Understanding the distinction between risk, where probabilities of outcomes are known, and uncertainty, where such probabilities are unknown, is essential in managing relationships effectively. Explore this article to learn how recognizing risk versus uncertainty can improve decision-making and strengthen connections.

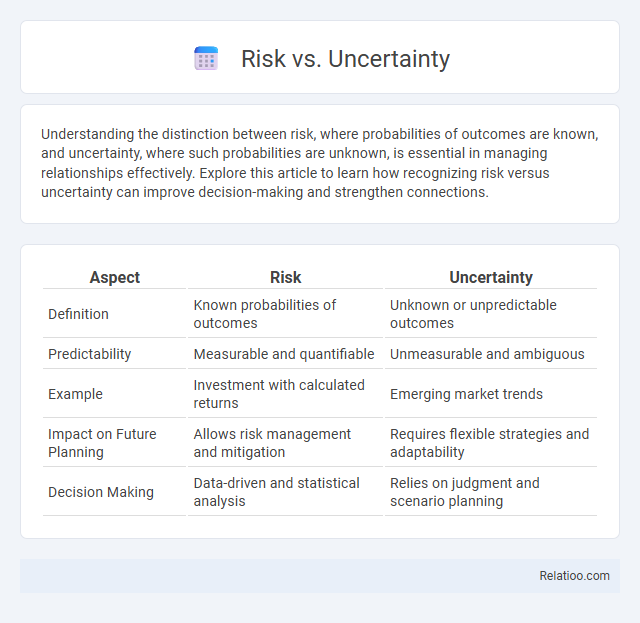

Table of Comparison

| Aspect | Risk | Uncertainty |

|---|---|---|

| Definition | Known probabilities of outcomes | Unknown or unpredictable outcomes |

| Predictability | Measurable and quantifiable | Unmeasurable and ambiguous |

| Example | Investment with calculated returns | Emerging market trends |

| Impact on Future Planning | Allows risk management and mitigation | Requires flexible strategies and adaptability |

| Decision Making | Data-driven and statistical analysis | Relies on judgment and scenario planning |

Understanding Risk vs Uncertainty

Risk involves situations where probabilities of outcomes are known and quantifiable, allowing for informed decision-making using statistical methods. Uncertainty refers to scenarios where these probabilities are unknown or indeterminate, making it difficult to predict outcomes or model potential impacts effectively. Future uncertainty encompasses all unforeseeable or ambiguous factors that may arise over time, further complicating risk assessment and management strategies.

Key Differences Between Risk and Uncertainty

Risk involves situations where the probabilities of different outcomes are known or can be estimated based on historical data, while uncertainty refers to scenarios where these probabilities are unknown or indeterminable due to lack of information. Future uncertainty expands on this concept by encompassing unpredictable changes in external factors like market conditions or technological advancements that affect decision-making. Understanding these distinctions helps you develop strategies that balance calculated risks with unknown variables to optimize outcomes.

Types of Risk in Decision-Making

Types of risk in decision-making include financial risk, operational risk, strategic risk, and compliance risk, each impacting your outcomes differently. Risk involves known probabilities, while uncertainty lacks precise probabilities, and future uncertainty refers to unpredictable changes over time. Understanding these distinctions helps you evaluate potential losses and make informed decisions under varying levels of predictability.

Sources of Uncertainty in Business

Sources of uncertainty in business stem from market volatility, technological changes, and regulatory shifts, all of which contribute to varying degrees of risk and uncertainty. Risk involves known probabilities of outcomes, while uncertainty relates to unknown or immeasurable probabilities, with future uncertainty encompassing unpredictable external factors like geopolitical events or natural disasters. Understanding these sources is crucial for strategic decision-making and effective risk management in dynamic business environments.

Measuring Risk: Methods and Tools

Measuring risk involves quantitative methods such as Value at Risk (VaR), Monte Carlo simulations, and sensitivity analysis to estimate potential losses under various scenarios. Tools like statistical models and risk management software enable You to analyze historical data and project probable outcomes, improving decision-making accuracy. Distinguishing between measurable risk and future uncertainty is crucial, as uncertainty often lacks precise probabilities and requires scenario planning and expert judgment for assessment.

Challenges of Managing Uncertainty

Managing uncertainty involves navigating unpredictable variables that lack clear probabilities, unlike risk which can be quantified and statistically analyzed. Future uncertainty compounds these challenges by introducing unknown changes in market conditions, technological advancements, and regulatory shifts that defy traditional forecasting models. Effective management requires adaptive strategies, robust scenario planning, and enhanced data analytics to mitigate the impacts of unforeseen events and maintain organizational resilience.

Real-World Examples: Risk vs Uncertainty

Risk involves quantifiable probabilities, such as a car insurance company predicting accident rates based on historical data, whereas uncertainty lacks calculable odds, like launching a completely innovative product in an untested market. Future uncertainty extends beyond current unknowns to unpredictable long-term factors, exemplified by the effects of climate change on agricultural yields over decades. Businesses navigating risk rely on statistical models, while addressing uncertainty demands adaptive strategies and scenario planning.

Strategies for Dealing with Risk

Risk involves situations with known probabilities, uncertainty refers to unknown probabilities, and future uncertainty encompasses unpredictable events that affect long-term outcomes. Effective strategies for dealing with risk include diversification, hedging, and comprehensive risk assessment to minimize potential losses. Your ability to implement proactive risk management frameworks ensures resilience against both immediate risks and evolving uncertainties.

Techniques for Navigating Uncertainty

Techniques for navigating uncertainty involve diversifying your investments and employing scenario planning to anticipate various outcomes in risk and uncertainty contexts. Utilizing probabilistic models and stress testing helps quantify potential impacts when future uncertainty clouds predictions. Emphasizing adaptive strategies allows you to remain flexible and responsive as new information emerges.

Risk and Uncertainty in Strategic Planning

Risk in strategic planning involves situations with known probabilities, allowing you to quantify potential outcomes and make informed decisions. Uncertainty refers to unknown probabilities or incomplete information, making it difficult to predict future events accurately. Managing future uncertainty requires adaptive strategies and contingency plans to navigate unpredictable changes effectively.

Infographic: Risk vs Uncertainty

relatioo.com

relatioo.com