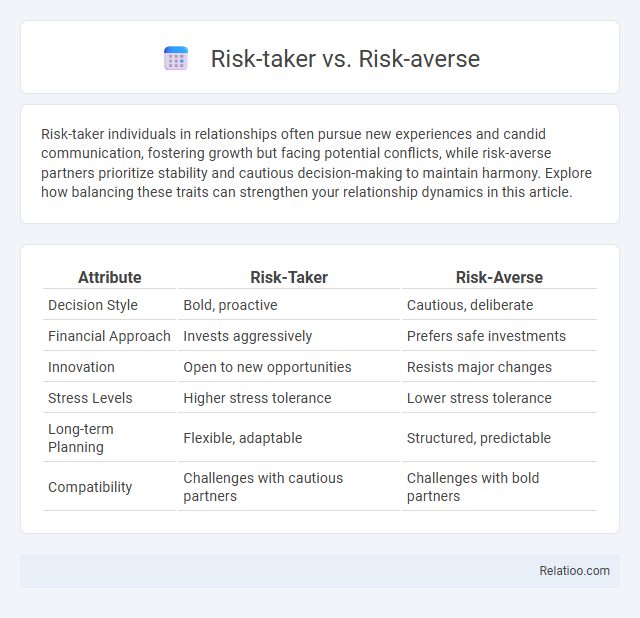

Risk-taker individuals in relationships often pursue new experiences and candid communication, fostering growth but facing potential conflicts, while risk-averse partners prioritize stability and cautious decision-making to maintain harmony. Explore how balancing these traits can strengthen your relationship dynamics in this article.

Table of Comparison

| Attribute | Risk-Taker | Risk-Averse |

|---|---|---|

| Decision Style | Bold, proactive | Cautious, deliberate |

| Financial Approach | Invests aggressively | Prefers safe investments |

| Innovation | Open to new opportunities | Resists major changes |

| Stress Levels | Higher stress tolerance | Lower stress tolerance |

| Long-term Planning | Flexible, adaptable | Structured, predictable |

| Compatibility | Challenges with cautious partners | Challenges with bold partners |

Understanding Risk-Taking and Risk-Aversion

Understanding risk-taking and risk-aversion is crucial for managing your financial habits effectively, as risk-takers tend to pursue higher returns through volatile investments while risk-averse individuals prioritize capital preservation and steady growth. Your financial behavior is shaped by your comfort level with uncertainty, influencing decisions such as stock market participation, savings patterns, and debt management. Balancing these tendencies helps optimize portfolio diversification and long-term wealth accumulation strategies.

Key Traits of Risk-Takers

Risk-takers exhibit key traits such as a high tolerance for uncertainty, a proactive approach to decision-making, and a strong desire for potential high rewards despite possible losses. They often engage in dynamic financial habits, including frequent investment in volatile markets and innovative ventures, contrasting sharply with risk-averse individuals who prioritize capital preservation and steady returns. These distinct behavioral patterns influence overall financial outcomes and portfolio diversification strategies significantly.

Defining Characteristics of Risk-Averse Individuals

Risk-averse individuals prioritize financial security and stability, often avoiding investments with high volatility or uncertainty. Their defining characteristics include a preference for low-risk assets such as bonds or savings accounts, consistent saving habits, and cautious decision-making that limits exposure to potential losses. This conservative approach reflects a strong emphasis on preserving capital rather than pursuing high returns.

Psychological Factors Influencing Risk Attitudes

Psychological factors such as fear of loss, overconfidence, and cognitive biases significantly influence whether individuals adopt risk-taker or risk-averse behaviors in their financial habits. Risk-takers often exhibit higher tolerance for uncertainty and are driven by potential rewards, while risk-averse individuals prioritize security and stability to avoid financial losses. Understanding these psychological drivers is crucial for tailoring financial advice and investment strategies that align with personal risk attitudes.

Risk-Taking vs. Risk-Aversion in Decision Making

Risk-taking involves embracing uncertainty and potential losses to achieve higher financial rewards, while risk-averse individuals prioritize safety and prefer stable returns even if growth is slower. Your financial habits, such as saving regularly or investing cautiously, often reflect your tolerance for risk and shape long-term wealth accumulation. Understanding the balance between risk-taking and risk-aversion helps optimize decision making by aligning financial choices with your comfort level and financial goals.

Benefits and Drawbacks of Taking Risks

Taking financial risks can lead to higher rewards and accelerated wealth growth, but it also exposes individuals to potential losses and volatility. Risk-takers may benefit from investment opportunities with substantial returns, while risk-averse individuals prioritize capital preservation and stability, potentially missing out on larger gains. Developing sound financial habits, such as diversification and regular savings, helps balance risk and reward, optimizing long-term financial outcomes.

Advantages and Disadvantages of Playing It Safe

Playing it safe with your finances offers the advantage of preserving capital and reducing the likelihood of significant losses, which is ideal for risk-averse individuals seeking stability. However, this cautious approach often results in lower returns compared to risk-takers who might capitalize on higher-yield ventures. Your financial habits, shaped by risk tolerance, directly influence your potential for growth and security, making it essential to balance safety with opportunities for moderate risk to optimize long-term wealth.

Risk Preferences in Career and Entrepreneurship

Understanding your risk preferences is crucial in shaping your career and entrepreneurship path, as risk-takers often pursue innovative startups while risk-averse individuals prefer stable employment or incremental business growth. Financial habits, such as consistent saving or investing, influence how you manage uncertainties and leverage opportunities in your professional life. Aligning your risk tolerance with your financial habits empowers you to make strategic decisions that foster long-term success and resilience in business ventures.

Managing Risk: Strategies for Balanced Choices

Managing risk involves balancing your financial habits with a clear understanding of your risk tolerance, whether you are a risk-taker or risk-averse. Employing strategies like diversification, emergency fund creation, and regular portfolio reviews helps mitigate potential losses while optimizing growth opportunities. Tailoring these approaches to your specific financial goals ensures balanced decision-making and long-term financial stability.

Cultivating a Healthy Risk Mindset

Cultivating a healthy risk mindset involves balancing the traits of risk-takers and risk-averse individuals by fostering informed decision-making and consistent financial habits. Risk-takers often pursue high-reward opportunities but may face significant losses, while risk-averse individuals prioritize security, potentially missing growth prospects. Developing disciplined financial habits, such as budgeting, diversification, and emergency fund creation, enhances resilience and supports calculated risk-taking for long-term wealth accumulation.

Infographic: Risk-taker vs Risk-averse

relatioo.com

relatioo.com