Saver personalities prioritize financial security by consistently setting aside money, while Spenders tend to value immediate gratification through consumption. Discover how understanding these distinct money mindsets can improve your relationship dynamics in this article.

Table of Comparison

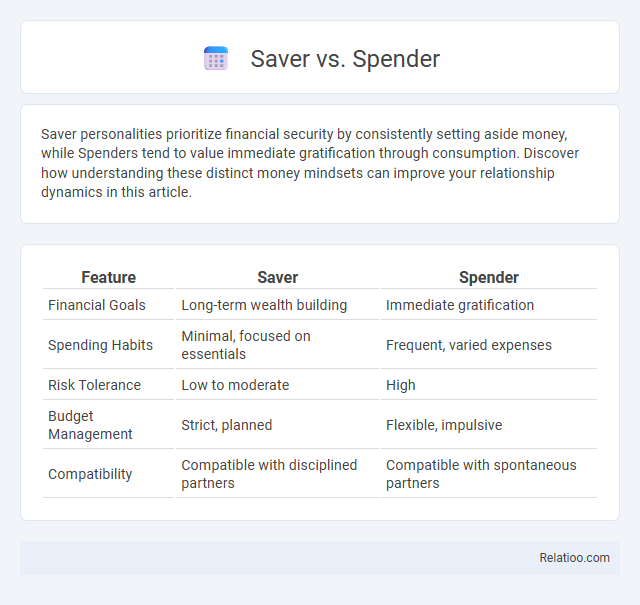

| Feature | Saver | Spender |

|---|---|---|

| Financial Goals | Long-term wealth building | Immediate gratification |

| Spending Habits | Minimal, focused on essentials | Frequent, varied expenses |

| Risk Tolerance | Low to moderate | High |

| Budget Management | Strict, planned | Flexible, impulsive |

| Compatibility | Compatible with disciplined partners | Compatible with spontaneous partners |

Introduction: Understanding Savers and Spenders

Understanding savers and spenders highlights distinct financial habits that significantly impact money management and long-term wealth accumulation. Savers prioritize setting aside funds for future needs, fostering financial security through disciplined budgeting and cautious spending patterns. Spenders tend to allocate more resources toward immediate gratification, often influenced by emotional triggers and consumer behavior, which can challenge consistent saving strategies.

Key Traits of a Saver

A saver prioritizes financial security by consistently setting aside a portion of income, demonstrating discipline and long-term planning in their spending habits. Your ability to resist impulsive purchases and focus on building an emergency fund or savings account highlights a strong commitment to future stability. Key traits of a saver include patience, goal-oriented mindset, and conscientious budgeting that supports wealth accumulation.

Key Traits of a Spender

Spenders exhibit key traits such as impulsive purchasing behavior, prioritizing immediate gratification over long-term savings, and often struggling to stick to budgets. They tend to make emotional decisions when shopping, leading to frequent discretionary expenses and less emphasis on financial planning. This mindset can result in difficulties building emergency funds or investing for future goals.

Psychological Factors Behind Saving and Spending

Psychological factors such as self-control, future orientation, and emotional regulation significantly influence whether an individual tends to be a saver or spender. Tendencies toward impulsivity can drive spending habits, while a strong sense of delayed gratification supports consistent saving behavior. Cognitive biases like present bias and loss aversion also shape financial habits by affecting how people perceive immediate versus long-term rewards.

Impact on Financial Health

Savvy savers who consistently allocate a portion of their income towards savings build a strong financial foundation, fostering wealth accumulation and emergency preparedness. Conversely, habitual spenders often face financial instability due to frequent impulsive purchases and insufficient savings, increasing the risk of debt. Effective financial habits, such as budgeting and mindful spending, enhance overall financial health by promoting balance between saving and spending, ultimately leading to improved credit scores and long-term financial security.

Pros and Cons of Saving vs. Spending

Saving builds financial security and emergency funds, helping you avoid debt and achieve long-term goals, but it may limit immediate enjoyment or opportunities for experiences. Spending can boost your quality of life and support the economy, yet excessive spending risks debt accumulation and financial instability. Balancing your financial habits is crucial to optimize both present satisfaction and future financial health.

Managing Relationships: Saver Meets Spender

When a saver meets a spender, managing financial habits requires clear communication about budgeting and long-term goals to prevent conflicts. Establishing shared financial boundaries and regularly reviewing expenses helps balance the saver's caution with the spender's desire for enjoyment. Respecting differing money mindsets promotes a healthier relationship by fostering mutual understanding and compromise in financial decisions.

Tips for Balancing Saving and Spending

Balancing saving and spending is essential for maintaining financial health and achieving your goals. You can start by setting clear budgets that allocate specific amounts for savings and discretionary expenses, ensuring you control impulse purchases without feeling deprived. Tracking your expenses regularly and prioritizing high-impact savings habits, such as automating transfers to your savings account, helps you develop a sustainable financial routine tailored to your lifestyle.

Building Healthy Money Habits

Building healthy money habits requires understanding the distinct financial behaviors of savers and spenders. Savers prioritize budgeting, regular saving, and long-term financial goals, while spenders often focus on immediate gratification and discretionary expenses. Combining disciplined saving strategies with mindful spending habits fosters financial stability and promotes sustainable wealth accumulation.

Conclusion: Finding Your Financial Balance

Finding a healthy financial balance involves understanding your tendencies as a saver or spender and developing disciplined financial habits tailored to your goals. Consistently tracking expenses, setting realistic budgets, and prioritizing both saving and mindful spending create a sustainable path to financial stability. Integrating these practices enhances wealth management and ensures long-term financial security.

Infographic: Saver vs Spender

relatioo.com

relatioo.com