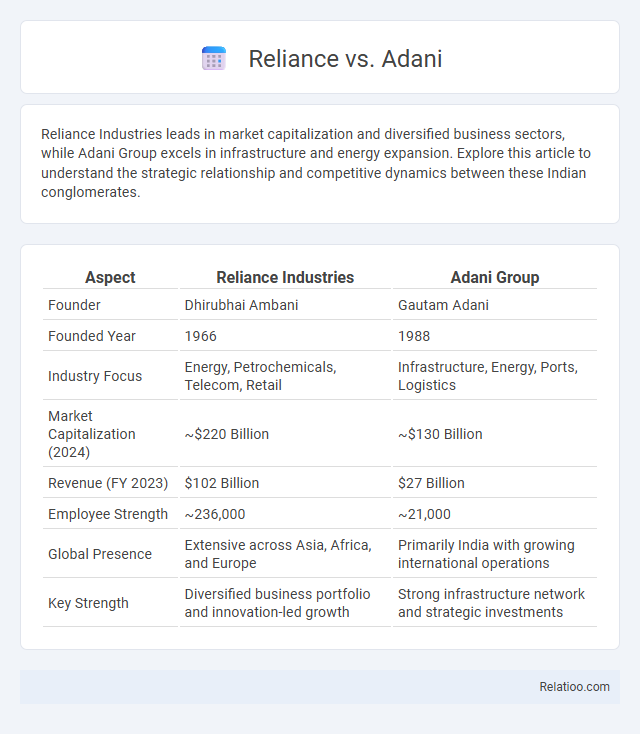

Reliance Industries leads in market capitalization and diversified business sectors, while Adani Group excels in infrastructure and energy expansion. Explore this article to understand the strategic relationship and competitive dynamics between these Indian conglomerates.

Table of Comparison

| Aspect | Reliance Industries | Adani Group |

|---|---|---|

| Founder | Dhirubhai Ambani | Gautam Adani |

| Founded Year | 1966 | 1988 |

| Industry Focus | Energy, Petrochemicals, Telecom, Retail | Infrastructure, Energy, Ports, Logistics |

| Market Capitalization (2024) | ~$220 Billion | ~$130 Billion |

| Revenue (FY 2023) | $102 Billion | $27 Billion |

| Employee Strength | ~236,000 | ~21,000 |

| Global Presence | Extensive across Asia, Africa, and Europe | Primarily India with growing international operations |

| Key Strength | Diversified business portfolio and innovation-led growth | Strong infrastructure network and strategic investments |

Overview: Reliance and Adani Conglomerates

Reliance Industries and Adani Group are two of India's largest conglomerates, dominating sectors like energy, infrastructure, and telecommunications. Reliance has a diversified portfolio spanning petrochemicals, retail, and digital services, while Adani excels in ports, power generation, and logistics. Understanding the strengths of these conglomerates helps you evaluate their market impact and future growth potential.

Historical Growth: Reliance and Adani’s Rise

Reliance Industries demonstrated exponential growth since its inception in 1966, evolving from a textile manufacturer to a diversified conglomerate with interests in petrochemicals, refining, and telecommunications, driven by visionary leadership and strategic investments. Adani Group, established in 1988, experienced rapid expansion by capitalizing on infrastructure, logistics, energy, and ports, leveraging government policies and global trade dynamics to become a key player in India's economic development. Both Reliance and Adani's historical growth trajectories highlight aggressive market penetration, diversification, and significant contributions to India's industrial landscape.

Key Business Sectors: A Comparative Analysis

Reliance Industries excels in petrochemicals, refining, and telecommunications, with Jio revolutionizing India's digital landscape, while Adani Group dominates in infrastructure, energy, and logistics, focusing on renewable energy and port operations. Both conglomerates invest heavily in sustainable development, but Reliance's consumer retail and digital services create a distinct competitive advantage. Your strategic insights can benefit from understanding how these key sectors overlap and diverge in market capitalization, innovation, and government partnerships.

Financial Performance: Revenue, Profit, and Market Valuation

Reliance Industries consistently leads with robust financial performance, reporting annual revenues exceeding $100 billion and net profits surpassing $8 billion, reflecting strong diversification across energy, retail, and telecom sectors. Adani Group, though rapidly growing, reports annual revenues around $45 billion with net profits close to $2 billion, driven by its focus on infrastructure, energy, and logistics. Your investment decisions should consider Reliance's higher market valuation, currently exceeding $200 billion, compared to Adani's valuation near $100 billion, indicating market confidence and growth potential differences between the two conglomerates.

Leadership Styles: Mukesh Ambani vs Gautam Adani

Mukesh Ambani's leadership style emphasizes strategic diversification and technological innovation, driving Reliance's transformation into a conglomerate with strong footprints in petrochemicals, telecommunications, and retail. Gautam Adani adopts an aggressive expansionist approach, focusing on infrastructure development, port operations, and energy sectors to rapidly scale the Adani Group's market presence. Your understanding of their contrasting leadership styles reveals how Mukesh Ambani prioritizes sustained innovation while Gautam Adani champions rapid growth through infrastructural prowess.

Infrastructure and Energy Investments

Reliance Industries has aggressively expanded its energy portfolio, focusing on renewable energy projects and refining capabilities to reduce carbon emissions. Adani Group dominates infrastructure investments with extensive portfolios in ports, logistics, and energy, driving India's transition to green energy through large-scale solar and wind power projects. While both giants invest heavily in energy, Reliance prioritizes integrated energy solutions and digital platforms, whereas Adani emphasizes infrastructure development combined with renewable energy capacity expansion.

Diversification Strategies: Expanding Horizons

Reliance Industries has aggressively pursued diversification by expanding into sectors like telecommunications with Jio, retail with Reliance Retail, and digital services, creating a robust multi-industry presence. Adani Group's diversification strategy centers on infrastructure, energy, and commodities, with significant investments in ports, renewable energy, and logistics, driving rapid growth across multiple sectors. While Reliance emphasizes digital and consumer-facing businesses, Adani focuses on building large-scale infrastructure projects, both aiming to establish dominant positions in their respective industries.

Sustainability and Green Initiatives

Reliance Industries and Adani Group are both accelerating their sustainability efforts, with Reliance investing heavily in renewable energy projects like green hydrogen and solar power to achieve carbon neutrality by 2035. Adani Group leads in large-scale renewable infrastructure, operating one of the world's largest solar power portfolios and committing to becoming carbon-neutral by 2025 through expanded green energy capacity. Both conglomerates are pivotal in India's green transition, emphasizing innovations in clean energy technology and sustainable business practices to reduce environmental impact.

Market Influence and Global Presence

Reliance Industries commands a vast market influence in India's energy, telecommunications, and retail sectors, leveraging its diversified portfolio to expand globally, particularly in emerging markets. Adani Group's rapid infrastructure development and energy projects have significantly boosted its market presence, focusing on strategic assets like ports and renewable energy to drive international growth. Your analysis should consider how Reliance's established multinational footprint contrasts with Adani's aggressive expansion tactics, shaping their competitive dynamics on the global stage.

Future Prospects and Competitive Outlook

Reliance Industries, Adani Group, and Tata Group each exhibit unique future prospects shaped by their diversified portfolios and strategic investments in energy, infrastructure, and technology. Your investment decisions should consider Reliance's aggressive pivot towards digital services and renewable energy, Adani's expansive infrastructure projects and focus on sustainable energy, and Tata's balanced growth across industries with a strong emphasis on innovation. The competitive outlook highlights intense rivalry, with each conglomerate leveraging scale, innovation, and government partnerships to dominate key sectors in India's evolving economy.

Infographic: Reliance vs Adani

relatioo.com

relatioo.com