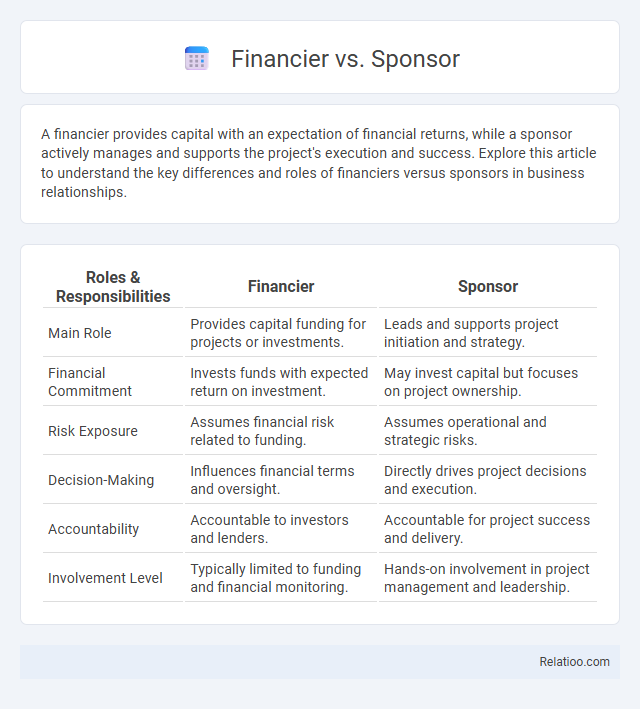

A financier provides capital with an expectation of financial returns, while a sponsor actively manages and supports the project's execution and success. Explore this article to understand the key differences and roles of financiers versus sponsors in business relationships.

Table of Comparison

| Roles & Responsibilities | Financier | Sponsor |

|---|---|---|

| Main Role | Provides capital funding for projects or investments. | Leads and supports project initiation and strategy. |

| Financial Commitment | Invests funds with expected return on investment. | May invest capital but focuses on project ownership. |

| Risk Exposure | Assumes financial risk related to funding. | Assumes operational and strategic risks. |

| Decision-Making | Influences financial terms and oversight. | Directly drives project decisions and execution. |

| Accountability | Accountable to investors and lenders. | Accountable for project success and delivery. |

| Involvement Level | Typically limited to funding and financial monitoring. | Hands-on involvement in project management and leadership. |

Introduction to Financier and Sponsor Roles

Financiers primarily provide the capital necessary for projects or businesses, often seeking returns through interest or equity stakes, playing a crucial role in funding operations and growth. Sponsors initiate and drive projects, assuming responsibility for management, securing resources, and aligning stakeholder interests, typically investing their own equity to demonstrate commitment. Understanding the distinct functions of financiers and sponsors highlights the complementary nature of capital provision and project leadership in successful ventures.

Defining "Financier" in Project Funding

A financier in project funding is an individual or institution that provides capital or financial resources necessary to support the project's development and execution. Unlike a sponsor, who typically initiates or endorses the project and may not always provide funding, the financier directly supplies the monetary assets or investment required. Understanding the financier's role helps you identify the primary source of the project's funding and its financial backing structure.

Understanding the Role of a Sponsor

A sponsor acts as the primary organizer and advocate for a project, often providing both financial backing and strategic oversight to ensure successful execution. Unlike financiers who primarily supply capital, sponsors take on active responsibility for managing the project's progress and risks. Understanding the role of a sponsor is crucial for you to effectively navigate project funding, align stakeholder interests, and secure necessary resources.

Key Responsibilities of Financiers

Financiers primarily focus on providing the necessary capital for projects or investments, managing risk assessment, and ensuring a return on their investment through financial oversight. Sponsors typically organize or initiate the project, overseeing its development and aligning stakeholder interests, while investors commit funds but may have less control over project operations. Your key responsibility as a financier includes thorough due diligence, monitoring financial performance, and structuring deals to maximize profit and minimize risk exposure.

Primary Duties of Sponsors

Sponsors primarily focus on project initiation, securing funding commitments, and overseeing development to ensure goals align with stakeholder expectations. They coordinate legal agreements, risk management, and maintain relationships with financiers and contractors, playing a central role in driving the project to completion. Your understanding of these duties helps differentiate sponsors from financiers, who mainly provide capital without direct operational involvement.

Differences Between Financier and Sponsor

A financier primarily provides capital or funding for a project or investment, often expecting financial returns without direct involvement in management. A sponsor not only contributes financially but also plays an active role in overseeing, organizing, or managing the project to ensure its success. Your choice between a financier and a sponsor depends on whether you seek passive financial backing or active partnership and guidance throughout the venture.

Advantages of Financiers in Project Development

Financiers provide critical capital injection enabling project initiation and scaling without diluting ownership or control, offering financial leverage through various debt instruments and equity participation. Their expertise in risk assessment and financial structuring optimizes project cash flow management, ensuring sustainability and profitability. Access to diverse funding sources and strong credit relationships allows financiers to secure favorable terms, enhancing the overall financial viability of project development.

Benefits of Sponsors in Project Success

Sponsors play a crucial role in project success by providing strategic vision, resource mobilization, and stakeholder alignment that financiers may not offer. Their benefits include bridging financial gaps through advocacy, ensuring governance compliance, and driving project objectives beyond mere capital investment. Unlike financiers focused on returns, sponsors actively engage in risk management and long-term project viability, enhancing overall project outcomes.

Financier vs Sponsor: Risk and Reward Dynamics

Financiers provide capital with a primary focus on financial returns and often assume credit risk, while sponsors actively manage projects, bearing operational and market risks to drive project success. Reward structures differ as financiers secure fixed or variable interest payments, whereas sponsors benefit from equity stakes, aligning incentives with performance outcomes. Understanding these risk and reward dynamics is critical for structuring deals and allocating responsibilities in project finance and investment partnerships.

Choosing the Right Partner: Financier or Sponsor

Choosing the right partner for a project hinges on understanding the distinct roles of financiers and sponsors, where financiers provide capital primarily for returns, while sponsors actively manage and support project execution. Evaluating project needs, risk tolerance, and involvement level helps determine whether a purely financial partner or an engaged sponsor better aligns with strategic goals. Thorough due diligence on financial stability, industry expertise, and alignment of interests ensures selecting an optimal partner between a financier or sponsor.

Infographic: Financier vs Sponsor

relatioo.com

relatioo.com