Reliance Industries holds substantial stakes in India's energy sector, while ONGC remains the largest state-owned oil and gas company driving domestic production. Explore this article to understand the contrasting strategies and market impacts of Reliance and ONGC.

Table of Comparison

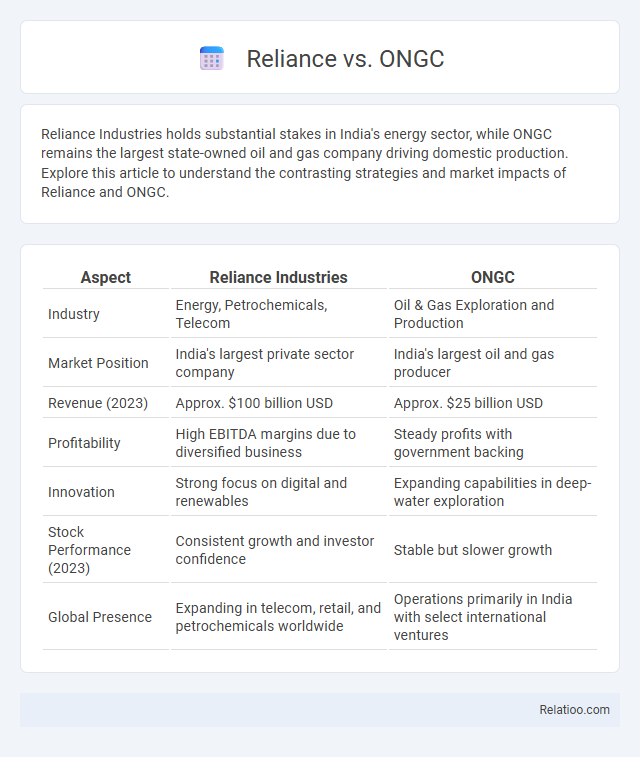

| Aspect | Reliance Industries | ONGC |

|---|---|---|

| Industry | Energy, Petrochemicals, Telecom | Oil & Gas Exploration and Production |

| Market Position | India's largest private sector company | India's largest oil and gas producer |

| Revenue (2023) | Approx. $100 billion USD | Approx. $25 billion USD |

| Profitability | High EBITDA margins due to diversified business | Steady profits with government backing |

| Innovation | Strong focus on digital and renewables | Expanding capabilities in deep-water exploration |

| Stock Performance (2023) | Consistent growth and investor confidence | Stable but slower growth |

| Global Presence | Expanding in telecom, retail, and petrochemicals worldwide | Operations primarily in India with select international ventures |

Introduction to Reliance and ONGC

Reliance Industries Limited, a major Indian conglomerate, dominates sectors like petrochemicals, refining, and telecommunications, showcasing robust innovation and market expansion. Oil and Natural Gas Corporation (ONGC) stands as India's leading oil and gas exploration and production company, significantly contributing to the nation's energy sector with extensive upstream operations. Both entities play pivotal roles in India's energy landscape, with Reliance focusing on diversified business models and ONGC emphasizing core hydrocarbon exploration and production.

Company Backgrounds: Reliance vs ONGC

Reliance Industries Limited, founded by Dhirubhai Ambani in 1966, is a diversified conglomerate with significant operations in petrochemicals, refining, oil exploration, and telecommunications, making it a key player in India's energy and industrial sectors. Oil and Natural Gas Corporation (ONGC), established in 1956 as a government-owned enterprise, is India's largest oil and gas exploration and production company, primarily focused on upstream activities such as exploration, drilling, and production of hydrocarbons. While Reliance concentrates on integrated business models combining upstream and downstream sectors, ONGC remains predominantly upstream-focused, playing a crucial role in India's energy security through state-controlled exploration and production efforts.

Core Business Segments Comparison

Reliance Industries primarily focuses on petrochemicals, refining, and retail, while ONGC's core business lies in oil and natural gas exploration and production, making it India's largest upstream oil and gas company. Both companies operate in the energy sector, but Reliance has diversified significantly into telecom and retail, whereas ONGC remains concentrated on hydrocarbon extraction and reserves management. Reliance's business model emphasizes integration and diversification across energy and consumer segments, whereas ONGC drives India's oil and gas self-sufficiency through exploration and production activities.

Financial Performance Analysis

Reliance Industries demonstrated robust revenue growth, reporting a 15% increase year-over-year in the latest quarter, driven by its diversified portfolio spanning petrochemicals, refining, and digital services. ONGC showed steady financial performance with a focus on upstream oil and gas operations, reflecting a 10% rise in net profit supported by higher crude oil prices and enhanced production efficiency. Comparing key financial metrics, Reliance leads in profitability and revenue scale, while ONGC maintains strong cash flow stability, highlighting different strategic strengths within India's energy sector.

Market Share and Industry Position

Reliance Industries holds a significant market share in India's energy sector, leveraging its diversified portfolio across refining, petrochemicals, and telecom, positioning it as a market leader. ONGC dominates upstream exploration and production, securing a substantial portion of India's crude oil and natural gas output, reinforcing its critical role in national energy security. Your strategic decisions in energy investments must consider Reliance's integrated approach and ONGC's production capacity to optimize growth opportunities.

Technological Innovations and Advancements

Reliance Industries leads in technological innovations with its pioneering use of advanced digital oilfields and AI-driven exploration techniques, significantly boosting operational efficiency. ONGC integrates cutting-edge seismic imaging and deepwater drilling technologies, maintaining its position as a frontrunner in India's hydrocarbon sector. Both companies prioritize R&D investments, but Reliance's aggressive adoption of renewable energy tech and smart refinery systems marks a distinct advancement over traditional methods used by ONGC.

Sustainability and Environmental Initiatives

Reliance Industries has aggressively pursued sustainability through investments in renewable energy projects, aiming for net-zero emissions by 2035 and expanding solar and hydrogen fuel developments. ONGC emphasizes environmental stewardship by implementing zero-flaring policies and improving energy efficiency in exploration and extraction to reduce carbon footprint. Between the two, Reliance leads in integrating cutting-edge green technologies, while ONGC maintains a strong focus on sustainable fossil fuel management and ecosystem conservation initiatives.

Key Projects and Investments

Reliance Industries has heavily invested in its Jamnagar refinery, one of the world's largest refining complexes with a capacity of 1.24 million barrels per day, alongside significant ventures in petrochemicals and digital services. ONGC focuses primarily on upstream oil exploration and production projects, including the KG-D6 gas project and offshore oilfields, with substantial investments aimed at boosting domestic oil and gas output. Reliance's strategic investments contrast with ONGC's resource-driven projects, reflecting differences in core business areas and expansion strategies within India's energy landscape.

Growth Strategies and Future Outlook

Reliance Industries emphasizes diversification and digital transformation, expanding its footprint in retail, telecom, and renewable energy sectors to sustain long-term growth. ONGC focuses on enhancing upstream oil and gas exploration, investing in technology for efficient extraction and expanding its global presence to stabilize production levels amid fluctuating crude prices. Future outlook for Reliance highlights aggressive expansion in green energy and digital platforms, while ONGC plans to invest in carbon capture and alternative energy solutions, positioning both companies for sustainable growth in an evolving energy market.

Conclusion: Reliance vs ONGC

Reliance Industries outperforms ONGC in market capitalization, revenue growth, and diversification across petrochemicals, refining, and retail sectors, showcasing stronger financial resilience. ONGC remains a key player in upstream oil and gas exploration with significant government backing but faces challenges in operational efficiency and slower profit margins. The competitive edge lies with Reliance due to its integrated business model and innovation-driven expansion.

Infographic: Reliance vs ONGC

relatioo.com

relatioo.com