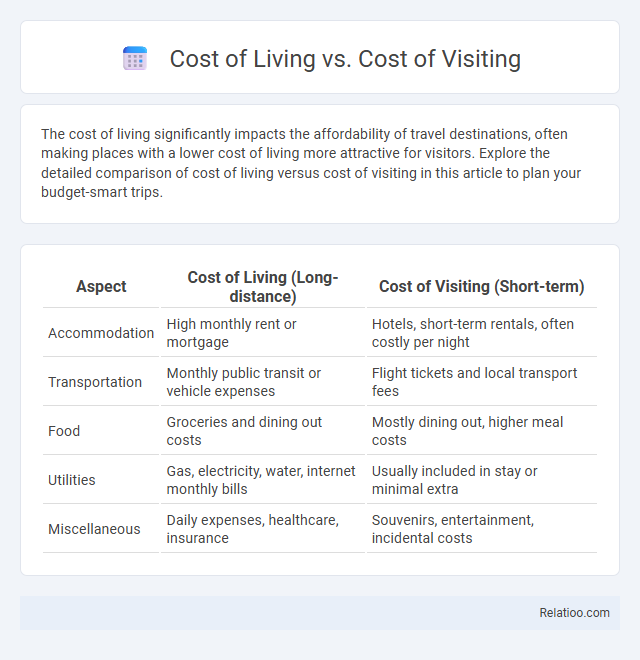

The cost of living significantly impacts the affordability of travel destinations, often making places with a lower cost of living more attractive for visitors. Explore the detailed comparison of cost of living versus cost of visiting in this article to plan your budget-smart trips.

Table of Comparison

| Aspect | Cost of Living (Long-distance) | Cost of Visiting (Short-term) |

|---|---|---|

| Accommodation | High monthly rent or mortgage | Hotels, short-term rentals, often costly per night |

| Transportation | Monthly public transit or vehicle expenses | Flight tickets and local transport fees |

| Food | Groceries and dining out costs | Mostly dining out, higher meal costs |

| Utilities | Gas, electricity, water, internet monthly bills | Usually included in stay or minimal extra |

| Miscellaneous | Daily expenses, healthcare, insurance | Souvenirs, entertainment, incidental costs |

Understanding the Difference: Cost of Living vs. Cost of Visiting

Cost of living refers to the ongoing expenses required to maintain a lifestyle in a specific location, including housing, food, transportation, and healthcare, while cost of visiting entails temporary expenditures such as accommodation, sightseeing, meals, and local transportation during a trip. Understanding the difference enables better financial planning by distinguishing between long-term budgeting needs and short-term travel expenses. Comparing data from sources like the Numbeo cost of living index versus typical tourist spending guides highlights these contrasts, helping individuals optimize their financial strategies.

Accommodation Expenses: Long-Term vs. Short-Term Stays

Accommodation expenses vary significantly between long-term and short-term stays, with long-term options generally offering lower monthly rates and more cost-effective solutions for your financial planning. Short-term stays often include higher costs due to flexible terms and amenities catering to temporary visitors, impacting the overall cost of visiting. Balancing these factors against the cost of living in a destination allows you to make informed decisions that optimize your budget.

Food and Dining: Resident vs. Tourist Spending

Residents typically allocate a larger portion of their budget to groceries and home-cooked meals, benefiting from local market prices and loyalty programs, which significantly reduce their food expenses compared to tourists. Tourists often spend more on dining out at restaurants, cafes, and fast food due to convenience and the desire to experience local cuisine, resulting in higher per-meal costs. Seasonal fluctuations, location popularity, and currency exchange rates further impact the financial differences in food and dining expenditures between residents and visitors.

Transportation Costs: Daily Commutes vs. Tourist Mobility

Transportation costs significantly impact both the cost of living and the cost of visiting, with daily commutes often requiring reliable, consistent expenses for residents, while tourists face variable transportation costs depending on mobility needs and travel modes. Your daily commute involves predictable expenses such as public transit passes or fuel, which contribute steadily to monthly living costs. Tourist mobility typically incurs higher per-trip costs due to rentals, taxis, or tours, influencing overall trip budgets rather than ongoing financial commitments.

Entertainment and Leisure: Locals’ Habits vs. Visitor Choices

Entertainment and leisure expenses vary significantly between locals and visitors due to differing habits and financial priorities. Locals often benefit from discounted rates and memberships, while visitors typically allocate more budget for premium experiences and tourist attractions. Your cost of visiting can exceed local spending, emphasizing the need to plan for diverse entertainment options and manage financial expectations effectively.

Utilities and Services: Resident Costs vs. Short-Term Use

Utilities and services represent a significant portion of monthly expenses for residents, with average utility bills including electricity, water, and gas often reaching $150 to $300 depending on location and consumption. Short-term visitors typically incur minimal direct utility costs as these expenses are embedded within accommodation fees, such as hotel rates or short-term rental charges. Financial planning for residents must account for ongoing service subscriptions and utilities, whereas visitors prioritize one-time or daily fees that cover amenities without long-term commitments.

Shopping and Souvenirs: Necessities vs. Tourist Splurges

Shopping costs vary significantly between locals and tourists, with residents focusing on necessities like groceries and household items, while visitors often spend on souvenirs and luxury goods. Financial planning for cost of living involves budgeting for daily essentials, contrasted with tourist spending patterns that favor unique and non-essential purchases. Understanding these distinctions helps optimize expenses according to purpose and duration of stay.

Seasonal Price Fluctuations for Locals and Visitors

Seasonal price fluctuations significantly impact the cost of living for locals and the cost of visiting for tourists, with peak travel seasons causing spikes in accommodation, dining, and entertainment expenses. Your financial planning should account for these variations, as off-peak periods often offer more affordable rates and reduced congestion, benefiting both residents and visitors. Understanding these trends helps optimize budgeting strategies and ensures better management of expenses throughout the year.

Budgeting Tips for Residents vs. Tourists

Balancing the cost of living with the cost of visiting requires understanding key financial differences; residents manage fixed expenses like rent and utilities, while tourists must budget for accommodations, transportation, and activities. Your budgeting strategy should account for these variations, focusing on long-term savings for residents and daily expense control for tourists. Efficient financial planning involves leveraging local discounts, meal prepping for residents, and selecting affordable attractions or public transit options for visitors.

Making the Right Choice: Relocate or Just Visit?

Evaluating the cost of living versus the cost of visiting is crucial for making the right choice between relocating or just visiting. Your financial situation determines whether long-term expenses like housing, utilities, and groceries outweigh short-term travel costs such as airfare, accommodation, and daily activities. Careful budgeting and comparing these factors ensure a decision that aligns with both your lifestyle and financial goals.

Infographic: Cost of living vs Cost of visiting

relatioo.com

relatioo.com