Risk tolerance determines how much volatility an investor can endure, while time horizon affects the investment strategy's duration and growth potential. Explore this article to understand how balancing risk tolerance with time horizon shapes financial decision-making.

Table of Comparison

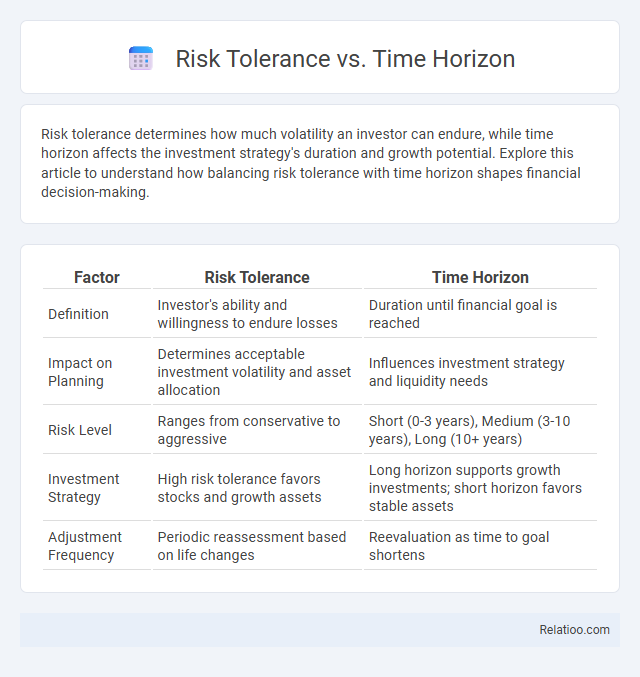

| Factor | Risk Tolerance | Time Horizon |

|---|---|---|

| Definition | Investor's ability and willingness to endure losses | Duration until financial goal is reached |

| Impact on Planning | Determines acceptable investment volatility and asset allocation | Influences investment strategy and liquidity needs |

| Risk Level | Ranges from conservative to aggressive | Short (0-3 years), Medium (3-10 years), Long (10+ years) |

| Investment Strategy | High risk tolerance favors stocks and growth assets | Long horizon supports growth investments; short horizon favors stable assets |

| Adjustment Frequency | Periodic reassessment based on life changes | Reevaluation as time to goal shortens |

Understanding Risk Tolerance: Definition and Importance

Risk tolerance defines your ability and willingness to endure market volatility and potential losses in investments. It is essential for tailoring your portfolio to match your emotional comfort and financial goals, preventing impulsive decisions during market fluctuations. Understanding your risk tolerance ensures your investment strategy aligns with both your time horizon and overall financial plan for sustained growth.

What Is Time Horizon in Investing?

Time horizon in investing refers to the length of time an investor expects to hold an investment before needing to access the funds. It significantly influences risk tolerance, as longer time horizons typically allow for greater exposure to higher-risk, higher-reward assets due to the potential to recover from market volatility. Investors with short time horizons often prioritize capital preservation and lower-risk investments to avoid significant losses before the investment goal is reached.

The Relationship Between Risk Tolerance and Time Horizon

The relationship between risk tolerance and time horizon is critical for effective investment strategies, as longer time horizons generally allow for higher risk tolerance due to the ability to recover from short-term market fluctuations. Your risk tolerance, influenced by factors such as financial goals and emotional comfort with market volatility, should align with the investment time horizon to optimize portfolio growth and minimize stress. Understanding this balance helps you tailor your investments to match both your financial objectives and the timeframe over which you aim to achieve them.

Factors Influencing Individual Risk Tolerance

Individual risk tolerance is influenced by factors such as age, income, financial goals, and emotional capacity for loss, directly affecting investment decisions over different time horizons. Your time horizon determines how much risk you can afford to take, as longer periods allow for recovery from market volatility while shorter horizons require more conservative approaches. Understanding these elements helps tailor a personalized investment strategy that balances potential returns with comfort level.

How Time Horizon Shapes Investment Strategies

Time horizon significantly influences your investment strategies by determining the level of risk you can afford to take. Longer time horizons generally allow for higher risk tolerance, enabling investments in more volatile assets like stocks to maximize growth potential. Shorter time horizons necessitate conservative approaches, emphasizing capital preservation through bonds or cash equivalents, to minimize potential losses.

Assessing Your Personal Risk Profile

Assessing your personal risk profile involves understanding the interplay between risk tolerance, time horizon, and financial goals. Risk tolerance reflects your comfort with market fluctuations, while time horizon determines how long your investments have to grow before you need access to funds. Aligning these factors helps create a tailored investment strategy that balances potential returns with your ability to withstand market volatility.

Aligning Investment Choices with Risk and Time Objectives

Aligning investment choices requires balancing risk tolerance and time horizon to optimize portfolio performance and meet financial goals. Investors with high risk tolerance and longer time horizons can pursue growth-oriented assets like stocks, while conservative investors with shorter time horizons should prioritize stability through bonds or cash equivalents. Effective alignment ensures portfolios withstand market volatility while progressing toward targeted returns over the desired investment period.

Common Mistakes: Misjudging Risk Tolerance or Time Horizon

Misjudging risk tolerance often leads investors to take on excessive or insufficient risk, jeopardizing portfolio stability. Confusing risk tolerance with time horizon may result in inappropriate asset allocation, as time horizon dictates investment duration while risk tolerance reflects emotional capacity for volatility. Failing to accurately assess both factors can cause misaligned financial goals and suboptimal investment outcomes.

Adapting Your Portfolio Over Time

Risk tolerance measures your comfort with investment volatility, while time horizon reflects the duration you plan to keep your investments before needing the funds. Adapting your portfolio over time involves gradually shifting from higher-risk assets like stocks to lower-risk assets such as bonds and cash as your time horizon shortens and your risk tolerance decreases. This dynamic balance helps optimize returns while managing potential losses according to changing financial goals and market conditions.

Key Takeaways: Balancing Risk Tolerance and Time Horizon

Balancing risk tolerance and time horizon is crucial for effective investment strategies, as higher risk tolerance can justify more aggressive asset allocations over longer time horizons. Investors with short time horizons should prioritize lower-risk investments to protect capital, while those with longer horizons can afford greater market volatility for potentially higher returns. Aligning risk tolerance with time horizon helps optimize portfolio performance and manage potential losses.

Infographic: Risk Tolerance vs Time Horizon

relatioo.com

relatioo.com