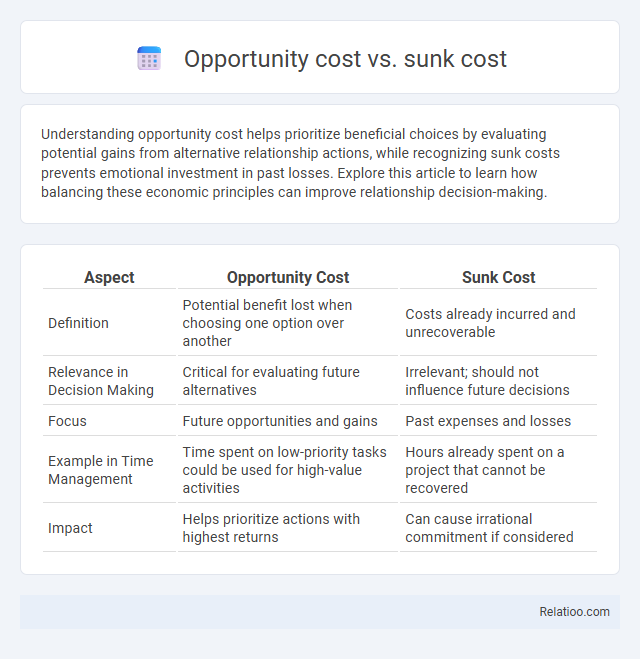

Understanding opportunity cost helps prioritize beneficial choices by evaluating potential gains from alternative relationship actions, while recognizing sunk costs prevents emotional investment in past losses. Explore this article to learn how balancing these economic principles can improve relationship decision-making.

Table of Comparison

| Aspect | Opportunity Cost | Sunk Cost |

|---|---|---|

| Definition | Potential benefit lost when choosing one option over another | Costs already incurred and unrecoverable |

| Relevance in Decision Making | Critical for evaluating future alternatives | Irrelevant; should not influence future decisions |

| Focus | Future opportunities and gains | Past expenses and losses |

| Example in Time Management | Time spent on low-priority tasks could be used for high-value activities | Hours already spent on a project that cannot be recovered |

| Impact | Helps prioritize actions with highest returns | Can cause irrational commitment if considered |

Understanding Opportunity Cost

Opportunity cost represents the potential benefits you forgo when choosing one option over another, making it crucial for effective decision-making. Unlike sunk costs, which are past expenses that cannot be recovered, opportunity cost emphasizes future possibilities and alternative uses of resources. Understanding opportunity cost helps maximize value by prioritizing choices that offer the greatest returns relative to what must be sacrificed.

Defining Sunk Cost

Sunk cost refers to expenses that have already been incurred and cannot be recovered, making them irrelevant to future decision-making. Unlike opportunity cost, which represents the potential benefits lost when choosing one option over another, sunk costs should not influence Your current or future choices. Understanding sunk cost helps you avoid throwing good resources after bad and focus on maximizing future gains.

Key Differences Between Opportunity Cost and Sunk Cost

Opportunity cost represents the potential benefits foregone when choosing one alternative over another, highlighting the value of the next best option. Sunk cost refers to past expenses that cannot be recovered and should not influence current decision-making. The key difference is that opportunity cost is forward-looking and relevant for future choices, whereas sunk cost is backward-looking and irrelevant for ongoing decisions.

Why Opportunity Cost Matters in Decision Making

Opportunity cost represents the value of the best alternative foregone when a decision is made, making it crucial for evaluating real trade-offs in resource allocation. Unlike sunk costs, which are past expenses that cannot be recovered and should not influence current decisions, opportunity cost helps prioritize options based on future benefits. Understanding opportunity cost ensures more rational economic choices by focusing on maximizing returns and minimizing overlooked benefits.

Recognizing Sunk Cost Fallacy

Recognizing the sunk cost fallacy is crucial for making rational decisions by understanding that past expenses, which cannot be recovered, should not influence your future choices. Opportunity cost highlights the potential benefits you forgo when selecting one alternative over another, emphasizing the value of missed opportunities. Avoiding the sunk cost fallacy allows you to focus on maximizing your current and future gains instead of irrationally clinging to irrecoverable investments.

Opportunity Cost Examples in Everyday Life

Opportunity cost represents the potential benefits you forgo when choosing one option over another, such as spending time watching TV instead of studying or saving money for a vacation rather than buying new electronics. Sunk costs are past expenses, like a non-refundable concert ticket, that should not influence your current decisions since the money is already spent. Recognizing opportunity cost helps you make better choices by evaluating the true value of your options against the alternatives you give up.

Sunk Cost Scenarios in Business

Sunk cost scenarios in business occur when past investments, such as marketing expenditures or research and development expenses, cannot be recovered, influencing decision-making despite their irrelevance to future outcomes. Understanding the difference between sunk costs and opportunity costs helps businesses avoid throwing good money after bad by focusing on potential benefits foregone from alternative options rather than unrecoverable expenditures. Effective management of sunk costs leads to more rational investment decisions, maximizing resource allocation and long-term profitability.

How to Avoid Sunk Cost Trap

Avoid the sunk cost trap by recognizing that past investments of time, money, or resources cannot be recovered and should not influence current decision-making. Focus on comparing future opportunity costs and potential benefits rather than attempting to justify previous expenditures. Regularly reassess ongoing projects and be willing to cut losses when the expected future gains do not outweigh the opportunity cost of alternative options.

Opportunity Cost vs Sunk Cost in Investments

Opportunity cost in investments represents the potential returns foregone by choosing one asset over another, highlighting the value of the next best alternative. Sunk cost refers to past expenses that cannot be recovered and should not influence future investment decisions, as they do not affect the incremental cash flows. Understanding the distinction between opportunity cost and sunk cost ensures rational allocation of capital and prevents emotional biases from undermining portfolio performance.

Practical Tips for Better Economic Decisions

Understanding the differences between opportunity cost, sunk cost, and opportunity is crucial for making smarter economic decisions. Focus on future benefits and avoid letting sunk costs, which are past and irrecoverable, influence your choices; prioritize opportunities that maximize your potential gains. By consistently evaluating what you must give up to pursue a particular action, you can improve Your resource allocation and increase overall economic efficiency.

Infographic: Opportunity Cost vs Sunk Cost

relatioo.com

relatioo.com