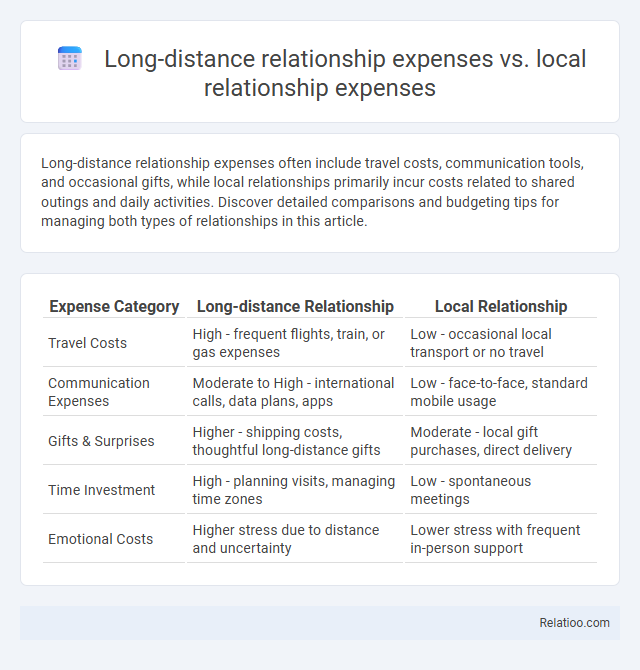

Long-distance relationship expenses often include travel costs, communication tools, and occasional gifts, while local relationships primarily incur costs related to shared outings and daily activities. Discover detailed comparisons and budgeting tips for managing both types of relationships in this article.

Table of Comparison

| Expense Category | Long-distance Relationship | Local Relationship |

|---|---|---|

| Travel Costs | High - frequent flights, train, or gas expenses | Low - occasional local transport or no travel |

| Communication Expenses | Moderate to High - international calls, data plans, apps | Low - face-to-face, standard mobile usage |

| Gifts & Surprises | Higher - shipping costs, thoughtful long-distance gifts | Moderate - local gift purchases, direct delivery |

| Time Investment | High - planning visits, managing time zones | Low - spontaneous meetings |

| Emotional Costs | Higher stress due to distance and uncertainty | Lower stress with frequent in-person support |

Overview of Relationship Expenses

Long-distance relationship expenses typically include higher travel costs, communication tools, and occasional accommodation, making them substantially more costly than local relationships, which primarily involve regular outings and shared daily expenses. Your financial commitments in local relationships often center around dining, entertainment, and transportation within proximity, whereas long-distance partnerships demand budgeting for flights, long-distance calls, and digital gifts. Understanding these expense differences helps you manage your finances effectively while maintaining emotional connections regardless of distance.

Common Costs in Long-Distance Relationships

Long-distance relationships often carry higher common costs than local relationships due to frequent travel expenses, technology for constant communication, and occasional gifts to maintain emotional connection. Your financial planning must account for flights, accommodation, long-distance calls or internet bills, and possibly shipping personal items, which are less significant or absent in local relationships. These expenses can significantly impact your budget, making careful financial management essential to sustaining a long-distance partnership.

Typical Expenses in Local Relationships

Typical expenses in local relationships often include frequent dining out, entertainment, and shared household costs, which contribute to regular but predictable financial outlays. In contrast, long-distance relationships incur higher travel expenses and costly communication tools, increasing overall financial pressure. Understanding these expense patterns helps couples budget effectively and manage relationship finances more efficiently.

Travel and Transportation Costs

Travel and transportation costs significantly impact the financial dynamics of long-distance relationships compared to local ones, with frequent flights or train tickets often doubling or tripling monthly expenses. Your budget must account for airfare, accommodations, and local transportation, which are minimal or nonexistent in local relationships where commuting is infrequent and short-distance. Understanding these expense differentials is essential for sustainable financial planning and maintaining your connection without undue monetary strain.

Communication and Technology Expenses

Long-distance relationship expenses often include higher communication and technology costs such as international phone plans, video calling platforms, and time zone coordination tools, whereas local relationships typically rely on less costly in-person interactions with minimal tech expenses. Your financial planning must account for monthly data plans, device upgrades, and subscription services that facilitate continuous contact across distances. Investing in reliable technology is essential to bridge the gap, making communication expenses a critical component of managing relationship finances effectively.

Gifts and Special Occasions Spending

Long-distance relationships often incur higher expenses on gifts and special occasions due to shipping costs and the need for more thoughtful, often personalized presents to bridge the physical gap. Local relationships allow for more spontaneous and less costly gifts, with opportunities to celebrate special occasions together without additional travel expenses. Managing your finances effectively requires balancing these costs by setting budgets that reflect the unique demands of your relationship type while prioritizing meaningful gestures over monetary value.

Dining Out and Entertainment Costs

Long-distance relationships often incur higher dining out and entertainment expenses due to travel and special outings during visits, whereas local relationships tend to have more consistent but lower daily costs for meals and activities. Managing your budget requires balancing the occasional high costs of long-distance meetups with the frequent but smaller expenses of local dates. Financial planning for relationships should factor in these varying dining and entertainment costs to maintain stability and enjoyment regardless of distance.

Housing and Living Arrangement Differences

Housing and living arrangement expenses in long-distance relationships often include separate rent and utility costs, while local relationships allow couples to share these expenses, reducing individual financial burdens. Long-distance couples may face additional travel costs that local partners typically avoid, impacting overall budget allocation. You need to carefully balance these financial differences to maintain relationship stability and manage housing expenditures effectively.

Emotional and Hidden Financial Costs

Long-distance relationships often incur higher financial expenses due to travel costs, communication tools, and occasional gifts, which can strain your budget more than local relationships where expenses are generally shared and more predictable. Emotional costs in long-distance setups include loneliness and anxiety, which may lead to hidden financial costs like therapy or stress-related spending. Local relationships typically involve more frequent social activities and daily expenses, yet emotional support is more accessible, potentially reducing hidden financial burdens tied to emotional distress.

Tips for Managing Relationship Expenses Efficiently

Long-distance relationship expenses often include travel costs, international communication fees, and occasional gifts, which can strain Your budget more than local relationships that generally incur regular dining, entertainment, and activity expenses. Managing relationship expenses efficiently requires setting clear budgets, using cost-effective communication tools like video calls, and scheduling affordable local activities or shared experiences. Tracking spending with financial apps and planning joint savings goals can help balance costs while strengthening your financial and emotional connection.

Infographic: Long-distance relationship expenses vs Local relationship expenses

relatioo.com

relatioo.com