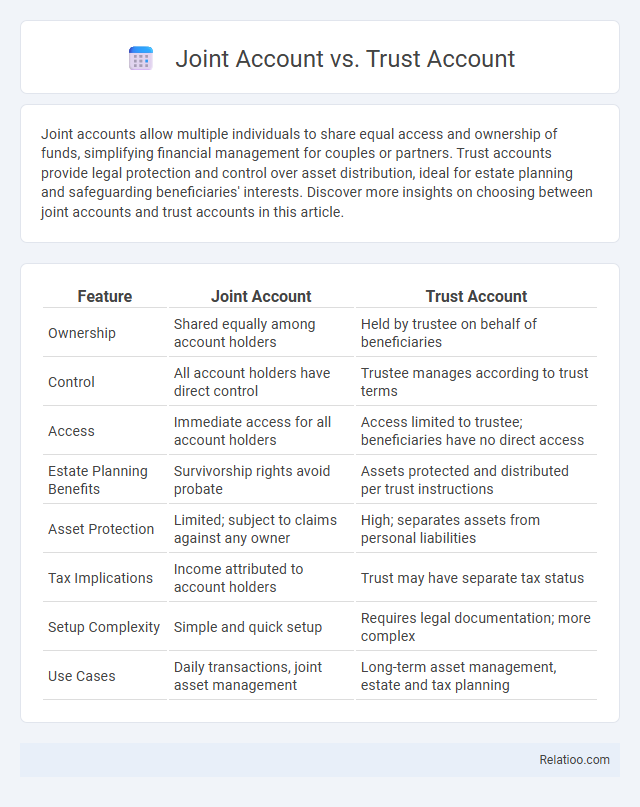

Joint accounts allow multiple individuals to share equal access and ownership of funds, simplifying financial management for couples or partners. Trust accounts provide legal protection and control over asset distribution, ideal for estate planning and safeguarding beneficiaries' interests. Discover more insights on choosing between joint accounts and trust accounts in this article.

Table of Comparison

| Feature | Joint Account | Trust Account |

|---|---|---|

| Ownership | Shared equally among account holders | Held by trustee on behalf of beneficiaries |

| Control | All account holders have direct control | Trustee manages according to trust terms |

| Access | Immediate access for all account holders | Access limited to trustee; beneficiaries have no direct access |

| Estate Planning Benefits | Survivorship rights avoid probate | Assets protected and distributed per trust instructions |

| Asset Protection | Limited; subject to claims against any owner | High; separates assets from personal liabilities |

| Tax Implications | Income attributed to account holders | Trust may have separate tax status |

| Setup Complexity | Simple and quick setup | Requires legal documentation; more complex |

| Use Cases | Daily transactions, joint asset management | Long-term asset management, estate and tax planning |

Understanding Joint Accounts

A joint account is a bank or investment account shared by two or more individuals, allowing all parties equal access to funds and account management. Understanding joint accounts involves recognizing that each account holder can deposit, withdraw, and make decisions independently, which may simplify financial collaboration but also introduces risks such as potential misuse of funds. Unlike trust accounts, joint accounts do not provide fiduciary protections or structured asset management, making them suitable for shared expenses rather than long-term estate planning.

What Is a Trust Account?

A trust account is a legal arrangement where a trustee holds and manages assets on behalf of beneficiaries, ensuring the assets are used according to the specified terms of the trust agreement. Unlike joint accounts, which are owned and accessed equally by all account holders, trust accounts provide controlled management and protection of assets, often used for estate planning and asset protection. Trust accounts offer greater flexibility in distribution and can be tailored to meet specific financial goals or legal requirements.

Key Differences Between Joint and Trust Accounts

Joint accounts allow multiple individuals to share equal ownership and access to funds, typically used for everyday transactions or shared expenses. Trust accounts are managed by a trustee on behalf of beneficiaries, offering greater control and protection of assets with specific terms outlined in the trust agreement. Unlike joint accounts, trust accounts provide legal safeguards and are often used for estate planning, asset management, and protecting beneficiaries' interests.

Ownership and Control of Funds

Joint accounts grant equal ownership and control of funds to all account holders, allowing any party to deposit, withdraw, or manage money independently. Trust accounts are managed by a trustee who controls the funds on behalf of the beneficiaries, ensuring legal responsibilities are met without direct ownership by the beneficiaries. Ownership in joint accounts is shared among account holders, whereas trust accounts separate control and legal ownership, with trustees having fiduciary duty but no personal claim to the funds.

Access and Usage Restrictions

Joint accounts allow all account holders to have equal access and control, enabling any party to make transactions independently. Trust accounts impose strict usage restrictions, limiting access to the trustee who manages funds according to the trust's terms, preventing beneficiaries from direct withdrawals. Joint tenancy accounts offer shared access but include rights of survivorship, meaning funds automatically transfer to the surviving owner without probate, impacting control and usage upon an account holder's death.

Estate Planning Considerations

Estate planning considerations vary significantly between joint accounts, trust accounts, and individual accounts. A joint account allows you and another individual to own assets with rights of survivorship, enabling seamless transfer upon death but potentially exposing assets to the co-owner's creditors. Trust accounts provide greater control over asset distribution, protect your estate from probate, and can specify beneficiaries according to your wishes, making them preferable for complex estate planning needs.

Tax Implications of Each Account Type

Joint accounts typically result in shared tax liability where income and gains are reported proportionally by each account holder, potentially causing higher tax brackets if income is substantial. Trust accounts have unique tax implications as the trust itself may be taxed separately, and distributions to beneficiaries are reported on their individual tax returns, often allowing for strategic tax planning. Understanding the tax implications of your joint or trust account helps in optimizing your financial strategy and minimizing tax burdens efficiently.

Legal Protections and Risks

A joint account offers you shared access and control but exposes all account holders to risks like liability for debts or unauthorized transactions, with limited legal protections if disputes arise. Trust accounts provide stronger legal protections by separating assets from personal ownership, safeguarding them for beneficiaries according to the trustee's fiduciary duty, but they involve more complex administration and legal oversight. Comparing joint vs trust accounts highlights that joint accounts risk asset exposure among holders, whereas trust accounts prioritize asset protection and legal clarity, crucial for estate planning and risk management.

Choosing the Right Account for Your Needs

Choosing the right account for your needs depends on how you want to manage and share assets; a joint account allows multiple individuals to access and control funds equally, ideal for spouses or business partners. A trust account involves a legal arrangement where a trustee manages assets on behalf of beneficiaries, offering more control and protection for specific financial goals or estate planning. Understanding your financial objectives and the level of control you desire helps you decide whether a joint or trust account best suits your situation.

Frequently Asked Questions About Joint and Trust Accounts

Frequently asked questions about joint and trust accounts often center on ownership, control, and access rights. Joint accounts allow multiple individuals to share equal ownership and access, while trust accounts are managed by a trustee for the benefit of designated beneficiaries, offering more control and protection over assets. Understanding these differences helps you choose the right account type based on your financial goals and the level of asset management you need.

Infographic: Joint Account vs Trust Account

relatioo.com

relatioo.com