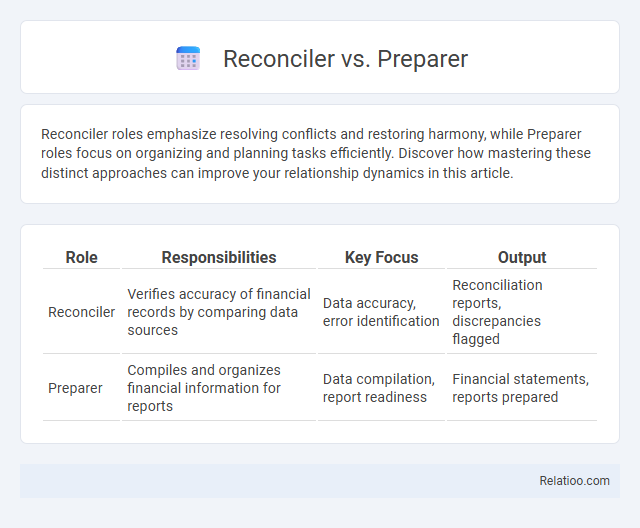

Reconciler roles emphasize resolving conflicts and restoring harmony, while Preparer roles focus on organizing and planning tasks efficiently. Discover how mastering these distinct approaches can improve your relationship dynamics in this article.

Table of Comparison

| Role | Responsibilities | Key Focus | Output |

|---|---|---|---|

| Reconciler | Verifies accuracy of financial records by comparing data sources | Data accuracy, error identification | Reconciliation reports, discrepancies flagged |

| Preparer | Compiles and organizes financial information for reports | Data compilation, report readiness | Financial statements, reports prepared |

Introduction to Reconciler vs Preparer

Reconciler and Preparer roles differ primarily in their core responsibilities within financial workflows; a Reconciler focuses on matching and verifying account balances to ensure accuracy, while a Preparer is responsible for assembling and organizing financial data for reporting or audit purposes. The Reconciler uses detailed transaction records to identify discrepancies and confirm consistency between internal records and external statements. Preparers utilize these verified documents to compile reports, prepare tax filings, or support compliance, emphasizing data accuracy before final submission.

Defining the Roles: Reconciler and Preparer

The Reconciler is responsible for verifying accuracy and consistency in financial records, ensuring that all transactions match across accounts and correcting discrepancies. The Preparer's role involves compiling, organizing, and inputting financial data to create initial reports or statements for further review. Both roles are essential in maintaining precise financial documentation, with the Preparer focusing on data entry and assembly while the Reconciler emphasizes validation and error resolution.

Key Responsibilities of Reconcilers

Reconcilers play a critical role in ensuring accuracy and consistency in financial records by verifying transactions, identifying discrepancies, and resolving errors between accounts. They are responsible for matching ledger entries with supporting documentation, conducting regular audits, and maintaining detailed reconciliation reports to support compliance and financial integrity. Their key responsibilities include investigating variances, liaising with other departments for information, and ensuring timely completion of reconciliations to prevent financial misstatements.

Key Duties of Preparers

Preparers are responsible for accurately compiling financial data, verifying source documents, and ensuring compliance with accounting standards and tax regulations. Your role involves organizing transactions, maintaining detailed records, and preparing initial financial statements or tax returns to support auditors or reconciliers. Efficient preparation reduces discrepancies and aids in the seamless reconciliation process, highlighting the preparer's critical function in financial accuracy.

Core Differences Between Reconciler and Preparer

The core difference between a Reconciler and a Preparer lies in their primary functions within financial processes: Preparers are responsible for compiling and organizing financial data, ensuring accuracy and completeness, while Reconcilers verify and compare financial records to identify and resolve discrepancies. Preparers focus on data entry and initial report generation, whereas Reconcilers analyze variances between accounts or systems to maintain consistency and integrity in financial reporting. Understanding these distinct roles enhances workflow efficiency and reduces errors in accounting operations.

Skills Required for Reconciler vs Preparer

Reconciler roles demand strong analytical skills, attention to detail, and proficiency in data verification to ensure accuracy in financial records and transactions. Preparers require expertise in document creation, knowledge of accounting principles, and the ability to organize and compile financial statements efficiently. Both roles benefit from familiarity with accounting software and strong communication skills, but Reconcilers focus more on problem-solving discrepancies while Preparers emphasize accurate and timely report generation.

Importance of Segregation of Duties

Segregation of duties between the Reconciler, Preparer, and Reviewer is crucial to ensure accuracy and prevent fraud in financial processes. You benefit from having the Preparer create the financial entries, the Reconciler verify the transactions' correctness, and the Reviewer provide an independent assessment to maintain internal controls. This separation helps mitigate errors and maintains compliance with regulatory standards by creating checks and balances within the accounting workflow.

Common Challenges Faced in Each Role

Reconciler roles often face challenges related to data discrepancies and accuracy in matching transactions across accounts, which can impede timely financial reporting. Preparers commonly struggle with compiling complete documentation and adhering to regulatory standards, risking compliance issues and delays in filing. Reconcilers balance the pressure of resolving inconsistencies while ensuring alignment with both preparers and auditors, often encountering communication gaps and workflow bottlenecks.

Best Practices for Reconcilers and Preparers

Best practices for Reconcilers include maintaining accurate and timely ledger balances by regularly verifying data against source documents, ensuring discrepancies are investigated promptly, and documenting all reconciliation adjustments thoroughly. Preparers should focus on compiling complete and reliable financial data, adhering strictly to accounting standards, and cross-referencing transactions to facilitate efficient review and approval by Reconcilers. Collaboration between Preparers and Reconcilers enhances overall accuracy, reduces errors, and accelerates the financial close process.

Choosing the Right Role for Your Organization

Choosing the right role for your organization requires understanding the distinct functions of Reconciler, Preparer, and Approver within financial workflows. The Reconciler ensures accuracy by verifying transactions and resolving discrepancies, the Preparer compiles and organizes financial data for reporting, while the Approver validates and authorizes final outputs. Your decision should prioritize the specific needs of your business processes and ensure clear separation of duties to enhance accountability and compliance.

Infographic: Reconciler vs Preparer

relatioo.com

relatioo.com