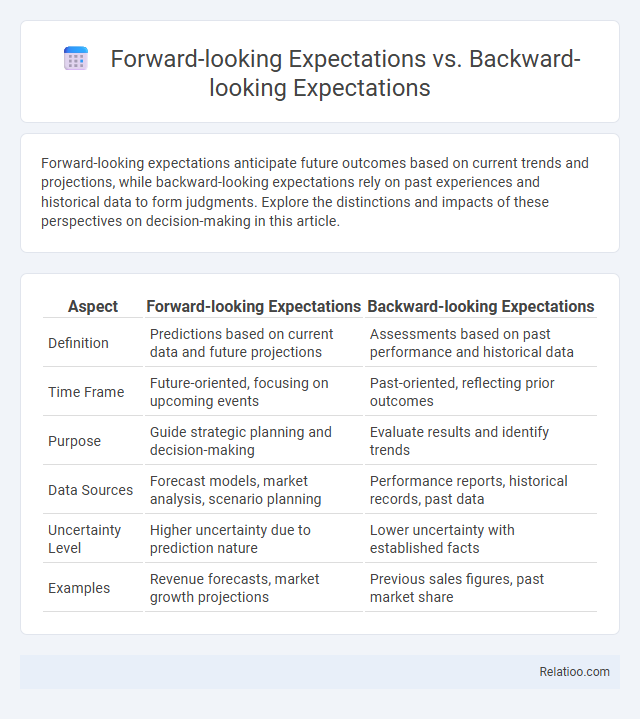

Forward-looking expectations anticipate future outcomes based on current trends and projections, while backward-looking expectations rely on past experiences and historical data to form judgments. Explore the distinctions and impacts of these perspectives on decision-making in this article.

Table of Comparison

| Aspect | Forward-looking Expectations | Backward-looking Expectations |

|---|---|---|

| Definition | Predictions based on current data and future projections | Assessments based on past performance and historical data |

| Time Frame | Future-oriented, focusing on upcoming events | Past-oriented, reflecting prior outcomes |

| Purpose | Guide strategic planning and decision-making | Evaluate results and identify trends |

| Data Sources | Forecast models, market analysis, scenario planning | Performance reports, historical records, past data |

| Uncertainty Level | Higher uncertainty due to prediction nature | Lower uncertainty with established facts |

| Examples | Revenue forecasts, market growth projections | Previous sales figures, past market share |

Understanding Expectations: A Semantic Overview

Forward-looking expectations emphasize predicting future economic variables based on available information, essential for forecasting inflation and investment decisions. Backward-looking expectations rely on past data and historical trends, often observed in adaptive learning behaviors influencing wage setting or price adjustments. Dynamic expectations integrate both approaches, evolving as agents update beliefs with new information, crucial for modeling realistic economic decision-making processes.

Defining Forward-looking Expectations

Forward-looking expectations involve predictions about future economic variables based on available information and anticipated policy changes, reflecting how agents form beliefs about upcoming market conditions. These expectations contrast with backward-looking expectations, which rely on past data and historical trends to inform current decisions. Dynamic expectations incorporate both forward-looking and backward-looking elements, adjusting as new information emerges over time to model evolving economic behavior more accurately.

Defining Backward-looking Expectations

Backward-looking expectations are formed based on historical data and past trends, emphasizing how previous outcomes influence current anticipations. Unlike forward-looking expectations, which rely on forecasts and projections, backward-looking models use past economic indicators to adjust predictions. In dynamic systems, backward-looking expectations provide a foundation for understanding adaptive behavior by continuously updating beliefs according to realized events.

Key Differences Between Forward and Backward-looking Expectations

Forward-looking expectations base predictions on anticipated future events and economic policies, while backward-looking expectations rely on past data and historical trends to form beliefs. Dynamic expectations adjust over time as new information becomes available, blending aspects of both forward and backward-looking perspectives. Your understanding of key differences lies in the timing reference: forward-looking models emphasize future outcomes, while backward-looking models focus on prior experiences.

The Role of Expectations in Economic Modeling

Forward-looking expectations incorporate agents' predictions about future economic variables, influencing decision-making and leading to models that anticipate policy impacts and market adjustments. Backward-looking expectations rely on past data and historical trends, often resulting in models with lagged responses to economic changes. Dynamic models blend both approaches, capturing the evolving nature of expectations and allowing for more accurate simulations of economic behavior over time.

Impact on Decision-Making: Forward vs Backward

Forward-looking expectations incorporate anticipated future events into decision-making, enabling proactive strategies that adapt to potential market changes and policy shifts. Backward-looking expectations rely on historical data and past trends, often leading to reactive adjustments that may lag behind rapidly evolving conditions. Dynamic expectations blend both approaches, continuously updating beliefs based on new information, which enhances decision accuracy and resilience in uncertain environments.

Real-World Applications in Markets and Policy

Forward-looking expectations, essential in financial markets, anticipate future economic conditions influencing asset prices and investment decisions, often modeled through rational expectations theory. Backward-looking expectations rely on historical data and past trends, shaping adaptive strategies seen in policy adjustments and risk assessments under uncertainty. Dynamic models integrate both approaches, enabling real-time response to evolving market signals and improving monetary policy effectiveness in managing inflation and employment targets.

Challenges and Limitations of Both Approaches

Forward-looking expectations rely on agents' ability to accurately forecast future economic conditions, posing challenges due to uncertainty and information asymmetry that can lead to model misspecification and biased decision-making. Backward-looking expectations depend on historical data, which may fail to capture structural changes or shifts in policy regimes, resulting in lagged adjustments and potential persistence of outdated beliefs. Dynamic approaches attempt to integrate both perspectives but face computational complexity and sensitivity to parameter estimation, which can limit their practicality and robustness in real-time economic modeling.

How Expectations Shape Future Outcomes

Forward-looking expectations anticipate future economic conditions, guiding investment and consumption decisions that directly influence growth trajectories and market stability. Backward-looking expectations rely on past data, potentially causing delayed adjustments and reinforcing existing economic trends. Dynamic expectations evolve continuously with new information, enabling adaptive responses that shape more resilient and flexible future outcomes.

Choosing the Right Expectation Model

Selecting the appropriate expectation model depends on the economic context and policy analysis goals; forward-looking expectations incorporate agents' predictions of future events, aligning with rational expectations theory and enhancing the accuracy of inflation forecasting. Backward-looking expectations rely on past data, often used in adaptive expectations models, capturing inertia but potentially lagging in response to structural changes. Dynamic models integrate both forward- and backward-looking elements to reflect realistic adjustment processes, improving macroeconomic modeling by balancing responsiveness and stability.

Infographic: Forward-looking Expectations vs Backward-looking Expectations

relatioo.com

relatioo.com