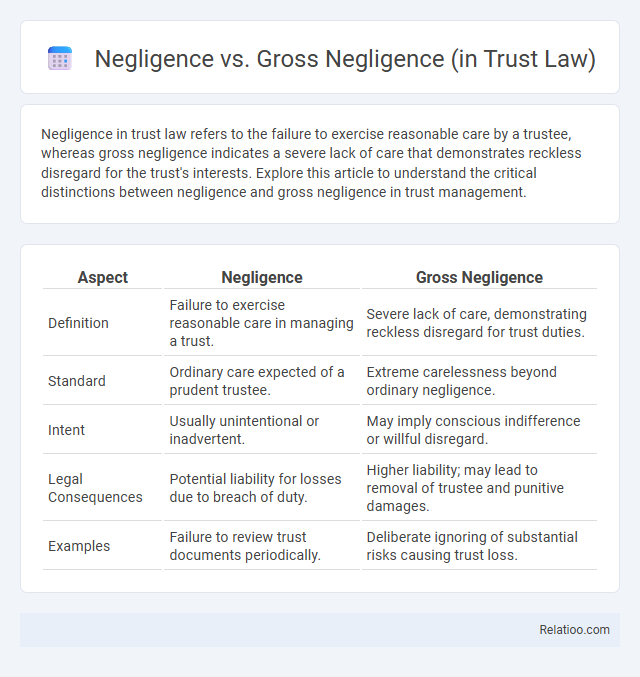

Negligence in trust law refers to the failure to exercise reasonable care by a trustee, whereas gross negligence indicates a severe lack of care that demonstrates reckless disregard for the trust's interests. Explore this article to understand the critical distinctions between negligence and gross negligence in trust management.

Table of Comparison

| Aspect | Negligence | Gross Negligence |

|---|---|---|

| Definition | Failure to exercise reasonable care in managing a trust. | Severe lack of care, demonstrating reckless disregard for trust duties. |

| Standard | Ordinary care expected of a prudent trustee. | Extreme carelessness beyond ordinary negligence. |

| Intent | Usually unintentional or inadvertent. | May imply conscious indifference or willful disregard. |

| Legal Consequences | Potential liability for losses due to breach of duty. | Higher liability; may lead to removal of trustee and punitive damages. |

| Examples | Failure to review trust documents periodically. | Deliberate ignoring of substantial risks causing trust loss. |

Understanding Negligence in Trust Law

Negligence in trust law refers to a trustee's failure to exercise the standard of care that a reasonably prudent person would use in managing the trust assets, which can result in financial loss to the beneficiaries. Gross negligence involves a more severe lack of care, indicating a reckless disregard for the trustee's duties, often leading to harsher legal consequences and potential personal liability. Understanding these distinctions is crucial for trustees to ensure compliance with fiduciary responsibilities and to protect beneficiaries' interests.

Defining Gross Negligence in Trust Law

Gross negligence in trust law refers to a severe lack of care or reckless disregard for the duties owed by a trustee, far exceeding ordinary negligence, which involves mere carelessness or failure to exercise reasonable care. While negligence signifies a breach of duty through inattentiveness or failure to act prudently, gross negligence denotes a flagrant deviation from the standard of care expected in the management and administration of trust property. This heightened standard in trust law holds trustees accountable for actions demonstrating willful disregard or extreme indifference to their fiduciary responsibilities.

Key Legal Differences: Negligence vs Gross Negligence

Negligence in trust law refers to the failure to exercise reasonable care by a trustee, resulting in unintended harm or loss to the trust. Gross negligence denotes a severe degree of carelessness or reckless disregard for the trust's interests, often involving a conscious indifference to duties. Key legal differences include the threshold of fault, where negligence implies a breach of ordinary care, whereas gross negligence signifies a higher level of culpability, often leading to stricter liability or harsher penalties.

Fiduciary Duties and Standards of Care

Negligence in trust law involves a fiduciary failing to exercise reasonable care in managing trust assets, whereas gross negligence reflects a more severe breach characterized by reckless disregard for duty. Your fiduciary duties require adherence to a higher standard of care, demanding prudence and loyalty to beneficiaries, with gross negligence exposing trustees to greater liability due to the blatant lack of care. Understanding these distinctions clarifies the legal consequences trustees face when violating their obligations, emphasizing the importance of diligent trust administration.

Examples of Negligence by Trustees

Trustees demonstrating negligence might fail to properly maintain trust assets, such as neglecting routine property upkeep leading to financial loss, or not monitoring investments resulting in diminished trust value. Gross negligence in trust law involves more severe breaches, like ignoring clear legal duties or reckless mismanagement causing substantial harm to the trust's beneficiaries. Understanding these distinctions helps you identify whether a trustee's actions reflect mere carelessness or a more serious failure in fiduciary responsibility.

Illustrative Cases of Gross Negligence in Trust Administration

Gross negligence in trust administration denotes a severe deviation from the standard of care expected from trustees, markedly more culpable than ordinary negligence, which involves mere carelessness or failure to act with reasonable prudence. Illustrative cases such as *Nestle v National Westminster Bank Plc* and *Armitage v Nurse* exemplify gross negligence where trustees failed to properly manage trust assets, leading to significant losses due to reckless mismanagement or omission. Courts often distinguish gross negligence by the trustee's blatant disregard for their fiduciary duties, imposing stricter liability to protect the beneficiaries' interests and maintain trust integrity.

Consequences of Negligence for Trustees

Trustees who commit ordinary negligence are typically held liable for losses resulting from a failure to exercise reasonable care, resulting in financial restitution but not punitive measures. Gross negligence involves a severe lack of care, demonstrating recklessness or indifference, leading to harsher consequences such as personal liability and potential removal from the trustee position. Your awareness of these distinctions is crucial, as gross negligence can result in more significant legal and financial repercussions compared to ordinary negligence in trust administration.

Legal Implications of Gross Negligence for Trusts

Gross negligence in trust law represents a severe lack of care, far beyond ordinary negligence, exposing trustees to significant legal liabilities including removal from their position and personal liability for losses. Your fiduciary duty demands strict adherence to trust terms and prudent management, with gross negligence indicating a reckless or willful disregard for these obligations. Courts differentiate gross negligence by its blatant deviation from standards of care, often resulting in harsher penalties and potential claims for damages against the trustee.

Protecting Against Trustee Negligence and Gross Negligence

Protecting against trustee negligence and gross negligence in trust law requires precise drafting of trust agreements with clear fiduciary duties and accountability measures. Courts generally impose higher standards of care for trustees, holding them liable for acts of gross negligence, which involves reckless disregard for their duties, beyond ordinary negligence characterized by simple carelessness or failure to act prudently. Implementing regular audits, beneficiary oversight, and specific indemnification clauses effectively mitigates risks associated with both negligence and gross negligence in trust administration.

Best Practices for Trustees to Avoid Liability

Trustees should maintain rigorous adherence to fiduciary duties, ensuring informed decision-making and thorough documentation to differentiate ordinary negligence from gross negligence under trust law. Implementing regular training on statutory obligations and seeking expert advice for complex matters minimizes the risk of breach and potential liability. Strict compliance with trust terms, prudent asset management, and transparent communication with beneficiaries are essential best practices to protect trustees from personal liability claims.

Infographic: Negligence vs Gross Negligence (in Trust Law)

relatioo.com

relatioo.com