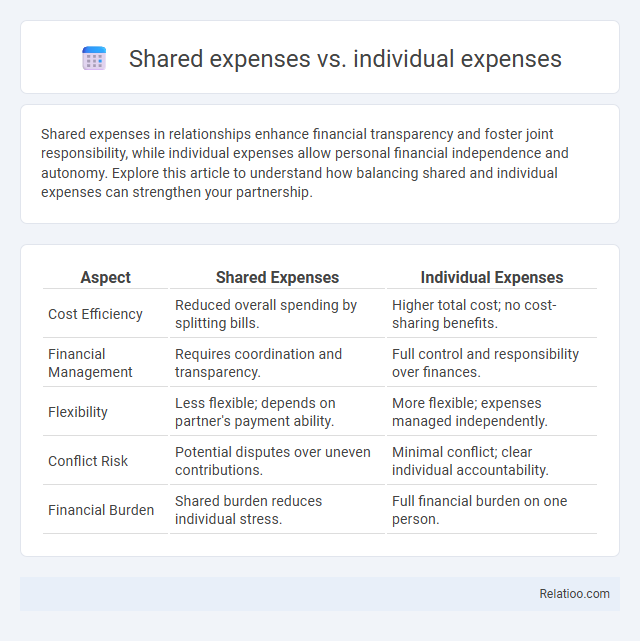

Shared expenses in relationships enhance financial transparency and foster joint responsibility, while individual expenses allow personal financial independence and autonomy. Explore this article to understand how balancing shared and individual expenses can strengthen your partnership.

Table of Comparison

| Aspect | Shared Expenses | Individual Expenses |

|---|---|---|

| Cost Efficiency | Reduced overall spending by splitting bills. | Higher total cost; no cost-sharing benefits. |

| Financial Management | Requires coordination and transparency. | Full control and responsibility over finances. |

| Flexibility | Less flexible; depends on partner's payment ability. | More flexible; expenses managed independently. |

| Conflict Risk | Potential disputes over uneven contributions. | Minimal conflict; clear individual accountability. |

| Financial Burden | Shared burden reduces individual stress. | Full financial burden on one person. |

Understanding Shared Expenses

Understanding shared expenses is crucial for effective financial management within households or partnerships where costs are divided among members. Shared expenses typically include rent, utilities, groceries, and transportation, which are split to ensure equitable contribution and reduce individual financial burden. Your ability to clearly distinguish these from individual expenses like personal subscriptions or discretionary spending helps maintain transparency and accountability in budgeting.

Defining Individual Expenses

Individual expenses refer to costs incurred by a single person for personal needs or discretionary spending, such as groceries, transportation, or entertainment. These expenses are distinct from shared expenses, which are costs divided between multiple individuals, like rent or utility bills in a household. Understanding individual expenses is essential for accurate personal budgeting and financial planning.

Key Differences: Shared vs Individual Expenses

Shared expenses involve costs split among multiple individuals, typically seen in households or roommates sharing rent, utilities, and groceries, promoting cost efficiency and fairness. Individual expenses are personal financial obligations such as personal entertainment, clothing, or subscriptions, which remain the sole responsibility of the individual. The key difference lies in the allocation of responsibility and payment: shared expenses require coordinated contributions, while individual expenses demand independent financial management.

Benefits of Sharing Expenses

Sharing expenses reduces your individual financial burden by distributing costs among multiple parties, promoting better budgeting and saving opportunities. It encourages transparency and accountability within groups, enhancing financial trust and cooperation. By pooling resources, shared expenses enable more efficient management of household bills, travel costs, or communal activities, ultimately increasing overall financial stability.

Challenges of Managing Shared Costs

Managing shared expenses often involves complex challenges such as tracking individual contributions, ensuring fair allocation, and preventing conflicts over payment deadlines. Your financial planning must accommodate varying spending habits and unexpected costs that can disrupt budgets and cause misunderstandings. Establishing clear communication and using budgeting tools helps to mitigate disputes and maintain transparency among all parties involved.

Advantages of Tracking Individual Expenses

Tracking individual expenses offers precise control over Your personal budget by categorizing spending habits, leading to better financial decision-making. It enhances accountability and transparency in managing finances compared to shared expenses, which can obscure individual contributions and lead to disputes. This focused approach ensures clearer insights into Your income allocation, promoting smarter saving and investment strategies.

Effective Methods for Splitting Shared Bills

Effective methods for splitting shared bills include using expense tracking apps like Splitwise or Venmo, which enable transparent and accurate division of costs among roommates or partners. Clearly defining categories such as rent, utilities, groceries, and personal expenses ensures fairness in managing shared versus individual expenses. Regular communication and scheduled reviews help prevent misunderstandings, maintaining financial harmony and accountability in joint budgeting.

Tools and Apps for Expense Management

Expense management tools and apps streamline tracking of shared expenses and individual expenses by offering features like real-time expense splitting, automatic reminders, and multi-user access. Popular apps such as Splitwise, Expensify, and Mint provide intuitive interfaces to manage finances collaboratively or independently while generating detailed reports and budget forecasts. Integrating bank accounts and payment platforms in these tools enhances accuracy and convenience, making financial management efficient for both personal and group contexts.

Tips for Avoiding Financial Conflicts

Establishing clear communication and setting predefined budgets for shared expenses prevent misunderstandings in financial management. Tracking individual expenses separately with expense-sharing apps or spreadsheets ensures transparency and accountability. Regularly reviewing financial commitments together promotes trust and helps avoid conflicts in both shared and individual monetary responsibilities.

Finding the Right Balance in Expense Management

Balancing shared expenses and individual expenses is essential for effective financial management, ensuring clear boundaries between joint responsibilities and personal spending. You can optimize budgeting by categorizing expenses into communal costs, such as household bills, and individual costs, like personal subscriptions, to promote transparency and fairness. Achieving the right balance helps prevent financial conflicts and supports healthy financial habits within partnerships or groups.

Infographic: Shared expenses vs Individual expenses

relatioo.com

relatioo.com