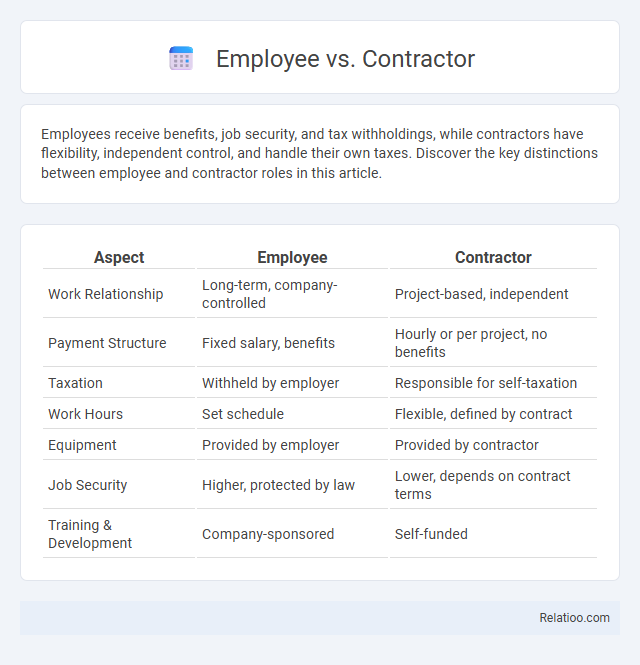

Employees receive benefits, job security, and tax withholdings, while contractors have flexibility, independent control, and handle their own taxes. Discover the key distinctions between employee and contractor roles in this article.

Table of Comparison

| Aspect | Employee | Contractor |

|---|---|---|

| Work Relationship | Long-term, company-controlled | Project-based, independent |

| Payment Structure | Fixed salary, benefits | Hourly or per project, no benefits |

| Taxation | Withheld by employer | Responsible for self-taxation |

| Work Hours | Set schedule | Flexible, defined by contract |

| Equipment | Provided by employer | Provided by contractor |

| Job Security | Higher, protected by law | Lower, depends on contract terms |

| Training & Development | Company-sponsored | Self-funded |

Introduction to Employees vs Contractors

Employees typically work under direct supervision and receive benefits such as health insurance and retirement plans, whereas contractors operate independently, handling their own taxes and work schedules. Your choice between hiring an employee or contractor affects tax obligations, legal responsibilities, and control over work processes. Understanding these distinctions ensures compliance and optimizes workforce management for your business needs.

Key Definitions: Employee and Contractor

An employee is an individual hired on a permanent or temporary basis who works under the direct control and supervision of an organization, receiving a salary and benefits defined by labor laws. A contractor operates independently, providing specific services based on a contractual agreement without the same level of control or entitlement to employee benefits. Differentiating these classifications is essential for legal compliance, tax obligations, and defining work responsibilities within a company.

Legal Differences Between Employees and Contractors

Employees are legally protected by labor laws including minimum wage, overtime pay, and unemployment benefits, while contractors operate under independent agreements without entitlement to these protections. Employers must withhold income taxes, provide benefits, and adhere to workplace safety regulations for employees, whereas contractors handle their own tax obligations, insurance, and benefits. Legal distinctions hinge on the degree of control, permanency, and nature of the work relationship, influencing liabilities and compliance requirements under labor and tax laws.

Tax Implications for Employees and Contractors

Employees are subject to payroll tax withholding, including income tax, Social Security, and Medicare, with employers responsible for matching certain taxes. Contractors receive payments without tax withholding, requiring them to manage estimated tax payments and self-employment taxes on their income. Misclassification of employees as contractors can result in significant tax penalties and back taxes owed to the IRS.

Hiring Considerations: Employee or Contractor?

When deciding between hiring an employee or a contractor, consider factors such as the level of control you need over work schedules and methods, as employees typically follow company policies and hours while contractors operate independently. Employment law requires employers to provide benefits and withhold taxes for employees, whereas contractors handle their own taxes and benefits. Your hiring choice impacts compliance, costs, and the flexibility of your workforce, making it essential to evaluate your business needs and the nature of the role.

Pros and Cons of Hiring Employees

Hiring employees provides your business with dedicated team members who align closely with company culture and long-term goals, ensuring consistent productivity and loyalty. Employees typically receive benefits and legal protections, increasing job satisfaction but also raising costs such as payroll taxes, health insurance, and compliance obligations. While employees offer stability and control, they involve higher financial and administrative commitments compared to independent contractors.

Pros and Cons of Hiring Contractors

Hiring contractors offers flexibility and cost savings by allowing you to scale your workforce based on project needs without incurring benefits or long-term commitments associated with employees. Contractors often bring specialized skills and efficiency, enhancing project delivery, but may lack company loyalty and availability compared to full-time employees. Legal and tax compliance can be complex when managing contractors, requiring careful attention to classification to avoid penalties.

Compliance and Regulatory Issues

Employee classification requires strict adherence to labor laws such as minimum wage, overtime, and benefits regulations, ensuring compliance with the Fair Labor Standards Act (FLSA). Contractors must comply with tax reporting requirements like IRS Form 1099-NEC, but are exempt from employee benefits and wage laws, reducing employer liabilities. Misclassification risks trigger audits, fines, and penalties from agencies like the Department of Labor (DOL) and IRS, emphasizing the importance of correctly distinguishing between roles to maintain regulatory compliance.

Determining the Right Fit for Your Business

Choosing between an employee, contractor, or role depends on your business's specific needs, budget, and project scope. Employees offer long-term commitment and control, contractors provide flexibility and specialized skills for temporary tasks, while defining clear roles ensures responsibilities align with organizational goals. Assessing legal, financial, and operational factors helps you determine the most effective arrangement to maximize productivity and compliance.

Conclusion: Choosing Between Employee and Contractor

Selecting between an employee and a contractor hinges on factors like control over work methods, duration of engagement, and tax implications. Employees receive benefits, have tax withheld by the employer, and are subject to labor laws, whereas contractors operate independently, invoice for services, and manage their own taxes. Businesses must carefully evaluate project scope, budget constraints, and legal responsibilities to determine the optimal classification for workforce management.

Infographic: Employee vs Contractor

relatioo.com

relatioo.com