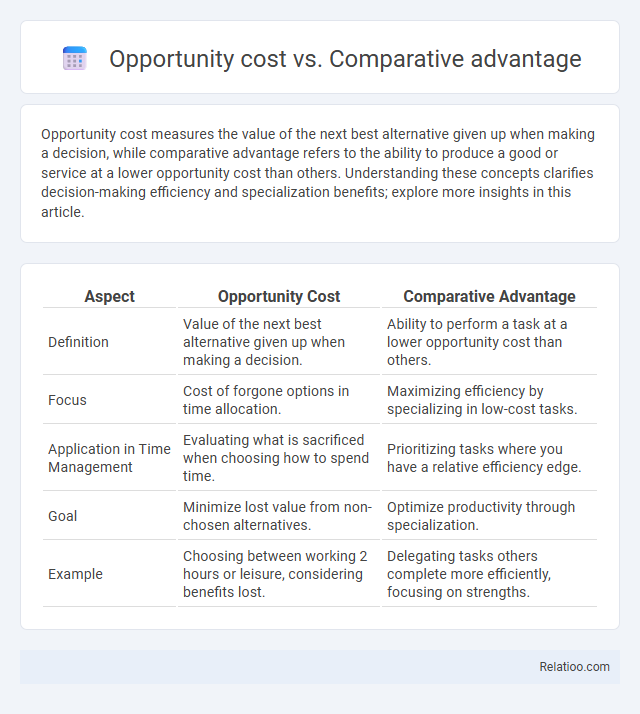

Opportunity cost measures the value of the next best alternative given up when making a decision, while comparative advantage refers to the ability to produce a good or service at a lower opportunity cost than others. Understanding these concepts clarifies decision-making efficiency and specialization benefits; explore more insights in this article.

Table of Comparison

| Aspect | Opportunity Cost | Comparative Advantage |

|---|---|---|

| Definition | Value of the next best alternative given up when making a decision. | Ability to perform a task at a lower opportunity cost than others. |

| Focus | Cost of forgone options in time allocation. | Maximizing efficiency by specializing in low-cost tasks. |

| Application in Time Management | Evaluating what is sacrificed when choosing how to spend time. | Prioritizing tasks where you have a relative efficiency edge. |

| Goal | Minimize lost value from non-chosen alternatives. | Optimize productivity through specialization. |

| Example | Choosing between working 2 hours or leisure, considering benefits lost. | Delegating tasks others complete more efficiently, focusing on strengths. |

Understanding Opportunity Cost

Understanding opportunity cost is crucial in economics as it represents the value of the next best alternative foregone when a decision is made. Comparative advantage highlights the ability of an individual or country to produce goods or services at a lower opportunity cost than others, driving efficient resource allocation. Differentiating opportunity cost from comparative advantage clarifies how decisions impact trade-offs and specialization in economic activities.

Defining Comparative Advantage

Comparative advantage refers to the ability of an individual, firm, or country to produce a good or service at a lower opportunity cost than others, enabling more efficient resource allocation in trade. Opportunity cost measures the value of the next best alternative foregone when making a choice, forming the basis for understanding comparative advantage. Unlike opportunity cost, which is a broader concept, comparative advantage specifically identifies relative efficiency differences that drive specialization and mutually beneficial exchange.

Key Differences Between Opportunity Cost and Comparative Advantage

Opportunity cost refers to the value of the next best alternative foregone when making a decision, while comparative advantage describes the ability of an entity to produce goods or services at a lower opportunity cost than others. Key differences lie in scope and application: opportunity cost is a broader economic concept used to evaluate trade-offs in any choice, whereas comparative advantage specifically guides specialization and trade between agents or countries. Understanding comparative advantage requires analyzing opportunity costs to identify which producer has the lower cost, enabling more efficient resource allocation and mutually beneficial trade.

The Role of Opportunity Cost in Decision-Making

Opportunity cost plays a crucial role in decision-making by quantifying the value of the next best alternative foregone when choosing one option over another. Understanding opportunity cost helps you allocate resources efficiently by comparing the relative benefits of different choices. This concept is fundamental to comparative advantage, which identifies the most efficient producer for a good or service based on lower opportunity costs.

How Comparative Advantage Drives Trade

Comparative advantage drives trade by enabling countries to specialize in producing goods and services at a lower opportunity cost than others, maximizing economic efficiency and overall output. Your ability to focus on tasks where you have a comparative advantage allows for beneficial exchanges that increase wealth and resource allocation across nations. Understanding the distinction between opportunity cost and comparative advantage is crucial in evaluating trade decisions and global market dynamics.

Real-World Examples of Opportunity Cost

Opportunity cost represents the value of the next best alternative foregone when making a decision, such as a farmer choosing to plant wheat instead of corn, losing potential corn profits. Comparative advantage refers to the ability of an individual or country to produce a good at a lower opportunity cost than others, exemplified by China specializing in manufacturing electronics while the US focuses on software development. Real-world examples of opportunity cost include a student spending time working part-time instead of studying, or a business investing capital in new equipment rather than marketing.

Practical Applications of Comparative Advantage

Practical applications of comparative advantage revolve around allocating resources to produce goods or services at lower opportunity costs, maximizing overall efficiency in trade and production. Businesses and countries leverage comparative advantage to specialize in activities where they have the greatest relative efficiency, enhancing profitability and economic growth. Understanding opportunity cost supports decision-making by highlighting the trade-offs involved, but comparative advantage drives strategic specialization that results in mutual benefits through exchange.

Common Misconceptions Explained

Common misconceptions about opportunity cost often confuse it with absolute cost, whereas comparative advantage highlights the efficiency gained by specializing in lower opportunity cost activities. Opportunity cost measures the value of the next best alternative forgone, while comparative advantage involves analyzing opportunity costs between different producers to determine who should specialize in which goods or services. Misunderstanding these concepts can lead to inefficient resource allocation and missed benefits in trade or production decisions.

Why Understanding Both Concepts Matters

Understanding opportunity cost and comparative advantage is crucial for making efficient economic decisions. Opportunity cost quantifies the value of the next best alternative forgone, while comparative advantage highlights the ability to produce goods or services at a lower opportunity cost compared to others. Grasping both concepts enables individuals and businesses to allocate resources optimally, enhancing productivity and maximizing overall gains in trade and investment.

Opportunity Cost vs Comparative Advantage: Summary and Takeaways

Opportunity cost quantifies the value of the next best alternative foregone when making a decision, while comparative advantage highlights a party's ability to produce a good or service at a lower opportunity cost than others. Understanding your opportunity cost is essential to leveraging comparative advantage effectively, enabling more efficient resource allocation and maximizing economic gains. Mastering the interplay between these concepts empowers you to make strategic decisions that optimize productivity and trade benefits.

Infographic: Opportunity cost vs Comparative advantage

relatioo.com

relatioo.com