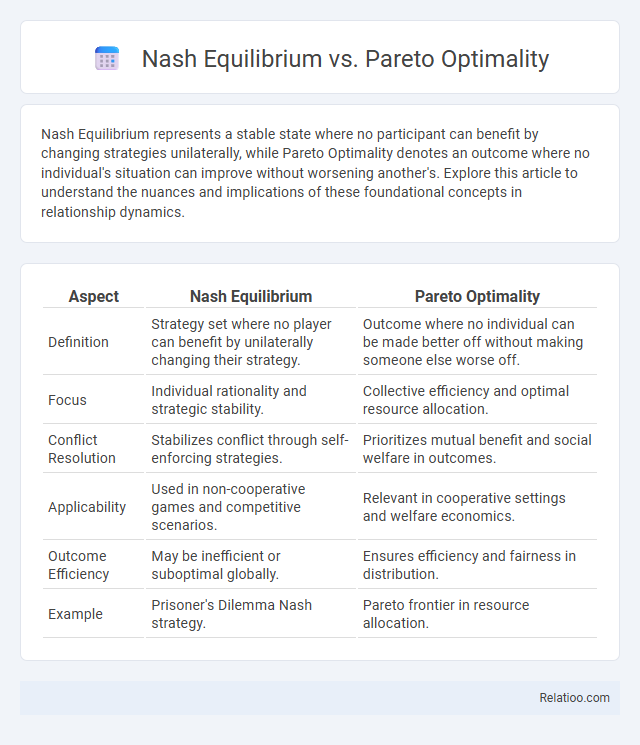

Nash Equilibrium represents a stable state where no participant can benefit by changing strategies unilaterally, while Pareto Optimality denotes an outcome where no individual's situation can improve without worsening another's. Explore this article to understand the nuances and implications of these foundational concepts in relationship dynamics.

Table of Comparison

| Aspect | Nash Equilibrium | Pareto Optimality |

|---|---|---|

| Definition | Strategy set where no player can benefit by unilaterally changing their strategy. | Outcome where no individual can be made better off without making someone else worse off. |

| Focus | Individual rationality and strategic stability. | Collective efficiency and optimal resource allocation. |

| Conflict Resolution | Stabilizes conflict through self-enforcing strategies. | Prioritizes mutual benefit and social welfare in outcomes. |

| Applicability | Used in non-cooperative games and competitive scenarios. | Relevant in cooperative settings and welfare economics. |

| Outcome Efficiency | May be inefficient or suboptimal globally. | Ensures efficiency and fairness in distribution. |

| Example | Prisoner's Dilemma Nash strategy. | Pareto frontier in resource allocation. |

Introduction to Nash Equilibrium and Pareto Optimality

Nash Equilibrium occurs when no player can improve their payoff by unilaterally changing their strategy, defining a stable state in game theory. Pareto Optimality refers to a resource allocation where no individual can be made better off without making someone else worse off, representing efficiency rather than stability. Unlike general equilibrium concepts, Nash Equilibrium emphasizes strategic interaction among rational players, while Pareto Optimality focuses on overall welfare without necessarily ensuring strategic stability.

Defining Nash Equilibrium

Nash Equilibrium is a foundational concept in game theory where no player can benefit by unilaterally changing their strategy, assuming other players' strategies remain constant. Unlike Pareto Optimality, which emphasizes outcomes where no individual can be made better off without making someone else worse off, Nash Equilibrium focuses on strategic stability for each participant. Your understanding of decision-making scenarios improves by distinguishing Nash Equilibrium from general Equilibrium concepts and Pareto efficiency in competitive environments.

Understanding Pareto Optimality

Pareto Optimality represents a state in which no individual's condition can be improved without worsening another's, highlighting efficiency in resource allocation. Unlike Nash Equilibrium, where each player's strategy is stable considering others' choices, Pareto Optimality emphasizes collective welfare without unilateral improvements. Understanding Pareto Optimality helps you identify outcomes that maximize overall benefit without sacrificing fairness among participants.

Key Differences Between Nash Equilibrium and Pareto Optimality

Nash Equilibrium occurs when no player can improve their outcome by unilaterally changing their strategy, focusing on individual rationality within strategic interactions. Pareto Optimality reflects a state where no participant's situation can be improved without worsening another's, emphasizing collective efficiency and welfare. Understanding these distinctions helps you analyze strategic decisions where individual incentives may conflict with group efficiency.

Real-World Examples Illustrating Nash Equilibrium

Nash Equilibrium occurs when no player can benefit by unilaterally changing their strategy, exemplified by the stalemate in the Prisoner's Dilemma where both suspects choose to betray each other despite mutual cooperation yielding better outcomes. Pareto Optimality refers to allocations where no individual can be made better off without making someone else worse off, such as efficient market trades in economics ensuring resources are optimally distributed. Real-world scenarios like competing firms in an oligopoly often reach Nash Equilibrium, where companies settle on pricing strategies that maximize profits given the competitors' actions, even if the outcome is not Pareto optimal.

Real-World Examples Illustrating Pareto Optimality

Pareto optimality occurs when no individual can be made better off without making someone else worse off, exemplified by market trade where resources are efficiently allocated to maximize mutual benefit. In contrast, Nash equilibrium describes situations like the Prisoner's Dilemma where each player's strategy is optimal given others' choices, but the outcome may be suboptimal overall. Real-world examples of Pareto optimality include competitive markets and cooperative agreements where resource allocation enhances total welfare without disadvantaging any participant.

Situations Where Nash Equilibrium and Pareto Optimality Coincide

Nash Equilibrium and Pareto Optimality coincide in certain strategic games where individual rationality leads to collectively efficient outcomes, such as in coordination games with multiple equilibria or in social dilemmas under specific payoff structures. In these cases, the strategies chosen by players maximize their payoffs without being individually improvable, while also ensuring no player can be made better off without making others worse off. Identifying scenarios like public goods provision or certain auction models reveals the alignment of equilibrium concepts, highlighting the interplay between stability and efficiency in game theory.

Limitations of Nash Equilibrium in Achieving Pareto Efficiency

Nash Equilibrium often leads to outcomes where no player can improve their payoff individually, but these outcomes may not be Pareto efficient, meaning Your resources or welfare could be improved without harming others. The key limitation is that Nash Equilibria can trap players in suboptimal situations due to the lack of cooperation or binding agreements. Unlike Pareto optimality, Nash Equilibrium does not guarantee maximized collective benefit, resulting in potential inefficiencies in strategic interactions.

Implications for Game Theory and Economic Decision-Making

Nash Equilibrium represents a state where no player can benefit by changing strategies unilaterally, highlighting strategic stability in competitive environments. Pareto Optimality indicates an allocation where no individual can be made better off without making someone else worse off, emphasizing allocative efficiency and social welfare. Understanding the distinction and interaction between these concepts informs Your approach to predicting outcomes in game theory and optimizing economic decision-making for balanced and efficient resource distribution.

Conclusion: Choosing Between Nash Equilibrium and Pareto Optimality

Choosing between Nash Equilibrium and Pareto Optimality depends on the context of strategic interaction and desired outcomes. Nash Equilibrium ensures stability where no player benefits from unilateral deviation, while Pareto Optimality prioritizes overall efficiency and collective welfare without making anyone worse off. In practical scenarios, decision-makers must balance individual rationality with social efficiency to achieve optimal strategic solutions.

Infographic: Nash Equilibrium vs Pareto Optimality

relatioo.com

relatioo.com