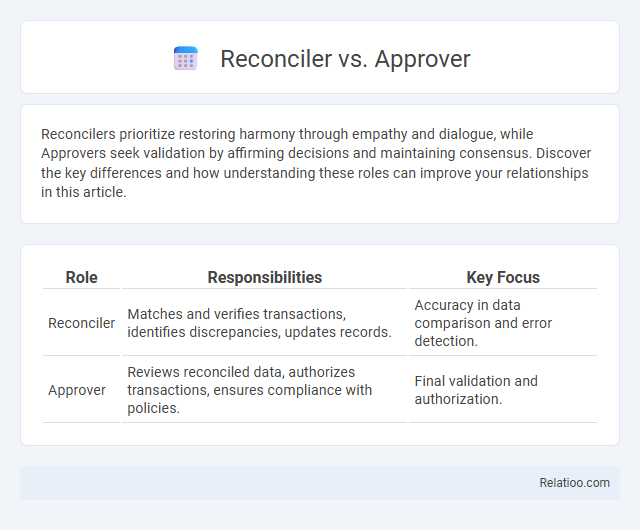

Reconcilers prioritize restoring harmony through empathy and dialogue, while Approvers seek validation by affirming decisions and maintaining consensus. Discover the key differences and how understanding these roles can improve your relationships in this article.

Table of Comparison

| Role | Responsibilities | Key Focus |

|---|---|---|

| Reconciler | Matches and verifies transactions, identifies discrepancies, updates records. | Accuracy in data comparison and error detection. |

| Approver | Reviews reconciled data, authorizes transactions, ensures compliance with policies. | Final validation and authorization. |

Introduction to Reconciler and Approver Roles

Reconciler roles focus on verifying and matching financial records to ensure accuracy and consistency in accounting processes, preventing discrepancies and errors. Approver roles involve reviewing and authorizing transactions or documents, confirming compliance with policies before final acceptance or processing. Clear distinction between these roles enhances internal controls and streamlines financial workflows within organizations.

Defining the Reconciler: Key Responsibilities

The Reconciler is responsible for verifying the accuracy of financial transactions by matching records across multiple sources, ensuring all discrepancies are identified and resolved promptly. Key responsibilities include reviewing account statements, confirming balances, and maintaining detailed documentation to support audit trails. This role is critical for preventing errors and fraud, safeguarding the integrity of financial data within organizations.

Approver Role: Functions and Duties

The Approver plays a critical role in financial and operational workflows by reviewing and authorizing transactions, documents, or decisions to ensure compliance and accuracy. You rely on the Approver to validate data integrity, enforce organizational policies, and prevent errors or fraud before finalization. Unlike Reconciler roles focused on matching records, the Approver's responsibilities emphasize decision-making authority and formal acceptance within approval hierarchies.

Semantic Differences Between Reconciler and Approver

A reconciler is responsible for verifying and matching financial transactions to ensure accuracy and resolve discrepancies within accounts. An approver's role centers on authorizing and validating transactions or documents based on compliance and organizational policies. While the reconciler focuses on validation through comparison and error correction, the approver holds decision-making authority to grant final consent or rejection.

Workflow Integration: Where Reconciler Meets Approver

The workflow integration between Reconciler and Approver is crucial for efficient financial operations, as the Reconciler ensures transaction accuracy by matching records before escalating discrepancies to the Approver. Approvers then validate and authorize reconciled transactions, maintaining compliance and internal controls. This seamless handoff enhances audit readiness and reduces processing delays in financial workflows.

Importance of Separation of Duties

Separation of duties is crucial in distinguishing the roles of Reconciler and Approver to prevent fraud and errors in financial processes. The Reconciler is responsible for verifying and matching transaction records, while the Approver authorizes these transactions, ensuring independent oversight. Your organization maintains internal controls and compliance by enforcing clear boundaries between these functions, reducing risk and enhancing accountability.

Benefits of Having Distinct Roles

Having distinct roles such as Reconciler, Approver, and Reviewer enhances your organization's internal controls by clearly defining responsibilities and reducing the risk of errors or fraud. Segregating duties ensures accurate verification and accountability during financial processes, improving compliance with regulatory standards. This structured approach promotes efficiency and transparency across reconciliation and approval workflows.

Common Challenges in Reconciler and Approver Processes

Reconciler and Approver roles often face common challenges including discrepancies in data accuracy, delayed transaction verifications, and communication gaps between departments. Reconciler processes struggle with matching complex financial records against multiple sources, while Approver processes encounter bottlenecks due to incomplete documentation and insufficient audit trails. Streamlining workflows and implementing automated validation tools can reduce errors and enhance collaboration between Reconcilers and Approvers.

Best Practices for Effective Collaboration

Effective collaboration between Reconcilers and Approvers hinges on clear role definitions and timely communication to prevent workflow bottlenecks. You should establish standardized reconciliation processes with transparent approval criteria, ensuring all transactions are thoroughly reviewed and discrepancies promptly resolved. Leveraging shared platforms and automated notifications enhances accountability and maintains the integrity of financial records across teams.

Choosing the Right Role for Your Organization

Choosing the right role between Reconciler, Approver, and combined Reconciler-Approver depends on the complexity and size of your organization's financial processes. A Reconciler focuses on verifying the accuracy of accounts and transaction details, ensuring discrepancies are identified and resolved. An Approver holds the responsibility of authorizing transactions or approvals after reconciliation, while a combined role may streamline workflows in smaller teams but risks reduced internal controls in larger organizations.

Infographic: Reconciler vs Approver

relatioo.com

relatioo.com