Devaluation and revaluation impact relationships by influencing self-worth and emotional dynamics; devaluation often leads to lowered trust and increased conflict, while revaluation fosters appreciation and deeper connection. Explore this article to understand how these processes shape relationship health and strategies to manage them effectively.

Table of Comparison

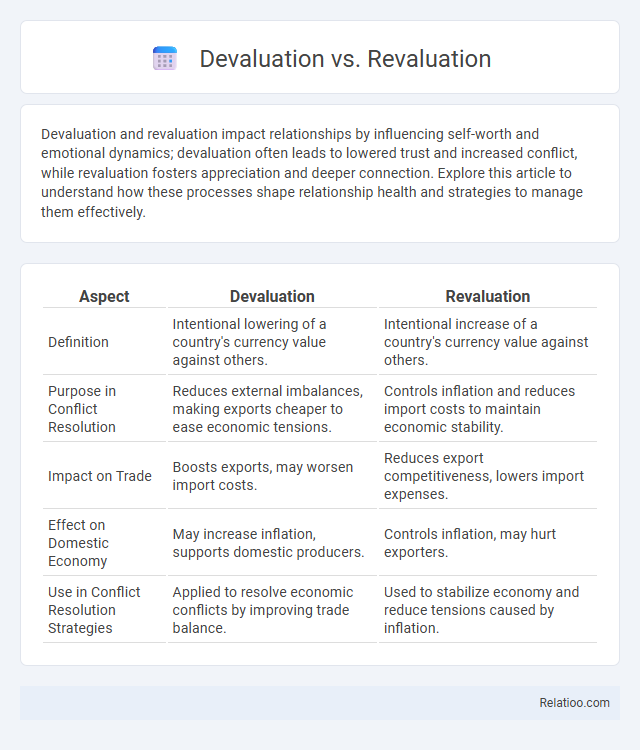

| Aspect | Devaluation | Revaluation |

|---|---|---|

| Definition | Intentional lowering of a country's currency value against others. | Intentional increase of a country's currency value against others. |

| Purpose in Conflict Resolution | Reduces external imbalances, making exports cheaper to ease economic tensions. | Controls inflation and reduces import costs to maintain economic stability. |

| Impact on Trade | Boosts exports, may worsen import costs. | Reduces export competitiveness, lowers import expenses. |

| Effect on Domestic Economy | May increase inflation, supports domestic producers. | Controls inflation, may hurt exporters. |

| Use in Conflict Resolution Strategies | Applied to resolve economic conflicts by improving trade balance. | Used to stabilize economy and reduce tensions caused by inflation. |

Understanding Devaluation and Revaluation

Understanding devaluation involves recognizing it as a deliberate downward adjustment of a country's currency value relative to foreign currencies, often aimed at boosting exports by making them cheaper globally. Revaluation, in contrast, is an upward adjustment of a currency's value, making imports more affordable but potentially reducing export competitiveness. Your grasp of these concepts helps in analyzing economic policies and their impact on trade balances and inflation rates.

Key Differences Between Devaluation and Revaluation

Devaluation refers to the deliberate downward adjustment of a country's currency value relative to another currency or standard, while revaluation is the deliberate upward adjustment of the currency's value in a fixed exchange rate system. Key differences between devaluation and revaluation include the direction of change, with devaluation decreasing the currency value to boost exports and reduce trade deficits, and revaluation increasing currency value to control inflation and reduce import costs. Both processes are government or central bank interventions that differ from depreciation, which is a market-driven decline in currency value without direct official action.

Causes of Currency Devaluation

Currency devaluation occurs primarily due to factors such as persistent trade deficits, high inflation rates, political instability, and weakening economic fundamentals that reduce investor confidence. Central banks may deliberately devalue a currency to boost export competitiveness and correct balance of payments issues. Contrastingly, revaluation involves an upward adjustment driven by strong economic performance or increased foreign demand for the currency, while depreciation and appreciation reflect market-driven fluctuations in exchange rates.

Reasons for Currency Revaluation

Currency revaluation occurs when a country's central bank or monetary authority increases the value of its currency relative to foreign currencies, often to curb inflation or control trade imbalances. You may experience benefits like reduced import costs and enhanced purchasing power, especially when the economy is overheating or facing excessive inflation. Governments revalue currency to stabilize the economy by making exports more expensive and imports cheaper, thereby managing trade deficits and protecting domestic industries.

Economic Impacts of Devaluation

Devaluation decreases a country's currency value relative to others, boosting export competitiveness by making goods cheaper abroad while raising import costs, potentially leading to inflation. Revaluation increases currency value, making exports more expensive and imports cheaper, which can reduce inflationary pressures but harm export-driven industries. Repression, unlike devaluation or revaluation, involves government controls that restrict currency convertibility and can distort market operations, often leading to inefficiencies and reduced economic growth.

Effects of Revaluation on the Economy

Revaluation strengthens a country's currency by increasing its value relative to foreign currencies, which reduces import costs and can lower inflation. It may lead to decreased export competitiveness, potentially harming export-driven industries and widening the trade deficit. Higher currency value also attracts foreign investment by increasing purchasing power, boosting domestic capital inflows.

Historical Examples of Devaluation and Revaluation

Historical examples of devaluation include the United Kingdom's 1967 devaluation of the pound sterling, which aimed to boost exports by lowering the currency's value against the US dollar from $2.80 to $2.40. Revaluation is evident in China's 2005 adjustment of the yuan, shifting its peg from the US dollar to a basket of currencies to gradually increase the yuan's value and control inflation. These currency adjustments demonstrate how governments intervene in exchange rates to influence trade balances and economic stability during periods of financial stress or policy transition.

Policy Tools for Managing Exchange Rates

Devaluation involves the deliberate downward adjustment of a country's currency value by its government or central bank to boost export competitiveness, while revaluation is the upward adjustment to strengthen the currency and control inflation. Exchange rate policy tools such as fixed exchange rate regimes allow for direct intervention in currency values, whereas floating exchange rates rely on market forces with occasional central bank interventions. Sterilized interventions, capital controls, and currency pegs are also utilized to stabilize exchange rates and manage economic objectives effectively.

Advantages and Disadvantages of Each Approach

Devaluation improves export competitiveness by making goods cheaper internationally but can trigger inflation and reduce import purchasing power; revaluation lowers export attractiveness and may slow economic growth but helps reduce inflation and lowers the cost of imports. Currency depreciation, often market-driven, can enhance trade balance by boosting exports but may lead to capital flight and increased foreign debt burdens. Each approach impacts economic stability, foreign investment, and inflation differently, requiring careful policy consideration based on a country's economic context.

Strategic Considerations for Policymakers

Strategic considerations for policymakers when addressing devaluation, revaluation, and depreciation revolve around managing trade balances, inflation control, and foreign investment flows. Devaluation can boost exports by making goods cheaper internationally but risks imported inflation, while revaluation may curb inflation yet dampen export competitiveness. Your decisions must weigh short-term economic stability against long-term growth, considering global market reactions and domestic fiscal conditions.

Infographic: Devaluation vs Revaluation

relatioo.com

relatioo.com