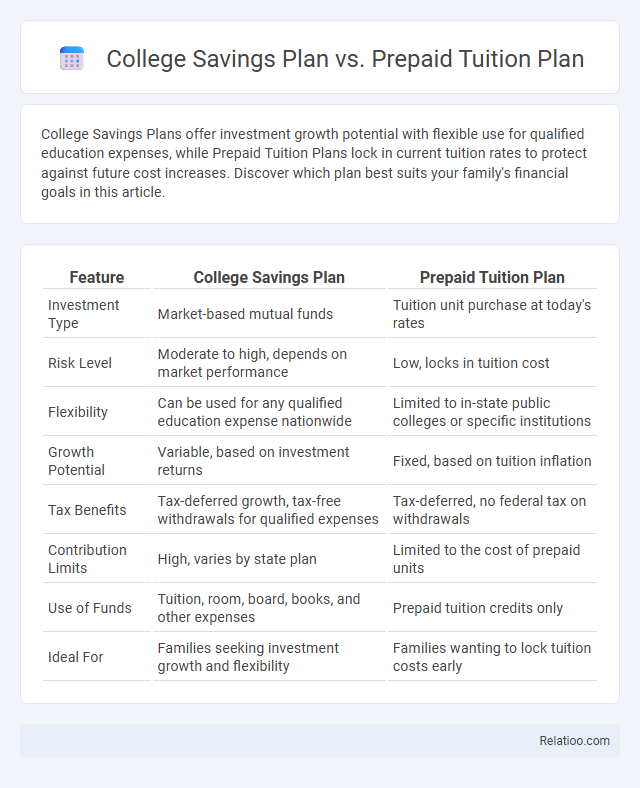

College Savings Plans offer investment growth potential with flexible use for qualified education expenses, while Prepaid Tuition Plans lock in current tuition rates to protect against future cost increases. Discover which plan best suits your family's financial goals in this article.

Table of Comparison

| Feature | College Savings Plan | Prepaid Tuition Plan |

|---|---|---|

| Investment Type | Market-based mutual funds | Tuition unit purchase at today's rates |

| Risk Level | Moderate to high, depends on market performance | Low, locks in tuition cost |

| Flexibility | Can be used for any qualified education expense nationwide | Limited to in-state public colleges or specific institutions |

| Growth Potential | Variable, based on investment returns | Fixed, based on tuition inflation |

| Tax Benefits | Tax-deferred growth, tax-free withdrawals for qualified expenses | Tax-deferred, no federal tax on withdrawals |

| Contribution Limits | High, varies by state plan | Limited to the cost of prepaid units |

| Use of Funds | Tuition, room, board, books, and other expenses | Prepaid tuition credits only |

| Ideal For | Families seeking investment growth and flexibility | Families wanting to lock tuition costs early |

Understanding College Savings Plans

College Savings Plans are tax-advantaged investment accounts specifically designed to help families save for future education expenses by growing funds that can be used at eligible institutions nationwide. Unlike Prepaid Tuition Plans, which lock in current tuition rates at specific colleges, College Savings Plans offer flexibility in investment options and allow funds to cover various qualified expenses such as tuition, room, board, and supplies. Education planning incorporates these tools to tailor a comprehensive financial strategy focused on maximizing tax benefits, managing risks, and ensuring sufficient funds for college costs.

What Are Prepaid Tuition Plans?

Prepaid Tuition Plans allow You to lock in current tuition rates by pre-purchasing future college credits or semesters at participating colleges, protecting against rising education costs. These plans are typically state-sponsored and guarantee tuition coverage at in-state public universities, offering financial predictability and peace of mind. Unlike College Savings Plans, which invest contributions and fluctuate with the market, Prepaid Tuition Plans provide a more secure way to ensure that Your tuition expenses are covered.

Key Differences: Savings vs Prepaid Options

College Savings Plans offer flexible investment options that grow over time based on market performance, allowing You to use funds for a wide range of education expenses. Prepaid Tuition Plans lock in current tuition rates by purchasing credits in advance, providing cost certainty but limited use to specific schools or in-state institutions. Education Planning combines these approaches by evaluating Your financial goals, expected costs, and risk tolerance to select the most suitable strategy for funding future educational needs.

Flexibility in College Savings Plans

College Savings Plans offer greater flexibility compared to Prepaid Tuition Plans by allowing you to use funds at a variety of eligible institutions nationwide, including colleges, universities, and some trade schools. These plans invest in a range of assets, enabling potential growth over time and the option to change beneficiaries within the same family. Education Planning encompasses both options but emphasizes tailoring strategies to your financial goals and adapting as your child's needs evolve.

Prepaid Tuition Plan Eligibility and Limitations

Prepaid Tuition Plans allow you to lock in current tuition rates by pre-purchasing credits at eligible in-state public colleges, offering protection against future tuition inflation. Eligibility for these plans typically requires residency in the sponsoring state and sometimes enrollment of a beneficiary within a specific age range, with limitations on transferring credits to private or out-of-state institutions. Compared to general College Savings Plans or broader Education Planning strategies, Prepaid Tuition Plans provide less flexibility but greater predictability in covering tuition costs.

Investment Growth Potential: Savings Plans

College Savings Plans offer higher investment growth potential compared to Prepaid Tuition Plans because they invest contributions in diversified portfolios including stocks and bonds, allowing funds to appreciate over time based on market performance. Prepaid Tuition Plans lock in today's tuition rates but lack growth potential beyond tuition increases, making them less flexible for rising education costs. Education Planning that emphasizes Savings Plans maximizes long-term financial growth by leveraging compounding returns and tax advantages, crucial for covering future higher education expenses.

Locking in Tuition Rates: Pros and Cons

Locking in tuition rates through a Prepaid Tuition Plan guarantees your child's tuition at today's prices, shielding you from future increases and providing predictability in educational expenses. College Savings Plans offer flexibility to cover various education costs but are subject to market fluctuations, which can impact the value of your savings. Your choice depends on balancing the security of fixed rates with the investment growth potential and broader expense coverage offered by these education planning options.

Tax Benefits Comparison

College Savings Plans offer tax-deferred growth and tax-free withdrawals for qualified education expenses, with potential state tax deductions or credits depending on the state. Prepaid Tuition Plans lock in current tuition rates, typically providing tax-free benefits at the state level but limited investment growth compared to savings plans. Education Planning encompasses both strategies, allowing for diversified tax advantages by balancing prepaid tuition's predictability with college savings plans' flexibility and federal tax benefits.

Risks and Drawbacks of Each Plan

College Savings Plans carry market risk as account values fluctuate with investment performance, and potential penalties apply for non-qualified withdrawals. Prepaid Tuition Plans face risks of state insolvency or program closure, possibly leading to loss of benefits or unpaid tuition, and often lack flexibility if a student attends a different institution. Education Planning requires careful forecasting of future costs and may involve inflation risk, making it challenging to ensure sufficient funds without over- or under-saving.

Choosing the Right Plan for Your Family

Choosing the right education savings plan depends on your family's financial goals, risk tolerance, and anticipated college costs. College Savings Plans offer investment flexibility and potential growth but carry market risk, while Prepaid Tuition Plans lock in current tuition rates, providing cost certainty without market exposure. Educational planning should evaluate state-specific plan benefits, tax advantages, and the child's expected college timeline to maximize financial readiness.

Infographic: College Savings Plan vs Prepaid Tuition Plan

relatioo.com

relatioo.com