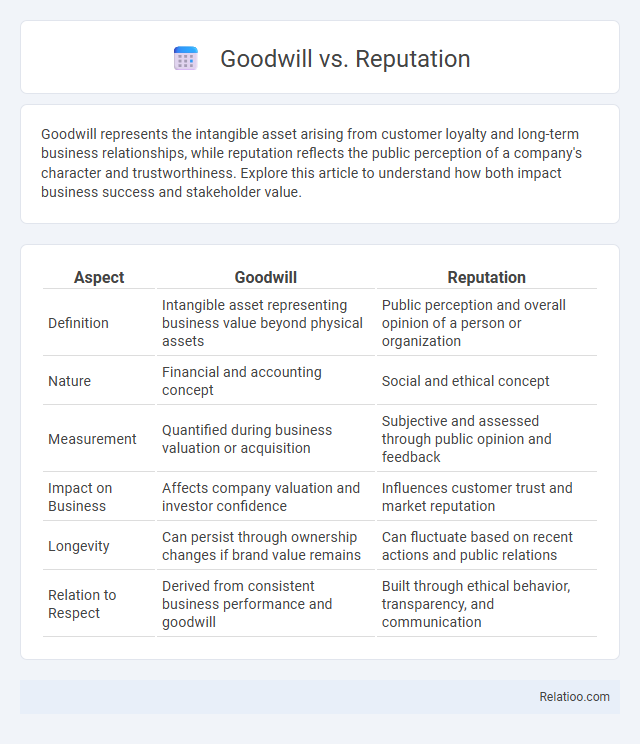

Goodwill represents the intangible asset arising from customer loyalty and long-term business relationships, while reputation reflects the public perception of a company's character and trustworthiness. Explore this article to understand how both impact business success and stakeholder value.

Table of Comparison

| Aspect | Goodwill | Reputation |

|---|---|---|

| Definition | Intangible asset representing business value beyond physical assets | Public perception and overall opinion of a person or organization |

| Nature | Financial and accounting concept | Social and ethical concept |

| Measurement | Quantified during business valuation or acquisition | Subjective and assessed through public opinion and feedback |

| Impact on Business | Affects company valuation and investor confidence | Influences customer trust and market reputation |

| Longevity | Can persist through ownership changes if brand value remains | Can fluctuate based on recent actions and public relations |

| Relation to Respect | Derived from consistent business performance and goodwill | Built through ethical behavior, transparency, and communication |

Understanding Goodwill: Definition and Significance

Understanding goodwill involves recognizing it as an intangible asset representing the value of a company's brand, customer relationships, and intellectual property beyond its tangible assets. Unlike reputation, which reflects public perception and trust, goodwill encapsulates economic benefits expected from business continuity and customer loyalty. Your focus on goodwill highlights its crucial role in mergers and acquisitions, where it directly influences a company's market valuation and financial health.

What is Reputation? Key Concepts Explained

Reputation is the collective perception and evaluation of a person, company, or brand based on past actions, performance, and behavior within a specific context. It serves as a crucial intangible asset influencing trust, credibility, and long-term relationships with stakeholders, shaped through consistent delivery of value and ethical conduct. Unlike goodwill, which represents the monetary value attributed to brand loyalty and customer relationships during company acquisitions, reputation emphasizes public opinion and social judgment without a direct financial measure.

Goodwill vs Reputation: Core Differences

Goodwill represents the intangible asset value derived from customer loyalty, brand recognition, and positive business relationships, often reflected in financial statements during acquisitions. Reputation relates to public perception and trustworthiness, shaped by experiences and communication but not directly quantifiable as an asset. Your understanding of these differences helps distinguish financial valuation (Goodwill) from market sentiment (Reputation), critical for strategic business decisions.

How Goodwill Impacts Business Valuation

Goodwill significantly impacts business valuation by representing the intangible assets such as customer loyalty, brand strength, and intellectual property that exceed the company's net tangible assets. Your business's goodwill reflects its market position and future earning potential, often resulting in higher purchase prices during mergers and acquisitions. Unlike reputation, which is public perception, goodwill is recorded as an accounting asset influencing financial statements and investor confidence.

The Role of Reputation in Customer Trust

Reputation plays a crucial role in establishing customer trust by reflecting the consistent delivery of positive experiences and ethical business practices, which enhances the perceived value beyond just goodwill or financial metrics. While goodwill represents intangible assets like brand loyalty and customer relationships, reputation is the broader public perception shaped by past actions and word-of-mouth. Your focus on cultivating a strong reputation directly influences customer decisions, driving trust and long-term loyalty that sustains business growth.

Building Goodwill: Effective Strategies

Building goodwill involves cultivating trust and positive relationships through consistent ethical behavior, excellent customer service, and community engagement. Strong reputation management emphasizes transparency, reliability, and delivering quality products or services that meet or exceed customer expectations. Effective strategies for building goodwill prioritize authentic communication, active listening to stakeholder needs, and demonstrating commitment to social responsibility.

Managing and Protecting Business Reputation

Managing and protecting your business reputation requires a clear understanding of goodwill, reputation, and goodwill accounting. Goodwill reflects the intangible asset value arising from brand loyalty and customer relationships, while reputation represents public perception shaped by your actions and communication. Prioritizing consistent quality, transparent communication, and ethical practices strengthens reputation and preserves the long-term goodwill essential for sustainable business success.

Measuring Goodwill and Reputation: Key Metrics

Measuring goodwill involves assessing intangible assets such as brand value, customer loyalty, and market position, often quantified through financial metrics like excess earnings or purchase price allocations. Reputation measurement relies on sentiment analysis, customer reviews, social media influence, and Net Promoter Score (NPS) to gauge public perception and trust levels. Your business can benefit from combining these key metrics to create a comprehensive understanding of both goodwill and reputation, enabling strategic decision-making and improved stakeholder relationships.

Goodwill vs Reputation in Mergers and Acquisitions

Goodwill in mergers and acquisitions represents the intangible asset arising when the purchase price exceeds the fair value of identifiable net assets, reflecting factors like brand loyalty, customer relationships, and intellectual property. Reputation refers to the overall public perception and trustworthiness of a company, heavily influencing future business opportunities and customer retention but is not recorded as an asset on the balance sheet. Your strategic assessment should carefully differentiate goodwill from reputation to accurately value a target company and anticipate the long-term benefits and risks associated with the acquisition.

Long-Term Benefits of Strengthening Goodwill and Reputation

Strengthening your goodwill and reputation creates long-term benefits by fostering customer loyalty, enhancing brand value, and generating positive word-of-mouth referrals. Goodwill, an intangible asset reflecting trust and emotional connection, complements reputation, which is the public perception of your business's reliability and quality. Investing in both ensures sustainable competitive advantage and resilience against market fluctuations.

Infographic: Goodwill vs Reputation

relatioo.com

relatioo.com