations and custody arrangements.

Navigating Disputes and Legal Assistance

Navigating disputes involving child support, alimony, and non-custodial arrangements requires a clear understanding of your legal rights and obligations to protect your financial and parental interests. Child support ensures that non-custodial parents contribute to their child's upbringing, while alimony addresses spousal support after separation or divorce, often necessitating legal intervention to resolve conflicts. You should seek expert legal assistance to mediate disputes effectively and secure fair agreements that comply with family law statutes in your jurisdiction.

Infographic: Child support vs Alimony

relatioo.com

relatioo.com