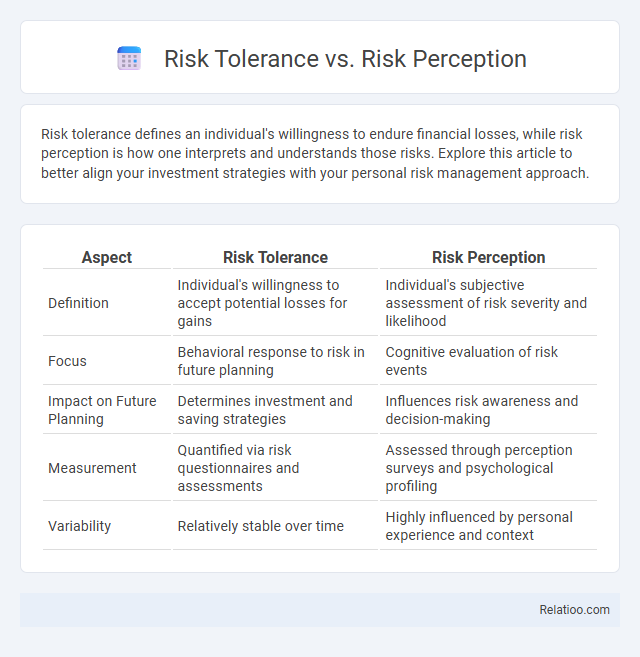

Risk tolerance defines an individual's willingness to endure financial losses, while risk perception is how one interprets and understands those risks. Explore this article to better align your investment strategies with your personal risk management approach.

Table of Comparison

| Aspect | Risk Tolerance | Risk Perception |

|---|---|---|

| Definition | Individual's willingness to accept potential losses for gains | Individual's subjective assessment of risk severity and likelihood |

| Focus | Behavioral response to risk in future planning | Cognitive evaluation of risk events |

| Impact on Future Planning | Determines investment and saving strategies | Influences risk awareness and decision-making |

| Measurement | Quantified via risk questionnaires and assessments | Assessed through perception surveys and psychological profiling |

| Variability | Relatively stable over time | Highly influenced by personal experience and context |

Understanding Risk Tolerance

Understanding risk tolerance is crucial for making informed investment decisions tailored to your financial goals and comfort level. Risk tolerance measures your ability and willingness to endure market fluctuations and potential losses, influencing asset allocation and long-term strategy. By accurately assessing risk tolerance, you can balance investment opportunities with your personal financial stability, reducing stress during market volatility.

Defining Risk Perception

Risk perception refers to your personal judgment about the severity and probability of a risk, influenced by emotions, experiences, and cognitive biases. It differs from risk tolerance, which is the level of risk you are willing to accept in pursuit of your financial goals, and risk capacity, which measures your actual ability to endure losses. Understanding risk perception helps tailor investment strategies that align with your psychological comfort and financial reality.

Key Differences Between Risk Tolerance and Risk Perception

Risk tolerance refers to Your actual willingness to take financial risks based on personal capacity and investment goals, while risk perception involves how you interpret and understand those risks, often influenced by emotions and experiences. The key difference lies in risk tolerance being an objective measure of acceptable risk levels, whereas risk perception is subjective and can lead to overestimating or underestimating potential dangers. Understanding these distinctions helps in making more informed financial decisions and aligning your investment strategy with your true risk capacity.

Factors Influencing Individual Risk Tolerance

Individual risk tolerance is influenced by factors such as age, financial situation, investment goals, and psychological traits like fear and confidence. Your personal experiences and knowledge also shape how you perceive and tolerate risks in financial decisions. Understanding these elements is crucial for aligning your investment strategy with your true risk capacity.

Psychological Aspects of Risk Perception

Risk perception involves your psychological evaluation of potential hazards, influenced by emotions, past experiences, and cognitive biases, which often differ from objective risk tolerance defined by your actual capacity to endure losses. While risk tolerance quantifies your willingness and financial ability to withstand risk, risk perception shapes how you interpret and emotionally respond to risks, impacting decision-making processes. Understanding these psychological aspects helps align your perceived risks with true risk tolerance for more effective risk management strategies.

The Role of Emotions in Risk Decision-Making

Risk tolerance reflects an individual's capacity to endure potential losses while making investment decisions, whereas risk perception involves the subjective evaluation of the likelihood and severity of those risks. Emotions significantly influence risk perception by amplifying fear or optimism, often skewing rational judgment and leading to either excessive risk aversion or unwarranted risk-taking. Understanding this emotional interplay is crucial for developing strategies that align actual risk tolerance with perceived threats, optimizing decision-making under uncertainty.

Measuring and Assessing Risk Tolerance

Measuring and assessing risk tolerance involves evaluating your financial capacity and emotional comfort with potential investment losses to ensure alignment with your investment goals. Risk perception reflects your subjective understanding of risk based on personal experiences and cognitive biases, which may differ from objective risk tolerance. Accurate risk assessment combines psychometric tools, questionnaires, and scenario analysis to capture both your true risk tolerance and perception, enabling tailored investment strategies.

How Risk Perception Impacts Financial Choices

Risk perception significantly influences financial choices by shaping how individuals interpret the potential dangers of investments or economic decisions, often leading to more conservative or aggressive behavior depending on their subjective assessment of risk. Unlike risk tolerance, which is the inherent capacity or willingness to endure financial loss, risk perception is dynamic and affected by factors such as market volatility, personal experiences, and media coverage, directly impacting the decision-making process. Understanding this distinction helps financial advisors tailor strategies to clients' psychological profiles, ultimately optimizing investment outcomes by aligning perception with actual risk tolerance.

Aligning Risk Tolerance with Investment Strategies

Aligning risk tolerance with investment strategies is essential to achieving long-term financial goals while managing potential losses. Risk tolerance, defined as an investor's ability and willingness to endure market volatility, must be clearly distinguished from risk perception, which is the subjective judgment about the severity and probability of risk. By accurately assessing risk tolerance through quantitative tools and psychological profiling, investors can select appropriate asset allocations that balance expected returns with acceptable risk levels, optimizing portfolio performance and minimizing emotional decision-making during market fluctuations.

Practical Tips for Balancing Risk Tolerance and Perception

Balancing risk tolerance and risk perception requires a clear understanding of your financial goals and the ability to differentiate between emotional reactions and rational assessments of risk. You can manage this balance by regularly reviewing your investment portfolio to ensure it aligns with your comfort level and updating your knowledge about market conditions to reduce bias. Practical tips include setting predefined limits for losses, diversifying investments, and consulting with financial advisors to maintain an objective perspective on risks versus rewards.

Infographic: Risk Tolerance vs Risk Perception

relatioo.com

relatioo.com